Top 3 Must-Read Books to Master Financial Literacy in 2025

In today’s fast-paced world where economic landscapes change overnight and financial independence is becoming more important than ever, one thing remains constant—the value of timeless knowledge. While there’s no shortage of YouTube gurus and finance influencers, true financial wisdom lies in the pages of a few game-changing books. Let’s check the top personal finance books.

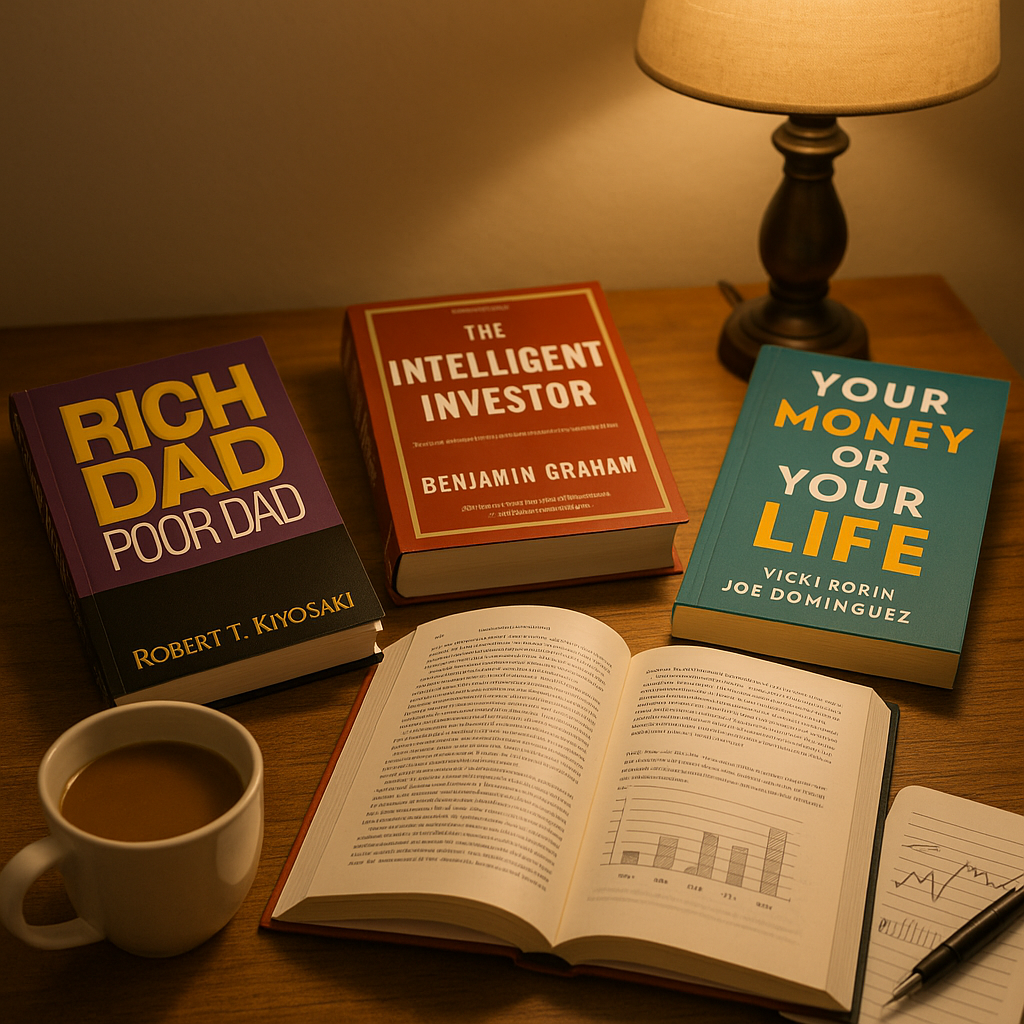

Here are the top 3 financial books that have educated millions across decades—and continue to do so. These aren’t just popular—they’re foundational.

1. Rich Dad Poor Dad by Robert Kiyosaki

Originally published in 1997, Rich Dad Poor Dad has sold over 40 million copies worldwide—and for good reason. This book is a powerful eye-opener, especially for those new to managing money or looking to escape the paycheck-to-paycheck cycle.

Kiyosaki contrasts the mindsets of his “rich dad” (his mentor) and his “poor dad” (his biological father), offering practical yet profound lessons on how wealth is truly built. The book breaks conventional ideas, challenging readers to rethink what they know about jobs, savings, assets, and liabilities.

Why it’s still relevant:

- Teaches how to make your money work for you.

- Encourages financial independence through smart investing.

- Offers a simple but revolutionary shift in money mindset.

Perfect for: Beginners, young professionals, and anyone ready to get out of the rat race.

2. The Intelligent Investor by Benjamin Graham

First published in 1949, The Intelligent Investor has long been considered the holy grail of investing. This book isn’t about get-rich-quick schemes—it’s about building sustainable wealth through patience, discipline, and informed decisions.

Benjamin Graham, known as the father of value investing, dives deep into the fundamentals of analyzing stocks, minimizing risks, and developing a rational investment strategy. The principles taught here are the very ones used by Warren Buffett, who called it “by far the best book on investing ever written.”

Why it’s still a top pick:

- Teaches the art of value investing—buying undervalued assets.

- Focuses on risk management and emotional control.

- Helps avoid common investor mistakes.

Perfect for: Intermediate to advanced investors and anyone planning long-term wealth growth.

3. Your Money or Your Life by Vicki Robin & Joe Dominguez

This 1992 bestseller is more than a financial guide—it’s a lifestyle manual that connects money to purpose. Unlike most books that focus solely on budgeting or investing, this one urges readers to evaluate how they spend both their time and money, and whether that aligns with what truly matters.

It introduces a step-by-step approach to transforming your relationship with money, helping you achieve financial independence and live a more intentional life.

Why it stands out:

- Emphasizes conscious spending and life fulfillment.

- Helps you define what “enough” means for you.

- Encourages the pursuit of freedom, not just financial gain.

Perfect for: Minimalists, early retirees (FIRE community), and those seeking purpose beyond the paycheck.

💡 Why These Books Matter—Now More Than Ever

- Timeless Lessons: These books have been around for decades, proving that sound financial principles don’t go out of style and have been the top personal finance books recommendations.

- Broad Appeal: Whether you’re a student, employee, entrepreneur, or retiree, their teachings are universal.

- Empowerment Through Knowledge: They don’t just tell you what to do—they explain why, building your confidence to make smart money decisions.

Also read our related articles: US Stock Market Crash: A Golden Opportunity for Long-Term Investors and Stock Market Corrections: What They Mean & How to Stay Prepared

Check out more article on Finance on our Finance Category section.

#FinancialLiteracy #InvestingWisely #RichDadPoorDad #MoneyMindset #TopFinanceReads #IntelligentInvestor #FinancialFreedomBooks #YourMoneyOrYourLife