Crypto Market Crash Unleashed: Why Bitcoin Crashed Below $80K and What’s Next

Crypto Market Crash Coming???

Picture this: It’s March 10, 2025, and the crypto market is a rollercoaster plummeting off its tracks. Bitcoin (BTC) has nosedived below $80,000, Ethereum (ETH) is teetering near $2,000, and altcoins like Solana (SOL) and Cardano (ADA) are shedding value faster than a bear running from a beehive.

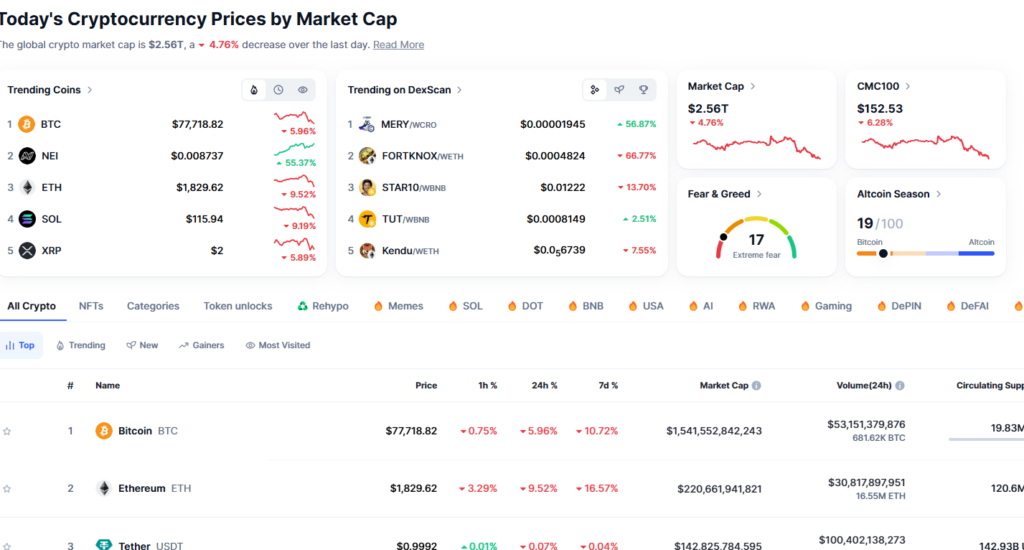

The total crypto market cap has shrunk to $2.7 trillion with a small Crypto market crash, erasing a jaw-dropping 14.7% in just seven days. Investors are panicking, liquidation heatmaps are glowing red, and the Crypto Fear & Greed Index is screaming “extreme fear” at a measly 10—the lowest since July 2022. What’s fueling this carnage, and could the dip get even uglier? Buckle up as we unpack the chaos, spotlight the culprits, and peek into the crystal ball for what’s next.

The Bloodbath Unfolds: Crypto’s Dark Monday

Monday, March 10, started with a gut punch. Bitcoin, which briefly teased $84,000 earlier in the day (thanks to a fleeting boost from MicroStrategy’s $21 billion fundraising buzz), crashed below $80,000, down 3.8% in 24 hours. Ethereum slipped below $2,000—its weakest level since November 2023—losing 4%. The broader CoinDesk 20 Index, a barometer of top cryptos, tanked 5%, with heavy hitters like Solana (SOL), Cardano (ADA), Aptos (APT), Avalanche (AVAX), and NEAR hemorrhaging 7% to 10%.

The pain wasn’t limited to coins. Crypto-related stocks got hammered too. MicroStrategy (MSTR), the biggest corporate Bitcoin whale, and Coinbase (COIN), the leading U.S. exchange, both plunged over 10%. Meanwhile, U.S. equity markets mirrored the misery: the Nasdaq dropped 3%, and the S&P 500 slid 2%. Risk assets everywhere were in full retreat, and crypto, ever the wild child of finance, took the fall hardest.

So, what’s behind this mess? Let’s dive into the three big drivers: Trump’s economic “transition,” a mass exodus from crypto funds, and a technical breakdown signaling more trouble ahead.

Reason #1: Trump’s “Short-Term Pain” Spooks Markets

President Donald Trump’s pro-crypto promises—like the U.S. Crypto Strategic Reserve—sent markets soaring post-election. But the honeymoon is over. In a Fox News interview on Sunday, March 9, Trump dropped a reality bomb: his policies, including trade tariffs on Canada, Mexico, and China, plus budget-slashing plans, could cause “a little disruption.” He didn’t rule out a recession in 2025, framing it as a “transition” to build a long-term foundation. “China thinks in 100-year terms; we obsess over quarters,” he mused.

Investors, though, aren’t feeling philosophical. The crypto rally was built on hopes of a deregulated, crypto-friendly administration. Now, the specter of a tariff war and a slowing economy is overshadowing any blockchain dreams. Trump’s acknowledgment of “short-term pain” has flipped the narrative: instead of a crypto utopia, markets are bracing for macroeconomic headwinds. And with the White House digital asset summit already in the rearview mirror, there’s no shiny new catalyst to reignite the bulls.

Reason #2: Investors Are Fleeing Crypto Funds Like Rats From a Sinking Ship

The numbers don’t lie: institutional money is bolting. According to CoinShares, digital asset investment products have seen outflows for four straight weeks, with $876 million vanishing in the week ending March 7. That’s part of a staggering $4.75 billion exodus over the past month, slashing year-to-date inflows to just $2.6 billion. Bitcoin bore the brunt, with $756 million in outflows, pushing total assets under management to $142 billion—the lowest since mid-November 2024, down $39 billion from its peak.

James Butterfill, CoinShares’ head of research, called it “capitulation.” Investors are de-risking, spooked by a toxic cocktail of negative sentiment and a lack of bullish triggers. The Crypto Fear & Greed Index plunging to 10 only confirms it: panic is in the driver’s seat. Meanwhile, derivatives markets are a war zone. Over the past 24 hours, $650.8 million in positions were liquidated—$595.75 million of them longs. Bitcoin and Ethereum alone saw $264.22 million and $114.76 million wiped out, respectively.

Reason #3: Technicals Flash a Bearish Warning

Zoom out to the charts, and the picture gets grimmer. The total crypto market cap (TOTAL) has validated a textbook descending triangle—a bearish pattern where lower highs meet a flat support line. On March 10, TOTAL broke below that support, hitting the pattern’s target of $2.6 trillion, right at the 50-week simple moving average (SMA).

Historically, this setup signals more downside: the maximum height of the triangle suggests a potential drop to the 100-week SMA at $2 trillion if selling pressure holds.

For the uninitiated, a descending triangle is like a coiled spring—once it snaps, the fall can be brutal. High volume on the breakdown confirms the bears are in control. Unless TOTAL claws back above the 50-week SMA and retests the triangle’s lower trendline near $3.1 trillion, the path of least resistance is down.

Even the Crypto Fear & Greed index is falling and has reached and all time low of 17/100, which highlights the sentiments of the investors.

The Perfect Storm: Why Now?

Crypto’s crash isn’t happening in a vacuum. It’s a symptom of a broader risk-off mood. U.S. stock indexes are reeling as recession fears creep in, and Trump’s tariff threats amplify the uncertainty. Add in the evaporation of crypto fund inflows and a technical setup primed for a fall, and you’ve got a perfect storm. The market’s earlier euphoria—fueled by Trump’s Bitcoin reserve hype and MicroStrategy’s aggressive BTC buys—has fizzled, leaving it vulnerable to macroeconomic punches.

Derivatives liquidations are the lighter fluid on this fire. When over-leveraged traders get margin-called, the cascade of sell-offs creates a feedback loop. It’s a brutal reminder: in crypto, leverage cuts both ways.

Is There More Dip Coming?

Here’s the million-dollar question: are we at the bottom, or is this just the appetizer? The signals are mixed. On one hand, the $2.6 trillion level at the 50-week SMA could act as a springboard if buyers step in—especially if Trump or MicroStrategy drops a surprise bullish bombshell. A bounce to $3.1 trillion isn’t off the table if sentiment flips.

But the bears have a stronger case right now. Persistent outflows, recession jitters, and the descending triangle’s downside target of $2 trillion paint a bleak picture. The Crypto Fear & Greed Index at 10 suggests capitulation isn’t done yet.

Historically, such “extreme fear” has preceded deeper drops before a true bottom forms. If U.S. equities keep sliding and Trump’s tariffs spark a trade war, crypto could easily tag that $2 trillion mark, a 25% plunge from here.

What’s Next for Crypto Investors?

For the brave souls still hodling, it’s gut-check time. Short-term, the market looks like a falling knife—catching it could mean bloody hands. But for long-term believers, this dip might be a buying opportunity if the $2 trillion level holds as support. Keep an eye on institutional flows: a reversal in outflows could signal the tide turning. And watch Trump’s next move—any hint of crypto-friendly policy could spark a relief rally.

For now, the bears are roaring, and the crypto winter feels colder than ever. Whether this is a blip or the start of a deeper freeze, one thing’s clear: volatility is back, and it’s not messing around. Crypto market crash and small dips like these are opportunities to invest and grow.

CoinDCX: For traders and investors in India, CoinDCX is the best platform whihc has quick deposits and withdrawls, lowest fee and CoinDCX is the platform I trust to learn, invest & trade in Crypto. Buy your first crypto and win up to ₹5,00,000 in crypto rewards!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Read more updates and articles on our Crypto category page

#CryptoCrash #BitcoinDip #EthereumPrice #TrumpPolicies #CryptoInvesting #MarketAnalysis #Altcoins #CryptoNews #Blockchain