Black Monday 2.0? Why the Markets Are Flashing Red Again

The New Black Monday? Why Markets Are Crashing Again

When people hear “Black,” they usually think of Black Friday sales—not stock market meltdowns. But lately, that’s changed. A wave of panic selling has gripped global markets, triggering fears of a repeat of the 1987 Black Monday crash.

On April 4, 2025, Wall Street recorded its worst single-day fall since the COVID-19 crisis. Over $5 trillion in market value vanished in hours. The trigger? A massive tariff offensive launched by US President Donald Trump targeting 180 countries, including China and India.

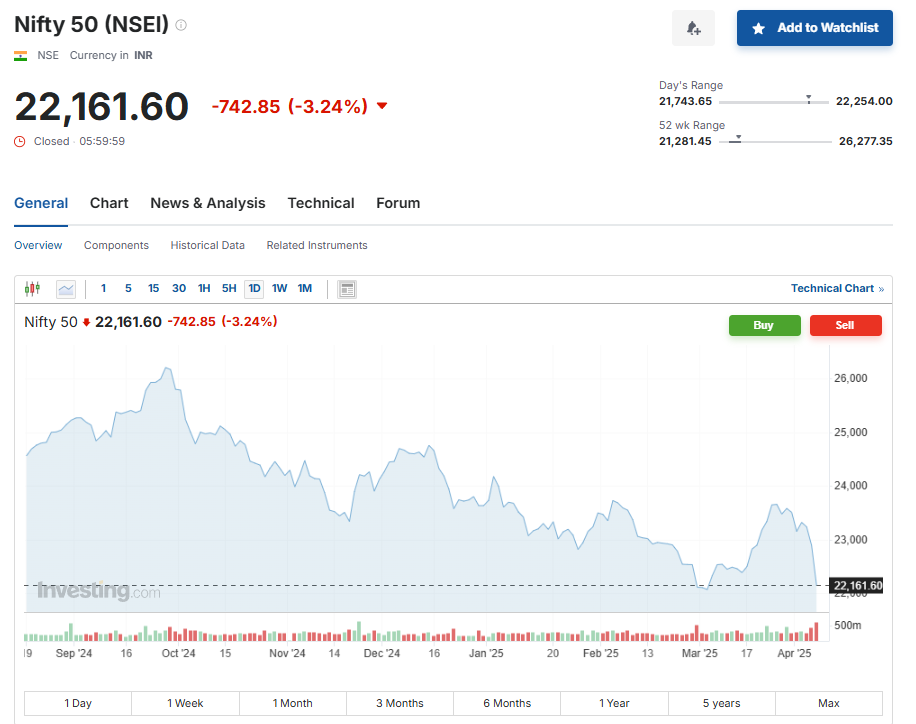

Just two days later, on April 6, market expert Jim Cramer warned of a potential crash on par with 1987 unless the US dials back its trade aggression. And by Monday, April 7, Indian markets echoed the fear. The Nifty50 nosedived over 1,100 points at open, and Sensex plunged 5%, wiping out ₹19 lakh crore in investor wealth.

Black Monday 1987: A Quick Recap

On October 19, 1987, the Dow Jones crashed 22.6% in one day—the biggest one-day percentage loss in history. The panic spread like wildfire, dragging down markets worldwide. Although it wasn’t followed by a depression, it spooked investors for months and took global markets time to recover.

What Triggered the 2025 Panic?

The meltdown began with Trump’s announcement on April 2, slapping tit-for-tat tariffs on nations deemed “unfair traders.” China immediately hit back with a 34% tariff on US imports. This trade-war spiral sparked fears of a prolonged slowdown, pushing investors to the edge.

J.P. Morgan raised the chances of a global recession in 2025 to 60%, and the India VIX surged 56%, signaling more volatility ahead. Many of the decisions of Trump and Elon are affecting the markets globally and causing a panic.

Sectors Hit Hardest in Indian Stock Market

In India, no sector was spared. But metal and IT stocks took the biggest blows:

- Metals: Tata Steel, Hindalco, JSW Steel—down sharply on global demand fears.

- IT: Infosys, TCS, and Wipro got hammered as clients in the US and Europe pulled back spending.

Auto, banking, and real estate stocks also bled amid broader fears of an economic slowdown and foreign investment outflows.

What Should Investors Do Now?

Experts are urging investors not to panic.

Pranay Aggarwal of Stoxkart advises sticking to SIPs and viewing this dip as a chance to buy strong stocks at a discount. “Don’t let fear lead your portfolio,” he said.

Mirae Asset and Motilal Oswal Experts recommends avoiding lumpsum investments until volatility cools, though he sees current valuations as relatively attractive for the long haul.

Just wait and watch the markets some time before making your next move. Hold on till the market stabilizes.

Stay focused on Index funds with low investment and go towards Fixed Deposits, bonds and Golds/Silvers/Bullions for long term. when the markets stabilizes then invest at the right time.

How Low Can the Indian Stock Market Go?

Analysts estimates that Nifty could drop to 21,000, and if corporate earnings take a hit, even below 20,000. Bloomberg data already shows earnings downgrades of 7% for CY25 and 2% for CY26.

Many big firms also predicts the market could test 21,500, with a deeper slide possible, suggesting to look to finance, FMCG, oil & gas, and consumption sectors for relative stability.

Final Word: Stay Calm, Stay Invested

This could be a rocky stretch. With global trade tensions high and recession risks rising, markets are likely to remain choppy. But as history shows, crashes don’t last forever.

Stick to your strategy. Keep your SIPs going. Focus on quality. And most importantly—don’t panic.

The next cues will come from RBI’s policy meeting and the upcoming earnings season. Until then, patience and smart risk management will be your best allies.

Also Check our previous article on US Stock Market Crash

Got questions? Drop them below—I’m all ears!

Check out more article on Finance on our Finance Category section.

#BlackMonday2025 #StockMarketCrash #GlobalRecession #TrumpTariffs #SensexCrash #Nifty50 #InvestorStrategy #FinanceNews #TradeWar #MarketVolatility