Bitcoin and Crypto Plunge: Why Trump’s Tariffs Are Shaking the Market

Crypto Market Crash due to Tariff Wars!

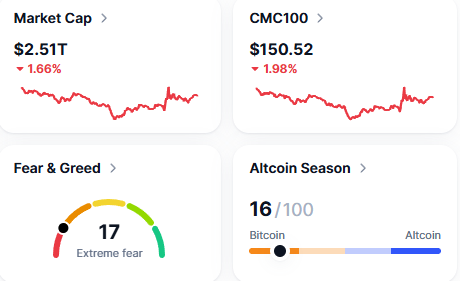

The crypto market is in chaos, and it’s not just another Monday dip. Bitcoin, Ethereum, and a slew of altcoins have nosedived by more than 10%, leaving investors scrambling for answers. The culprit? Looming trade tariffs tied to Trump’s economic policies, which have sent shockwaves through global markets. If you’re wondering why your portfolio is bleeding red, let’s unpack what’s happening and what it means for the future of crypto in this crypto market crash.

A Tariff-Fueled Firestorm

Trade tariffs—taxes slapped on imported goods—aren’t exactly new, but the latest proposals have markets on edge. With talks of hefty levies on major trading partners, fears of a global trade war are spiking. Crypto, often seen as a “risk-on” asset, gets hit hard when uncertainty reigns.

Unlike gold, which thrives in tough times, Bitcoin and its peers tend to mirror the volatility of tech stocks. When investors panic, they ditch speculative assets like crypto, and that’s exactly what we’re seeing.

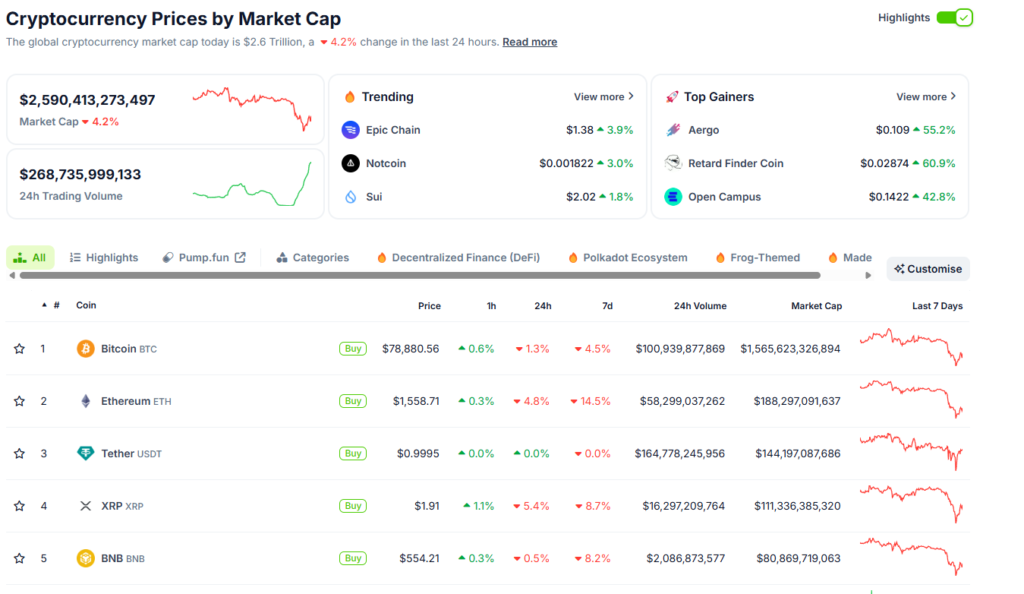

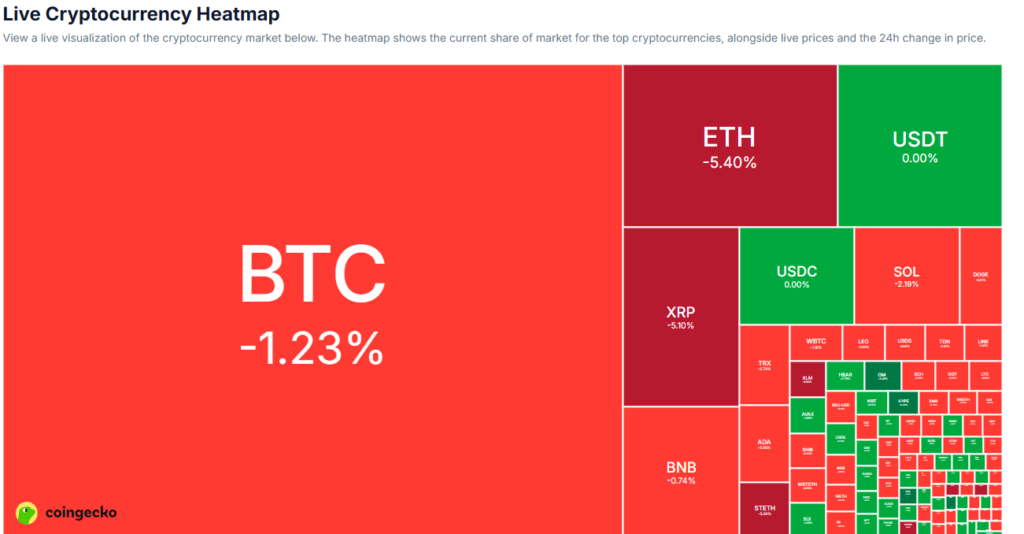

The numbers tell a grim story. Bitcoin, the king of crypto, has shed over 10% of its value in a matter of days, dipping below key support levels.

Ethereum’s taken a similar beating, with altcoins like Solana and Cardano faring even worse. This isn’t just a blip—it’s a full-blown market shakeout, and the tariff talk is the spark that lit the fuse.

Why Crypto’s Feeling the Heat

So, why are tariffs such a big deal for crypto and how did it influence this crypto market crash? It’s all about sentiment and ripple effects. Tariffs can drive up costs for businesses, slow economic growth, and fuel inflation.

That’s bad news for risk-hungry investors who pour money into crypto during bullish times. Plus, with crypto trading 24/7, it often reacts faster than stocks to global headlines, making it a frontline casualty in market turmoil.

The broader context doesn’t help. Rising interest rates, geopolitical tensions, and a jittery stock market are already weighing on investor confidence.

Add in the uncertainty of new trade policies, and it’s no surprise that crypto’s taking a hit. Some traders are even calling this a “Trump tariff tantrum,” as markets grapple with what these policies might mean for global commerce.

The Investor’s Dilemma: Panic or Opportunity?

For crypto holders, the question is simple but brutal: sell now or hold tight? Panic-selling during a dip can lock in losses, but waiting out the storm takes nerves of steel. Historically, crypto has bounced back from worse—think 2018 or the 2022 bear market.

But this time, the macro picture is murky. If tariffs escalate into a prolonged trade war, we could see more pain ahead.

On the flip side, some see this as a buying opportunity. Bitcoin’s long-term fans argue it’s still a hedge against fiat currency woes, especially if inflation spikes. Altcoins, too, have a knack for staging comebacks when least expected.

The trick is timing—and a lot of patience. For now, keeping an eye on tariff developments and broader market trends is key. Every time there is a crypto market crash, it gives investors to make money and grow.

What’s Next for Crypto?

The road ahead depends on how the tariff saga plays out. If trade tensions ease, we could see a relief rally in crypto, especially for battered altcoins. But if the rhetoric heats up, expect more volatility. Investors should also watch the Federal Reserve—any hint of rate hikes or cuts could sway crypto’s fate.

For those looking to navigate this mess, diversification is your friend. Mixing crypto with more stable assets like bonds or blue-chip stocks can soften the blow. And if you’re a trader, volatility can be a playground—just don’t bet the farm on a single coin.

Stay Sharp, Stay Informed

The crypto market’s wild ride is far from over. Trump’s tariffs have thrown a wrench into the works, but they’re also a reminder of how interconnected global markets are. Whether you’re a seasoned hodler or a curious newbie, staying informed is your best defense. Keep tabs on trade news, monitor price levels, and don’t let fear drive your decisions.

Crypto’s been through crashes before, and it’s always come out swinging. Will this time the Crypto market crash be different? Only time will tell—but one thing’s for sure: in the world of crypto, boring days are rare.

Also read our previous article of Pi Coin future price prediction: Pi Coin: Can It Soar to New Heights by March 2025?

Read more updates and articles on our Crypto category page

#CryptoCrash #BitcoinDrop #TrumpTariffs #CryptoMarket #TradeWar #Ethereum #Altcoins #Investing2025 #MarketVolatility #TechTrends