Mantra Token’s 90% Crash Shocks Crypto World: What Really Happened?

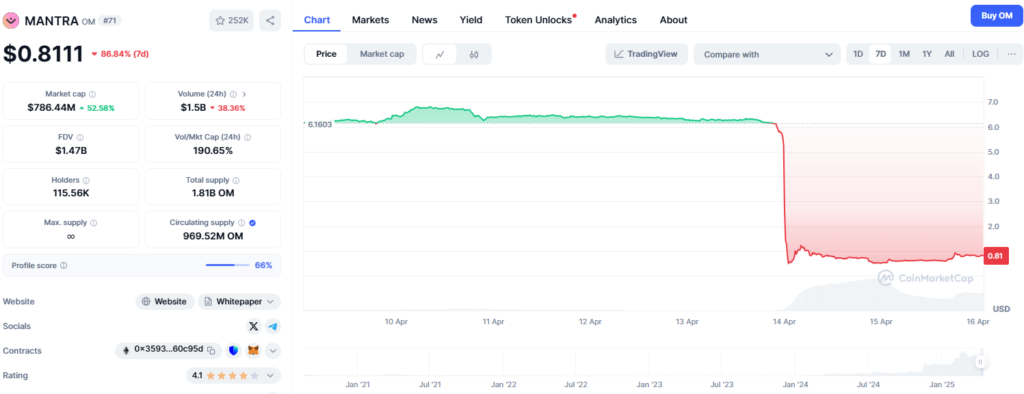

Imagine waking up to find your investment slashed by 90% overnight. That’s the nightmare Mantra (OM) token holders faced on April 13, 2025, when OM token crash happened. The token nosedived from $6.30 to a jaw-dropping $0.70 in mere hours. Once boasting a market cap of nearly $6 billion, Mantra’s valuation shriveled to $683 million, sending shockwaves through the crypto community.

But what sparked this catastrophic collapse? The Mantra team blames “reckless” exchange liquidations, while skeptics whisper of deeper issues. Let’s unravel the chaos and explore what this means for the future of real-world asset (RWA) tokenization.

A Sudden Collapse Sparks Panic

The crypto market is no stranger to volatility, but Mantra’s plunge was a gut punch. In just hours, the OM token triggered over $74.7 million in liquidations, with ten major positions losing more than $1 million each, according to Coinglass data.

The crash unfolded during low-liquidity hours on a Sunday evening, amplifying the damage as panic selling took hold. For a blockchain celebrated for tokenizing real-world assets like real estate and data centers, this was a brutal blow to investor confidence.

Mantra’s Defense: Exchange Liquidations to Blame

Mantra’s co-founder, John Patrick Mullin, wasted no time addressing the crisis. In a fiery post on X, Mullin pointed fingers at centralized exchanges, accusing them of initiating “reckless forced closures” on OM account holders.

He argued the timing—early Monday morning in Asia—suggested negligence or even deliberate market moves by exchanges. “This was not us,” Mullin insisted, distancing the Mantra team from the collapse. He explicitly ruled out Binance as the culprit but stopped short of naming a specific platform to be the reason behind Mantra OM token crash.

The narrative of forced liquidations paints a picture of cascading sell-offs. When leveraged positions fall below maintenance levels, exchanges automatically sell assets to cover losses, often triggering a domino effect in thin markets. For Mantra, this perfect storm obliterated billions in value, leaving traders reeling.

Whispers of a Rug Pull?

As the dust settled, speculation erupted. Some investors, like market commentator Gordon, drew parallels to infamous crypto collapses like Terra’s LUNA and FTX, warning that Mantra could “head to zero” without transparency. The term “rug pull”—where project insiders allegedly dump tokens and vanish—started trending. But Mantra’s team pushed back hard, calling their project “fundamentally strong” and denying any internal wrongdoing.

Adding fuel to the fire, on-chain sleuths at Lookonchain reported that 17 wallets deposited 43.6 million OM tokens—worth $227 million, or 4.5% of the circulating supply—into exchanges before the crash. Two wallets were reportedly tied to Laser Digital, a strategic investor in Mantra.

The Bigger Picture: RWA and Crypto Volatility

Mantra isn’t just another altcoin—it’s a layer-1 blockchain focused on tokenizing real-world assets, from property to infrastructure. Earlier in 2025, it inked a $1 billion deal with UAE-based DAMAC Group to digitize assets, cementing its reputation as a rising star.

But this crash exposes the risks of crypto’s wild swings, especially for projects tied to institutional ambitions. With $108 million invested in the MANTRA Ecosystem Fund, backed by heavyweights like Laser Digital, the stakes are high.

Critics argue the crash highlights structural issues, like concentrated token supply or over-leveraged trading. While Mantra denies controlling 90% of OM tokens, as some claim, the incident raises questions about transparency and market resilience in the RWA space.

What’s Next for Mantra?

The road to recovery looks steep. Mantra’s team has promised a full investigation, and Mullin recently unveiled a $109 million recovery plan, including token buybacks to restore trust. But with investor sentiment shaken and comparisons to past crypto disasters lingering, rebuilding confidence will take more than words (including the incident of the OM token crash).

For now, the crypto world watches closely. Can Mantra rise from the ashes, or will this crash mark a turning point for RWA tokenization? One thing’s clear: in the high-stakes game of crypto, even the brightest stars can fall fast.

Also read our previous article of Pi Coin future price prediction: Crypto Comeback: Trump’s Policy Shifts Spark Rebound, But Experts Urge Caution

Read more updates and articles on our Crypto category page

#MantraToken #CryptoCrash #OMToken #Blockchain #CryptoNews #Liquidations #RWA #CryptoInvesting