Tether (USDT) vs. USD Coin (USDC): A Detailed Comparison

Introduction

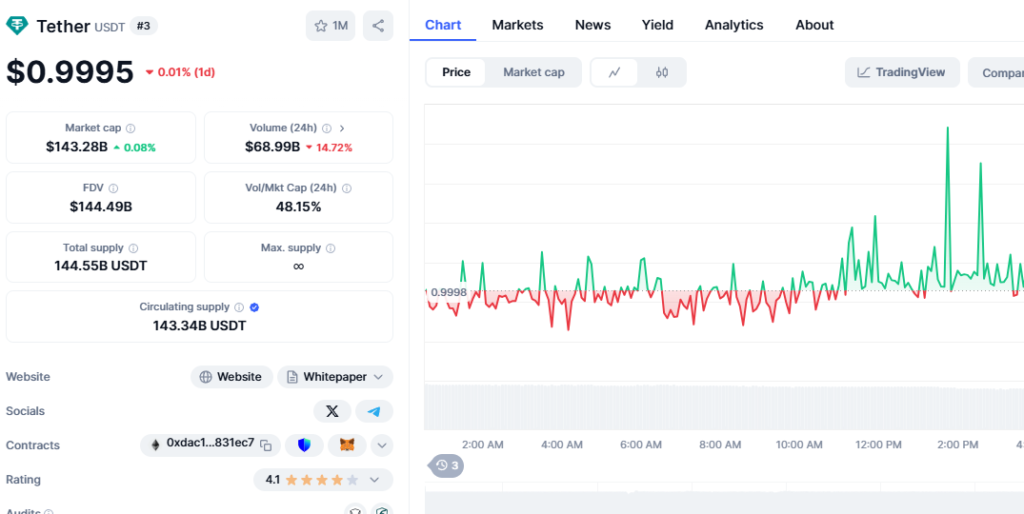

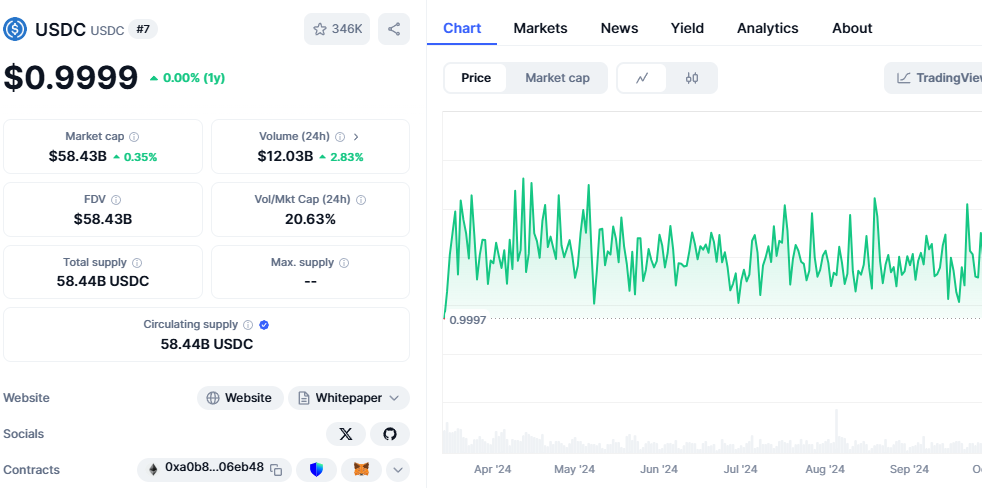

Stablecoins play a crucial role in the cryptocurrency ecosystem, providing traders and investors with price stability while retaining the advantages of blockchain technology. Among the most widely used stablecoins are Tether (USDT) and USD Coin (USDC). As of now, Tether ranks 3rd in market capitalization, while USDC ranks 7th. Both aim to maintain a 1:1 peg to the U.S. dollar but differ significantly in transparency, backing mechanisms, and use cases.

This article explores the key differences between Tether and USDC, their technical structures, and their roles in the broader financial ecosystem.

What is Tether (USDT)?

Tether (USDT) is the largest and most widely used stablecoin in the crypto market. Launched in 2014 by Tether Limited, it was one of the first stablecoins designed to offer liquidity and stability in the volatile crypto market. USDT is pegged to the U.S. dollar and is issued on multiple blockchain networks, including Ethereum (ERC-20), Tron (TRC-20), Binance Smart Chain (BEP-20), Solana, and others.

Key Features of Tether (USDT):

- Market Capitalization: Over $100 billion (as of 2024), making it the most traded stablecoin.

- Blockchain Support: Available on multiple chains, including Ethereum, Tron, and Binance Smart Chain.

- Backing Mechanism: Backed by a mix of cash reserves, commercial paper, and other assets, though past controversies have raised transparency concerns.

- Use Cases: Widely used for trading, remittances, and as a store of value in volatile crypto markets.

- Regulation and Transparency: Limited audits; Tether has faced scrutiny for its lack of full transparency regarding its reserves.

What is USD Coin (USDC)?

USD Coin (USDC) was launched in 2018 by Circle and Coinbase, under the Centre Consortium. Unlike Tether, USDC is known for its transparency and regulatory compliance. It is fully backed by cash and short-term U.S. government bonds, making it a more trusted alternative for those seeking a regulated stablecoin.

Key Features of USD Coin (USDC):

- Market Capitalization: Around $30 billion, making it the second-largest stablecoin by supply.

- Blockchain Support: Issued on Ethereum, Solana, Algorand, Avalanche, Stellar, and more.

- Backing Mechanism: 100% backed by cash reserves and U.S. Treasury bonds, with regular audits.

- Use Cases: Primarily used in decentralized finance (DeFi), cross-border payments, and institutional adoption.

- Regulation and Transparency: Fully audited by Grant Thornton LLP, making it one of the most transparent stablecoins.

Technical Differences: USDT vs. USDC

1. Blockchain Networks Supported

| Stablecoin | Blockchains Supported |

|---|---|

| USDT | Ethereum (ERC-20), Tron (TRC-20), Binance Smart Chain (BEP-20), Solana, Avalanche, Algorand, and more |

| USDC | Ethereum, Solana, Algorand, Avalanche, Stellar, Hedera, and more |

2. Transparency and Audits

| Feature | USDT | USDC |

| Audits | Limited transparency, not fully audited | Fully audited and backed by U.S. Treasury reserves |

| Reserve Composition | Mix of cash, commercial paper, and other assets | Fully backed by cash and short-term U.S. government bonds |

| Regulatory Compliance | Faced legal scrutiny for reserve disclosures | Regulated and compliant with U.S. financial regulations |

3. Security and Smart Contract Risks

Both USDT and USDC are issued as ERC-20 tokens (Ethereum) and TRC-20 tokens (Tron for USDT). The security risks include:

- USDT: Higher risk due to less transparency in audits and potential regulatory actions.

- USDC: More secure due to regular audits and compliance with U.S. financial regulations.

Fiat and Crypto Ecosystem: The Role of USDT & USDC

1. Fiat-Backed Stability

Both Tether and USDC aim to bridge the gap between traditional finance (fiat currency) and digital assets (crypto) by maintaining a stable value pegged to the U.S. dollar.

- USDT offers more liquidity and is widely accepted across global exchanges.

- USDC is preferred by institutions and DeFi platforms due to its transparency.

2. Use Cases in Crypto Trading and DeFi

| Use Case | USDT | USDC |

| Crypto Trading | Most used stablecoin for trading pairs | Increasingly used but less dominant |

| DeFi (Lending, Yield Farming) | Supported but not always trusted | Preferred due to transparency |

| Cross-Border Payments | Widely used | More trusted by businesses |

| Regulatory Preference | Less regulated | More compliant and preferred by institutions |

Conclusion: Which One Should You Choose?

- Choose USDT if you need high liquidity and global acceptance on major exchanges.

- Choose USDC if you prefer transparency, regulatory compliance, and DeFi adoption.

Both stablecoins serve crucial roles in the crypto ecosystem, but USDC is the safer and more transparent option, while USDT remains the most liquid and widely used stablecoin.

Final Thoughts

Understanding the differences between USDT and USDC is essential for anyone involved in cryptocurrency trading, DeFi, or blockchain applications. While USDT remains the market leader, USDC’s focus on transparency and regulatory compliance makes it a strong competitor for the future of stablecoins.

Which one do you prefer? Let us know in the comments! 🚀

CoinDCX: For traders and investors in India, CoinDCX is the best platform which has quick deposits and withdrawls, lowest fee and CoinDCX is the platform I trust to learn, invest & trade in Crypto. Buy your first crypto and win up to ₹5,00,000 in crypto rewards!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Read more updates and articles on our Crypto category page

#Crypto #Stablecoins #Tether #USDC #Blockchain #DeFi #Bitcoin #Ethereum #Web3 #CryptoTrading