How Visa and Mastercard Work: Understanding Payments and Business Model

Introduction:

Visa and Mastercard are two of the most widely recognized payment networks in the world. They operate as intermediaries between consumers, merchants, banks, and financial institutions to facilitate secure electronic payments. Unlike banks, Visa and Mastercard do not issue credit or debit cards themselves; instead, they provide the network that enables transactions between cardholders and businesses. There are also other payment networks as below, but we will be focusing on Visa and Mastercard for the time being:-

Other major payment networks include:

- American Express (Amex) – Operates as both an issuer and a network, charging higher fees but offering premium rewards.

- Discover – Similar to Amex, it acts as both an issuer and network, primarily in the U.S.

- UnionPay – The dominant card network in China, with global acceptance.

- JCB (Japan Credit Bureau) – A Japanese network with international reach.

- RuPay – An Indian payment network designed for domestic transactions but expanding globally

How the Payment Process Works🪙

Visa Mastercard Amex

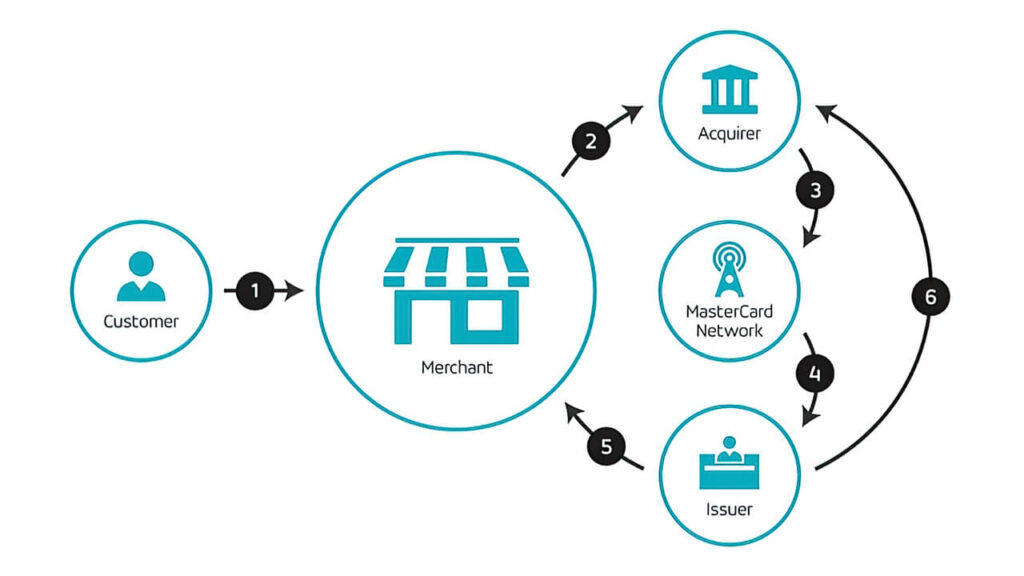

When a consumer makes a purchase using a Visa or Mastercard, the payment process involves several key players:

- Cardholder: The individual using a Visa or Mastercard for purchases.

- Merchant: The business accepting card payments for goods or services.

- Acquirer (Merchant Bank): The financial institution licensed by Mastercard or Visa that enables merchants to accept card payments.

- Issuer (Cardholder’s Bank): The bank or institution that provides credit or debit cards to consumers.

- Payment Processor: The company that manages the transaction between the merchant and acquiring bank.

- Card Network (Visa/Mastercard): The infrastructure that routes transactions securely between banks and businesses.

Step-by-Step Payment Process💲

- Purchase Initiation: The cardholder swipes, taps, or enters their card details at a merchant’s checkout.

- Authorization Request: The merchant’s terminal sends the transaction request to the acquirer.

- Transaction Routing: The acquirer forwards the request to Visa or Mastercard, which then routes it to the issuer (cardholder’s bank).

- Approval or Decline: The issuer checks the account for sufficient funds or available credit and responds with an approval or decline.

- Transaction Settlement: If approved, funds are transferred from the issuer to the acquirer, and finally to the merchant’s account.

What is an Acquirer?

An acquirer (also called a merchant bank) is a financial institution licensed by Mastercard or Visa that helps a merchant process card transactions. They ensure that the merchant receives funds from card transactions and manage risks associated with accepting card payments.

Example: If a retail store accepts Visa and Mastercard remittance, it partners with an acquirer like JPMorgan Chase or Bank of America Merchant Services, which processes transactions on its behalf.

What is an Issuer?

An issuer is the financial institution or entity that provides consumers with credit or debit cards. This could be a bank, credit union, savings and loan association, government entity, or retailer. The issuer determines spending limits, interest rates, and security measures for each cardholder.

Example: If you have a Visa or Mastercard credit card issued by Citibank, Citibank is the issuer responsible for approving transactions and managing your account.

What is a Payment Processor?💸

Payment processors are companies that handle transactions between merchants, issuing banks, and acquiring banks. They securely transmit payment data and ensure transactions are approved or declined. Some major payment processors include:

- Stripe – A popular online payment processor for e-commerce and subscription services.

- PayPal – Facilitates online payments and peer-to-peer transfers.

- Square – Specializes in small business payments with point-of-sale (POS) systems.

- Adyen – Provides global payment solutions for large enterprises.

- Worldpay – A major processor handling in-store and online transactions.

How Visa and Mastercard Make Money 💰

Since Visa and Mastercard do not issue cards or lend money, their revenue comes from transaction fees and financial services. Their primary revenue sources include:

- Interchange Fees: A small percentage of each transaction that merchants pay to process payments.

- Assessment Fees: Charges that issuing banks pay Visa or Mastercard for using their network.

- Data and Security Services: Visa and Mastercard provide fraud detection, transaction security, and analytics services for financial institutions.

- Licensing Fees: Banks and financial institutions pay Visa and Mastercard for the right to issue branded cards.

Conclusion

Visa and Mastercard play a crucial role in the global financial ecosystem by facilitating seamless, secure, and efficient transactions. By acting as intermediaries between merchants, banks, and consumers, they ensure a smooth flow of digital payments worldwide.

Also comment what else I should be writing about?

Visa #Mastercard #Payments #Fintech #CreditCards #DigitalPayments #Finance #Banking #Ecommerce #MoneyMatters