India’s Stocks Market Faces Turbulence: Smart Investors Eye Bluechip & Banking Stocks

The Indian equity market is expected to remain range-bound in 2025, with stretched valuations capping significant upside potential despite recent corrections in midcap and smallcap stocks. According to experts, the Nifty’s current trading level—approximately 18times its projected March 2026 earnings—leaves little room for a substantial rally in the near term.

Evaluating Nifty’s Valuation and Growth Potential

The Nifty’s present valuation is significantly above historical averages, currently trading at a 90% premium to the MSCI Emerging Markets Index. This elevated level is concerning, particularly given the projected earnings CAGR of 14% for FY26 and FY27, which faces potential downside risks.

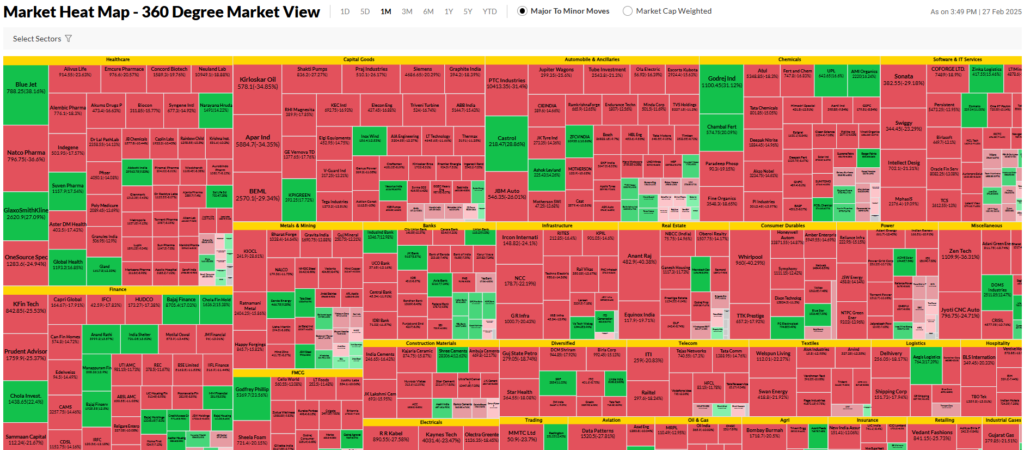

India’s benchmark indices have seen a 5% decline year-to-date, with the Nifty down nearly 14% from its all-time high. The downturn has been more pronounced in smaller stocks, with the Nifty Midcap Index dropping 13% and the Nifty Smallcap Index plunging 18% in 2024 alone.

Foreign and Domestic Investment Trends

Foreign investors, who have maintained a cautious stance on Indian equities, are beginning to show selective interest, particularly in large-cap stocks within the financial services, real estate, and consumer sectors, such as e-commerce and quick-service restaurants. However, many remain hesitant, awaiting deeper market corrections before making larger allocations.

There has also been a direct effect of US president Donald Trumps erratic decisions around the Tariff and trade wars, which has grabbed the investors sentiment in fear, in both stocks and crypto markets.

On the domestic front, mutual funds and institutional investors are shifting focus from smallcap and midcap stocks to large-cap and balanced funds due to concerns over high valuations and potential earnings downgrades. Equity inflows remain positive but show signs of moderation.

FII Investors Cashing Out

Foreign Institutional Investors (FIIs) have been pulling out funds from the Indian market, adding to the market’s volatility. The selling pressure from FIIs has contributed to sharp corrections, particularly in midcap and smallcap stocks. A combination of high valuations, global interest rate concerns, and better opportunities in other emerging markets has led to this trend. However, long-term investors view this as a potential accumulation phase for strong, fundamentally sound stocks.

Key Sectors to Watch

Kotak Institutional Equities maintains a bullish outlook on select industries with strong growth potential, including:

- Large private banks and NBFCs

- Life insurance

- Residential real estate

- Hotels and airlines

Conversely, the firm remains cautious on sectors such as consumer staples, discretionary stocks, oil & gas, and chemicals, citing limited upside and valuation concerns.

While corporate sentiment remains subdued, some industries remain optimistic. Banks are bracing for slower loan growth and tighter liquidity, while real estate developers, hospitality businesses, and renewable energy firms anticipate strong demand in the coming years.

Market Risks and Potential Triggers

Key downside risks identified by Kotak include:

- A sharper-than-expected global economic slowdown

- Poor monsoon conditions impacting rural demand

- Declining domestic retail inflows

On the flip side, potential market catalysts include a weaker U.S. dollar and an uptick in private capital expenditure, which could lend support to equities.

Tactical Investment Approach: Focus on Bluechip and Banking Stocks

Even some of India’s most resilient stocks have seen a sharp correction. Top stocks from the Tata Group have corrected nearly 50% from their peak, indicating the extent of the broader market downturn. While this may seem concerning, it also presents a strategic investment opportunity.

Historically, downturns have provided long-term investors with strong entry points into bluechip stocks and banking sector leaders, which tend to be more resilient during market fluctuations. Large private banks, NBFCs, and select bluechip companies with strong fundamentals remain the best bet for investors seeking stability in this volatile phase.

Caution for Midcap and Smallcap Investors

The midcap and smallcap sectors have been hit particularly hard, with deep corrections wiping out a significant portion of gains from previous rallies. While these segments may offer high-growth potential over the long term, investors should exercise caution. Short-term volatility remains a major risk, and those looking to invest in midcap and smallcap stocks should maintain a minimum investment horizon of 3-5 years to withstand market fluctuations and capitalize on eventual recoveries.

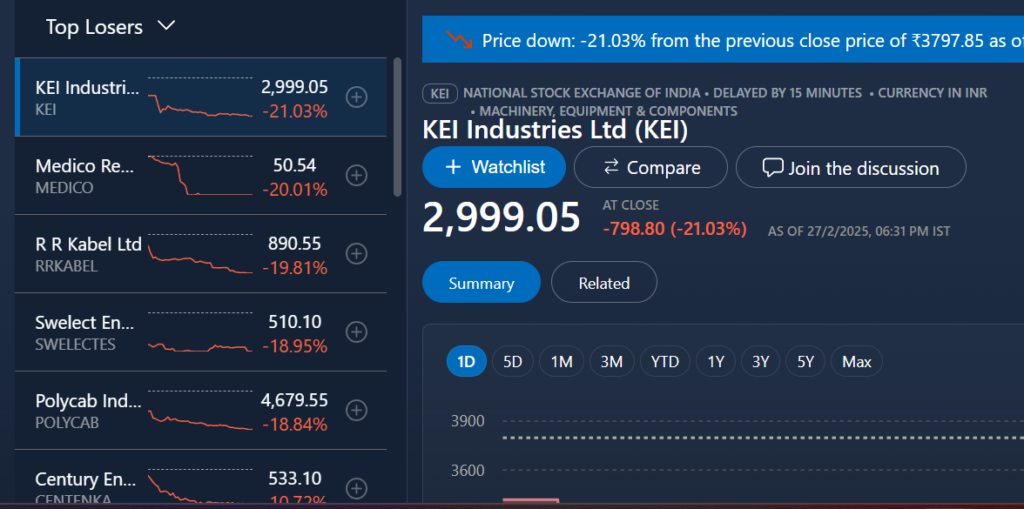

Sharp Fall in Electrical Cable Stocks

Today, electrical cable stocks such as Polycab, Havells, and KEI witnessed a significant decline after UltraTech Cement announced its entry into the wires and cables segment. The company plans to invest ₹1,800 crore over the next two years as part of its expansion into the broader construction value chain. This development has heightened competition concerns, leading to a sharp sell-off in existing players within the segment.

Final Take: A Temporary Correction or a Deeper Bear Phase?

With the Nifty trading at a historically high premium, investors remain split on whether this downturn signals a prolonged bear market or just a short-term correction. While risks persist, Kotak believes that India’s long-term growth trajectory remains intact, justifying elevated valuations. Investors should adopt a cautious yet strategic approach, balancing exposure to resilient large-cap stocks while keeping an eye on emerging opportunities in a volatile market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Check out more article on Finance on our Finance and Crypto articles on our Crypto Category section.

#StockMarket #Investing #Nifty50 #BluechipStocks #BankingSector #Midcap #Smallcap #IndiaEquities #MarketCrash #SmartInvesting #Tata #Adani #Reliance