U.S. Stock Market Crashes: Is Trump’s Tariff War a Recession Trigger?

What’s Happening by the decisions of Trump

The U.S. stock market has taken a dramatic nosedive in recent days of April 2025, with the NASDAQ and Dow Jones Industrial Average reflecting significant losses as trade tariff wars escalate under President Donald Trump’s administration.

Fueled by strategic decisions involving Trump and influential figures like Elon Musk (DOGE), the market has officially entered bear mode, raising fears of a recession. However, some analysts suggest this could be a calculated move to position the U.S. as a global economic powerhouse, strengthening the USD and setting the stage for a robust recovery.

NASDAQ and Dow Jones Levels: A Stark Decline

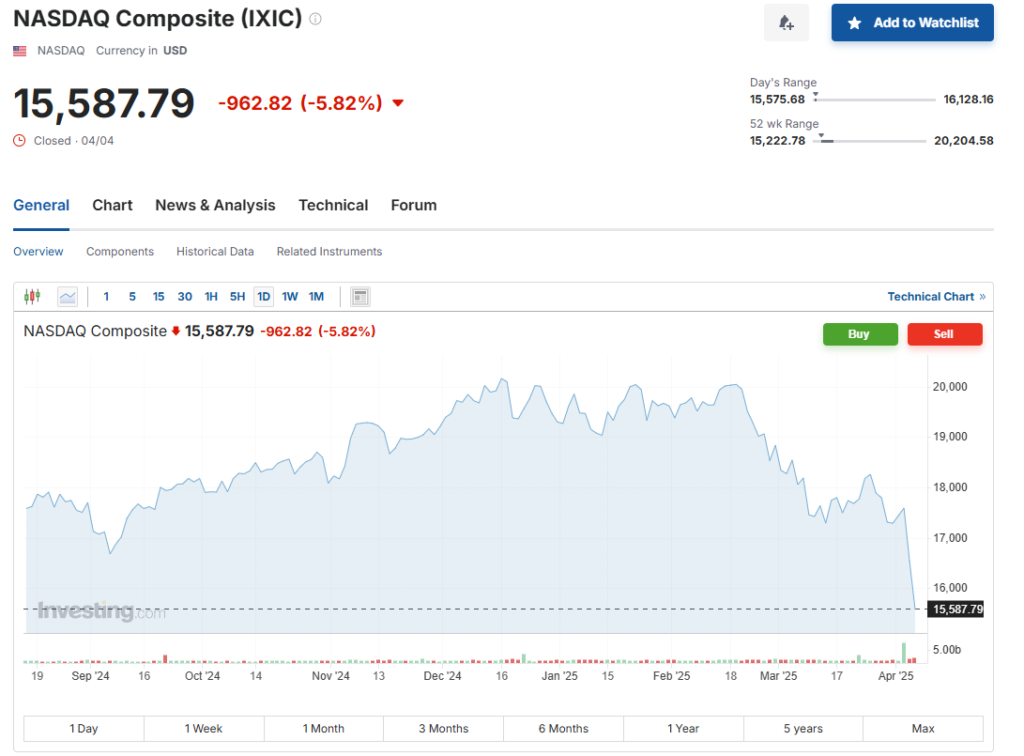

As of April 06, 2025, the U.S. stock market is reeling from its worst performance since the 2020 pandemic crash. The NASDAQ Composite, heavily weighted with tech giants, closed at 15,587.79 on Friday, April 4, after plummeting 962.82 points—or 5.82%—in a single day.

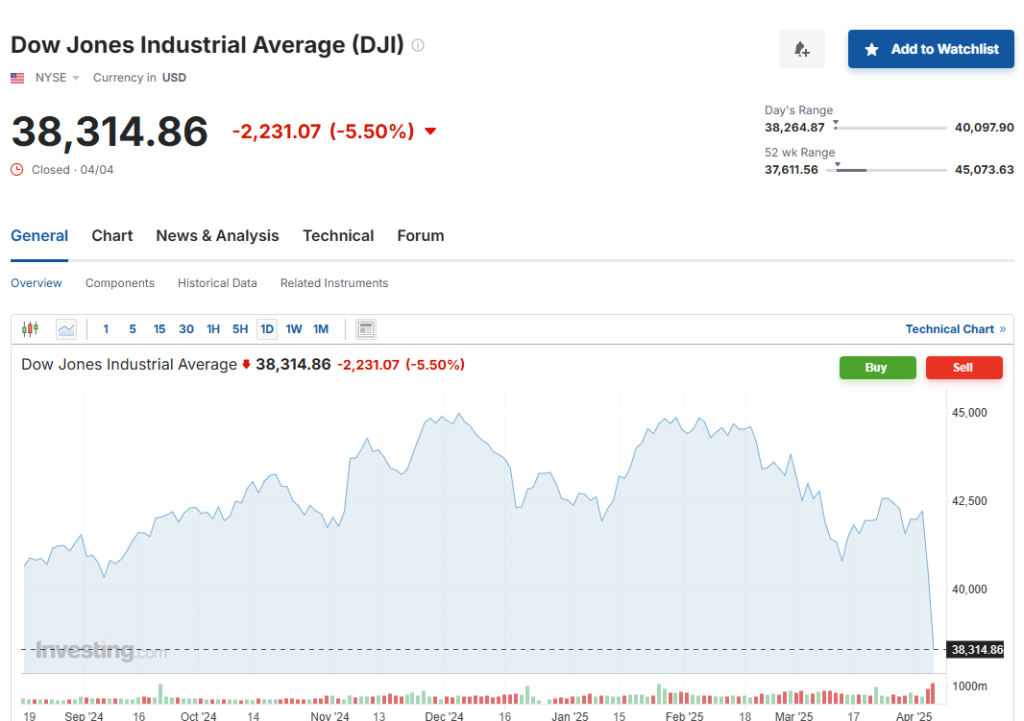

This drop pushed the index into bear market territory, defined as a decline of 20% or more from its recent high of 20,173.89 on December 16, 2024. Meanwhile, the Dow Jones Industrial Average fell 2,231.07 points, or 5.5%, to 38,314.86, marking a correction as it sits over 10% below its December peak of 45,014.04.

These staggering declines—wiping out over $5 trillion in market value from the S&P 500 alone in just two days—signal a shift into recession-type conditions. Investors are rattled, but could this be part of a broader strategy?

Trade Tariff Wars: Trump and Elon’s Bold Moves

The catalyst behind this market turmoil is President Trump’s aggressive trade tariff policies, which have sparked a global trade war. On Wednesday, April 2, 2025, Trump announced sweeping tariffs, including a baseline 10% levy on imports from nearly all U.S. trading partners, with additional duties reaching up to 34% on Chinese goods.

China then made the quick response by imposing a matching 34% tariff on all U.S. exports effective April 10, intensifying fears of supply chain disruptions and inflation.

Elon Musk, a key advisor to Trump and a vocal influencer via his platform X, has played a controversial role in this economic shakeup. While Musk has criticized some of Trump’s trade advisors, like Peter Navarro, for downplaying the market fallout, his involvement in the administration signals a strategic alignment.

Analysts speculate that Musk’s push for American manufacturing resurgence—aligned with Trump’s tariff agenda will aim to weaken foreign economies and bolster U.S. dominance. This will eventually give an opportunity for US Dollar to strengthen in near future.

Bear Mode and Recession Fears: A Strategic Play?

The U.S. stock market’s descent into bear mode has economists sounding recession alarms. JPMorgan now estimates a 60% chance of a global recession in 2025, up from 40%, citing the tariff fallout.

The S&P 500, closing at 5,074.08 after a 6% drop on Friday, has lost over 10% in two days, its worst stretch since March 2020. Tech stocks like Apple (-7.3%), Tesla (-10.4%), and Nvidia (-7.4%) have been hit hardest, reflecting vulnerabilities in global supply chains.

Yet, some see this as a deliberate maneuver. Trump has dismissed recession fears, claiming on social media that his policies will “supercharge” the U.S. economy. The theory gaining traction is that this orchestrated market drop—mirrored across global exchanges—will devalue foreign currencies and assets, making the USD the world’s strongest currency. As stock markets falter globally, the U.S. could emerge as a safe haven, attracting investment once the dust settles.

Trump’s Next Move: Boosting the U.S. Economy

With the USD poised to strengthen, President Trump is expected to pivot from disruption to recovery. Insiders suggest he will soon urge investors to “invest more” in American markets, leveraging the lower stock prices as a buying opportunity. This could spark a rally, particularly in sectors like manufacturing and energy, which stand to benefit from reduced foreign competition.

There is a chance that Trump with his money reserves and funds, along with his near and dear one’s can start buying now to reap good benefits in the future.

Elon Musk’s influence may amplify this call to action. His companies, such as Tesla and SpaceX, could lead the charge in a revitalized U.S. economy, supported by domestic production incentives tied to the tariffs.

What’s Next for Investors?

For now, uncertainty reigns. The Federal Reserve, led by Chairman Jerome Powell, has warned that tariffs could fuel inflation and slow growth, complicating monetary policy. Investors are flocking to safe-haven assets like gold, which surged 20% this week, while Treasury yields dip to 3.9%.

However, those who buy into Trump’s vision may see today’s plummeting NASDAQ and Dow Jones levels as a rare chance to invest in a future U.S.-led economic boom.

What can the investors do in this point: keep on investing and averaging out the Index Funds and gold reserves. Go for Blue-chip stocks and bonds to be safe and secure for future.

The U.S. stock market’s bear mode and recession-like conditions are undeniable, but the trade tariff wars and Trump-Elon partnership could be rewriting the global financial playbook. Will this gamble pay off? Only time will tell, but one thing is clear: the stakes have never been higher.

Also Check our previous article on US Stock Market Crash

Got questions? Drop them below—I’m all ears!

Check out more article on Finance on our Finance Category section.

#USStockMarket #StockMarketCrash #TradeTariffWars #TrumpTariffs #Recession2025 #NASDAQ #DowJones #USDEconomy #Investing #ElonMusk