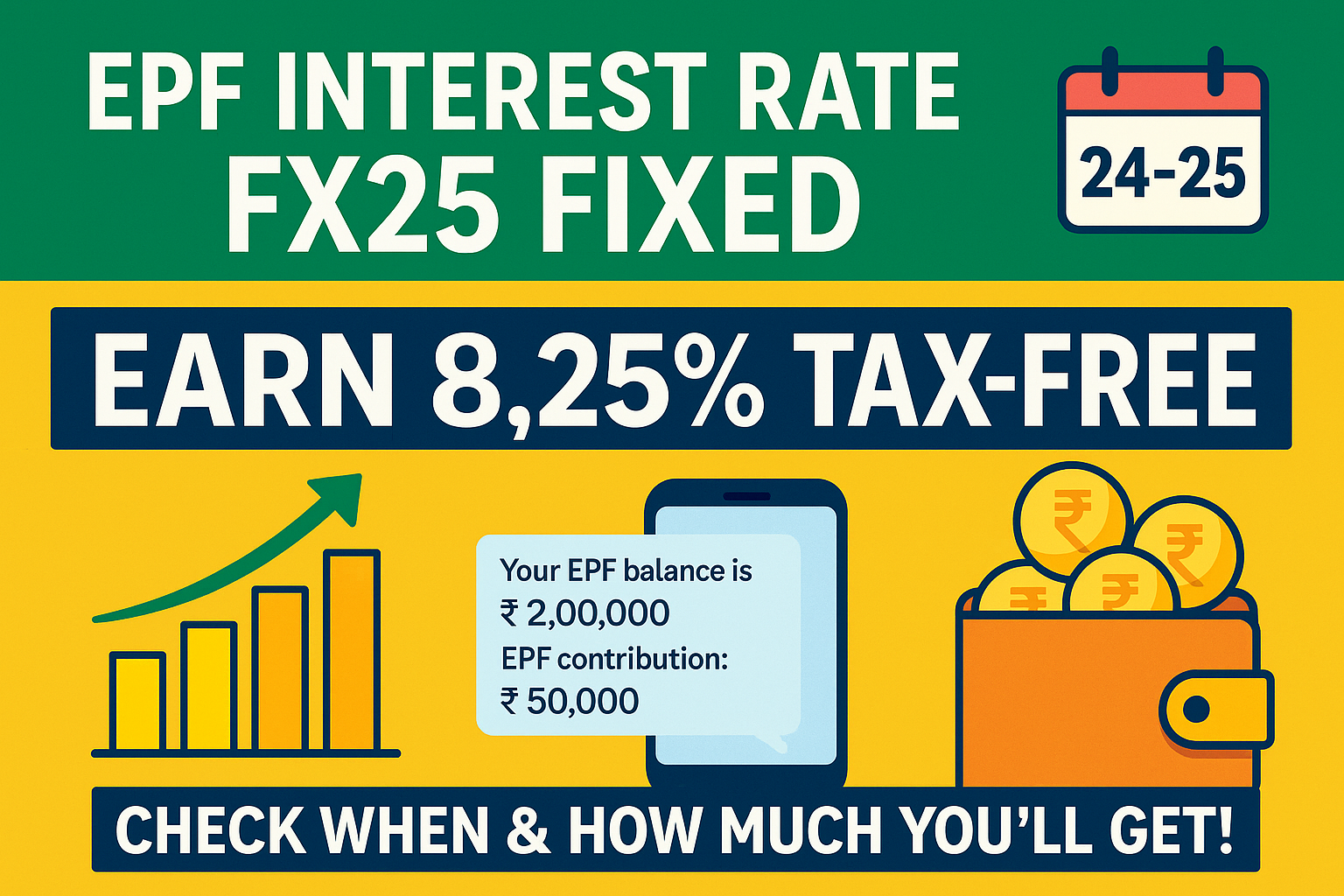

EPF Interest Rate for FY25 Stays at 8.25%: How Much You’ll Earn & When It Gets Credited

EPF interest rate 2024-25: The Indian government has officially announced that the interest rate on Employees’ Provident Fund (EPF) deposits will remain at 8.25% for the financial year 2024-25, maintaining the same rate as last year. This decision, first recommended by the Central Board of Trustees (CBT) and later approved by the Ministry of Finance, ensures continued stable returns for over 6 crore EPF subscribers.

📈 How EPF interest rate 2024-25 Is Calculated

The Employees’ Provident Fund Organisation (EPFO) computes interest monthly, though it is credited at the end of the financial year. Each month’s interest is calculated using the formula:

Monthly Interest = (Monthly Closing Balance × 8.25%) ÷ 12

This results in a monthly interest rate of 0.6875%, which compounds as your balance grows each month.

For example, if your EPF account has a closing balance of ₹2,00,000 at the end of April:

Interest = ₹2,00,000 × 0.6875% = ₹1,375

This amount is added to your balance and contributes to the compounding effect in subsequent months.

💼 Understanding Contributions & Year-End Payout

EPF contributions are shared by both employee and employer:

- 12% of the basic salary is deducted from the employee.

- The employer matches this 12%, though a portion goes to the Employees’ Pension Scheme (EPS).

For example:

- If your basic salary is ₹50,000, both you and your employer contribute ₹6,000 each.

- From the employer’s ₹6,000, ₹1,250 goes to EPS and ₹4,750 to EPF.

This pooled amount earns interest monthly but is credited in bulk at the end of the financial year, typically around April to July of the following year.

🔎 How to Check Your EPF Balance

Keeping track of your EPF balance is now easier than ever with the following free services:

📞 Missed Call Method

- Dial 9966044425 from your registered mobile number.

- You’ll receive an SMS with your latest balance and contribution.

📩 SMS Method

- Text “EPFOHO UAN” to 7738299899.

- Available in multiple Indian languages like Hindi, Tamil, Kannada, Bengali, and more.

Make sure your Universal Account Number (UAN) is activated and KYC details are updated for these services to work.

💡 Why It Matters

With tax-free returns and government-backed security, EPF remains one of the most reliable long-term savings tools for salaried professionals. The steady interest rate of 8.25%, despite economic shifts, reflects EPFO’s consistent performance—backed by robust annual incomes (₹1.07 lakh crore in FY24 on a corpus of ₹13 lakh crore).

By monitoring your balance and understanding your interest accrual, you can make smarter financial decisions and ensure your retirement corpus is on track.

EPF investment is one of the best options for investment and is a safe option for investment. It provides higher return than FD and can be used in emergency times.

Got questions? Drop them below—I’m all ears!

Also, read our other article – Indian Stock Market Outlook 2025: Key Trends, Nifty 50 Predictions & Safe Investment Strategies

Check out more article on Finance on our Finance Category section.

#EPF2025 #ProvidentFund #EPFInterest #TaxFreeReturns #EPFO #FinanceIndia #SavingsTips #SalaryPlanning