Crypto Market in Turmoil: Bitcoin’s Plunge Sparks Massive Altcoin Sell-Off – Is a Deeper Crash Ahead?

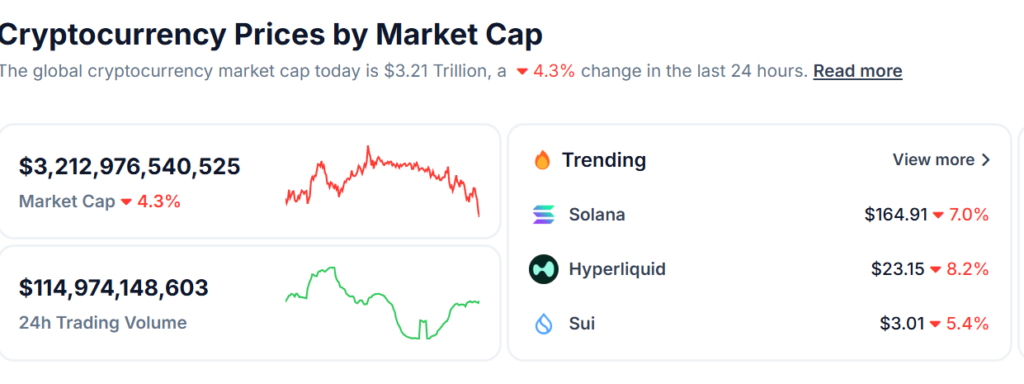

Cryptocurrency market is facing intense volatility as Bitcoin’s sudden decline triggers a mass exodus from altcoins. Over the past week, Bitcoin’s price has dropped sharply, increasing its market dominance as investors retreat from riskier digital assets.

This shift has been exacerbated by rising macroeconomic uncertainty, aggressive trade policies, and tightening financial conditions, all of which have fueled widespread fear in the market.

Many analysts are now questioning: Is this just a temporary correction, or are we witnessing the early stages of a deeper market crash?

Bitcoin’s Fall and Its Market-Wide Impact

Bitcoin’s price movements often set the tone for the entire cryptocurrency market, and this latest downturn is no exception. Over the past few days, BTC has:

📉 Dropped from a high of $97,500 to a low of $92,100, marking a 5.5% decline within a short span.

📈 Bitcoin dominance surged to 52.8%, as traders abandon altcoins in favor of the “safer” blue-chip crypto.

🚨 Over $750 million in leveraged positions liquidated, with $620 million coming from long positions, highlighting the level of panic selling.

Historically, whenever Bitcoin’s dominance rises during a market decline, altcoins experience disproportionate losses, and the current cycle is proving to be no different.

Altcoins Suffer Heavier Losses

With Bitcoin’s dip, altcoins have been hit even harder, with several major tokens witnessing double-digit losses in just a few days.

🔻 Ethereum (ETH): Dropped 4.2%, currently trading at $2,747.

🔻 Solana (SOL): Down 6.8%, hovering around $104.

🔻 Avalanche (AVAX): Fell 8.3%, now at $38.10.

🔻 Dogecoin (DOGE): Plunged 9.1%, trading at $0.084.

🔻 Polygon (MATIC): Down 10.5%, struggling at $0.91.

The sharp declines reflect a mass sell-off among altcoins, driven by fear and risk aversion. Many investors are offloading high-risk assets, seeking safety in Bitcoin or moving to stablecoins to hedge against further losses.

What’s Driving the Crypto Market Down?

Several factors have contributed to this market-wide downturn, making it clear that Bitcoin’s decline is not happening in isolation.

1️⃣ Macroeconomic Uncertainty & Strong U.S. Dollar

The crypto market remains highly sensitive to macroeconomic trends, and several global developments have spooked investors:

💰 The U.S. Dollar Index (DXY) has risen above 104.2, making risk assets like Bitcoin and altcoins less attractive.

📉 10-Year Treasury Yields increased to 4.19%, pulling liquidity away from speculative markets.

🇨🇳 China’s economic slowdown and weakening yuan have triggered risk-off sentiment globally.

These macroeconomic headwinds have created an environment where investors prioritize capital preservation, leading to a liquidity drain from riskier assets like crypto.

2️⃣ Bitcoin ETF Outflows: Institutions Are Selling

Bitcoin and Ethereum exchange-traded funds (ETFs) have been experiencing large net outflows, signaling that institutional investors are cautiously exiting the market.

- Between February 10–14, Bitcoin ETFs saw $581.23 million in net outflows.

- Fidelity’s FBTC lost $282.12 million in a single week, marking one of its biggest outflow streaks.

- Ethereum ETFs suffered a net exit of $26.3 million, with Grayscale’s ETHE leading the losses with $56.46 million withdrawn.

This institutional retreat suggests that larger investors are de-risking their portfolios, which could prolong the market downturn.

3️⃣ Technical Breakdown: Bitcoin Faces Critical Support Levels

From a technical perspective, Bitcoin is currently at a make-or-break level, with key supports under threat:

🔸 $92,000: A historically significant support level that has held multiple times in the past.

🔸 $87,000: A deeper support zone that, if broken, could trigger a much larger capitulation.

If Bitcoin fails to hold above $92K, analysts warn that the next leg down could bring BTC into the $87K–$85K range, triggering a more severe market correction.

Meanwhile, altcoins are showing signs of further weakness, with many breaking below their 200-day moving averages—typically a bearish indicator signaling an extended downtrend.

Investor Sentiment: Caution and Fear Take Over

The shift in investor sentiment is evident across multiple metrics:

📊 Crypto Fear & Greed Index has dropped to 39 (“Fear”), reflecting growing market anxiety.

📉 Funding rates have turned negative, indicating that traders are increasingly bearish.

🚨 Over $320 million in liquidations occurred within 24 hours, suggesting panic-driven exits.

While some contrarian traders see potential for a rebound, the overall mood in the market remains cautious, with many investors opting to stay on the sidelines.

What’s Next? Will the Crypto Market Recover or Crash Further?

As the dust settles, the next few days will be crucial in determining whether this downturn is a temporary shakeout or the beginning of a deeper market crash.

🔹 Potential Scenarios:

✅ Scenario 1: Bitcoin Holds Above $92K – Market Stabilization

If Bitcoin finds strong support around its current levels and ETF outflows slow down, we could see a short-term recovery. This could allow altcoins to rebound, and sentiment may improve.

🚨 Scenario 2: Bitcoin Falls Below $92K – Deeper Crash Ahead

If BTC breaks below its critical support zones, the market could enter a more extended bearish phase, leading to further liquidations and heavier altcoin losses.

For now, all eyes remain on Bitcoin’s price action. Until BTC establishes firm support, caution remains the best approach for traders and investors navigating this volatility.

💬 What’s your strategy during this market downturn? Are you buying the dip, holding, or staying in stable assets? Share your thoughts below!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Read more updates and articles on our Crypto category page

#Bitcoin #CryptoCrash #Altcoins #Ethereum #CryptoMarket #BTC #ETH #DeFi #HODL #BearMarket