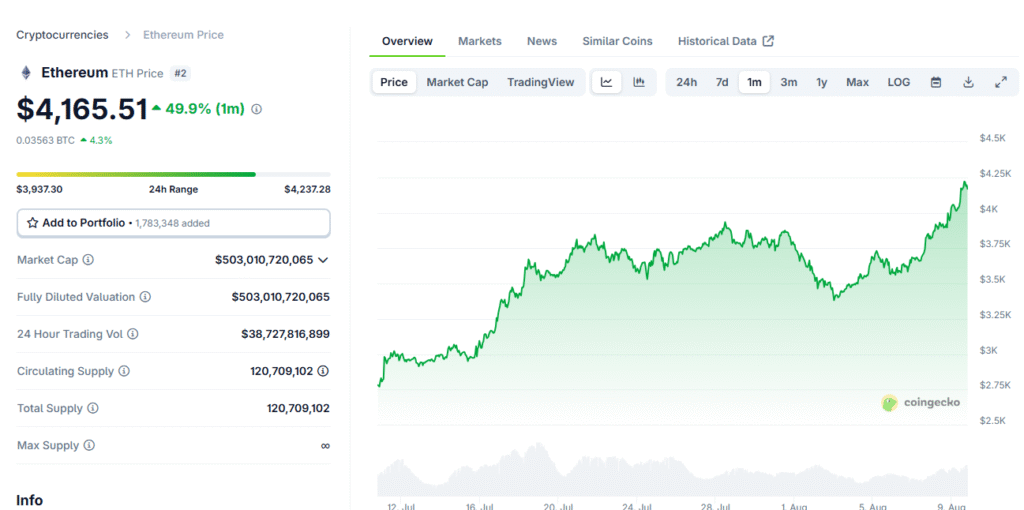

Ethereum Surges Past $4,000: Reasons, Price Targets, and What’s Next for ETH Investors

Ethereum Breaks $4,000 — Here’s Why the Bull Run Might Just Be Starting

Ethereum (ETH) has crossed the $4,000 mark, marking a significant milestone in the cryptocurrency market. This surge has not only renewed bullish sentiment but also raised important questions for traders and long-term investors on ETH Market analysis: What’s driving this rally? Where could ETH go next? And should you invest now or wait for a correction?

1. Key Drivers Behind Ethereum’s $4,000 Breakout

a) Institutional Adoption on the Rise

Institutional investors have been steadily increasing their exposure to Ethereum, with major asset managers, hedge funds, and even traditional banks exploring ETH-based financial products. The approval of Ethereum ETFs in several markets has significantly boosted liquidity.

b) Growth in DeFi and Web3

Ethereum remains the backbone of decentralized finance (DeFi) and Web3 applications. With billions locked in DeFi protocols and NFT activity showing signs of revival, demand for ETH’s network utility is climbing.

c) The ETH Supply Crunch

Thanks to Ethereum’s EIP-1559 upgrade, a portion of transaction fees is permanently burned. This deflationary effect, combined with increased staking through Ethereum 2.0, is reducing circulating supply, creating upward price pressure.

d) Broader Market Sentiment

Bitcoin’s stability above $60,000 has strengthened investor confidence, pulling altcoins like Ethereum into a bullish momentum phase.

2. Expert Price Targets for Ethereum

Analysts are divided on ETH’s next move, but most agree on a bullish trajectory:

- Short-term target: $4,500 – $4,800

- Medium-term target: $5,200 – $6,000

- Long-term target: $8,000+ by 2026 if network growth and adoption continue at the current pace.

Some bullish projections suggest ETH could eventually challenge the $10,000 mark if blockchain adoption accelerates in enterprise and financial systems.

3. Potential Risks to Watch

While the outlook is strong, investors should be mindful of:

- Regulatory uncertainty in major markets like the US and EU

- Ethereum network congestion and high gas fees during peak usage

- Competition from rival blockchains like Solana, Avalanche, and Cardano

4. Ethereum’s Long-Term Investment Case

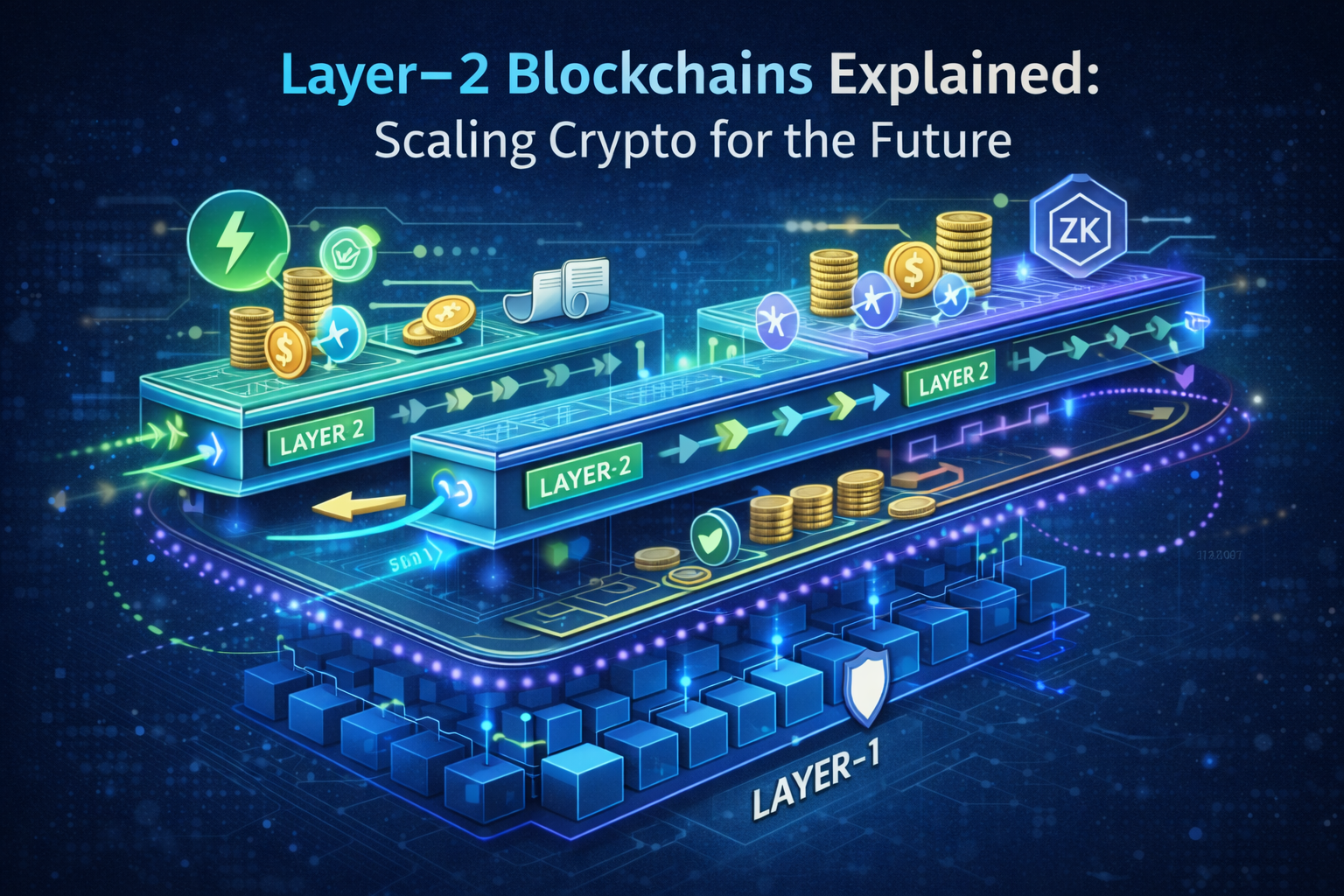

Ethereum is more than a cryptocurrency — it’s a foundational technology for decentralized apps, tokenization, gaming, and finance. The network’s continued upgrades, including scalability improvements via layer-2 solutions, position it as a critical player in the future of digital finance.

For investors with a multi-year horizon, Ethereum’s current breakout could be the beginning of a longer-term bull cycle.

📌 Final Take:

Ethereum crossing $4,000 isn’t just a market headline — it’s a signal that the network’s adoption, utility, and investor interest are reaching new heights. With both bullish momentum and technological upgrades on its side, ETH’s future could be brighter than ever for ETH market analysis.

Read more updates and articles on our Crypto category page and also for Bitcoin price Forecast. Also, read our article on – How the Elon Musk–Donald Trump Feud and Epstein Files Are Quietly Rocking the Crypto Market

#Ethereum #ETH #CryptoNews #ETHPricePrediction #Blockchain #CryptoInvesting #EthereumSurge #CryptoMarket