Bitcoin Price Near $110,000: Why BTC Fell and What to Expect in the Next 4 Months

Bitcoin Near $110,000: Correction or Start of a Bigger Move?

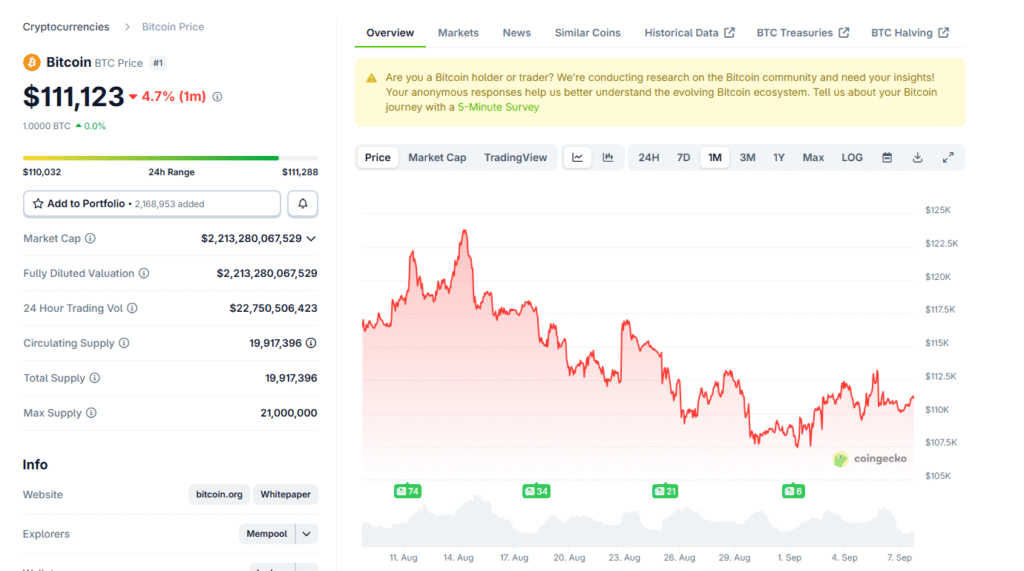

Bitcoin, the world’s largest cryptocurrency, recently tested the $110,000 zone before experiencing a noticeable pullback. While corrections in crypto markets are nothing new, the timing and scale of this drop have left traders questioning whether this is a short-term shakeout or the beginning of a larger consolidation phase.

📊 Why Did Bitcoin Fall from $110,000?

Several factors have contributed to BTC’s retracement from its recent highs:

- Overheated Momentum:

- Rapid price rallies often lead to overextended RSI levels, prompting profit-taking among institutional and retail investors.

- Macro-Economic Factors:

- Shifts in interest rate expectations, inflation concerns, and global economic slowdowns tend to weigh heavily on risk assets like Bitcoin.

- On-Chain Movements:

- Whale wallets and early holders moving coins onto exchanges triggered concerns of selling pressure, contributing to the downturn.

- Market Sentiment Cycles:

- Following every strong breakout, Bitcoin historically experiences 10–20% pullbacks before resuming its trend. This could simply be another cycle reset.

🔍 Technical Analysis: BTC’s Current Market Structure

- Immediate Support Zones:

- $102,000 – A crucial demand area where buyers have stepped in before.

- $98,000 – Strong psychological level and prior breakout zone.

- Resistance Levels to Reclaim:

- $110,000 – The level that rejected BTC initially.

- $115,000 – Next upside barrier if bullish momentum returns.

- Indicators to Watch:

- RSI: Cooling down from overbought levels.

- MACD: Showing signs of bearish divergence, suggesting short-term consolidation.

- Volume Trends: Declining volume on recent rallies signals weakening buyer strength.

📅 Price Predictions for the Next 4 Months

September 2025 – Retest of Support

- Expect Bitcoin to test the $100,000–$102,000 support zone. A bounce here could confirm a healthy correction.

October 2025 – Accumulation Phase

- Consolidation between $100,000–$110,000 as traders accumulate BTC. Sideways movement is likely before a breakout attempt.

November 2025 – Bullish Rebound

- If macroeconomic conditions improve, BTC could push toward $115,000–$120,000, breaking the current resistance.

December 2025 – Year-End Rally Potential

- Historically, Q4 tends to favor crypto markets. If liquidity inflows return, Bitcoin may attempt a surge toward $125,000–$130,000 by year-end.

🔮 Future Outlook: Is Bitcoin Still on Track for Higher Highs?

Despite the recent correction, Bitcoin’s long-term structure remains bullish. The breakout above the six-figure level earlier this year solidified institutional confidence. Moreover:

- ETF inflows and adoption continue driving demand.

- Halving effects from earlier in the cycle are still playing out, historically pushing BTC higher in extended rallies.

- Global adoption trends remain intact, with Bitcoin increasingly seen as a hedge against inflation and geopolitical uncertainty.

📌 Conclusion: Correction Today, Higher Targets Tomorrow?

Bitcoin near $110,000 may have sparked uncertainty, but this pullback looks more like a healthy reset than a trend reversal. As long as BTC holds above $100,000, the mid-term trajectory toward $120,000+ remains intact.

For traders, the next four months could present a mix of volatility, accumulation opportunities, and possibly a strong year-end rally.

Bitcoin #BTC #CryptoNews #BitcoinPrediction #BTCPriceForecast #CryptoAnalysis #Blockchain #BTCBullRun #BitcoinFuture #CryptoMarket