China’s Tech Giants Go Global — Moving AI Model Training Overseas to Tap Nvidia Chips

Why This Matters Now

In 2025, a major shift is unfolding in the AI world. Faced with mounting export restrictions on advanced semiconductors, top Chinese tech firms are relocating their AI model training to overseas data centers — primarily in Southeast Asia — to keep accessing critical hardware from Nvidia. This move reflects broader tensions between global tech supply chains and geopolitics, and signals how AI will increasingly become a border-spanning enterprise. (Nvidia chips export restrictions 2025)

🏃♂️ What’s Happening: The Offshore AI Training Shift

- According to a report from Financial Times cited by Reuters, Chinese giants such as Alibaba and ByteDance have started training their large language models (LLMs) in data centers outside China — notably in Southeast Asian countries.

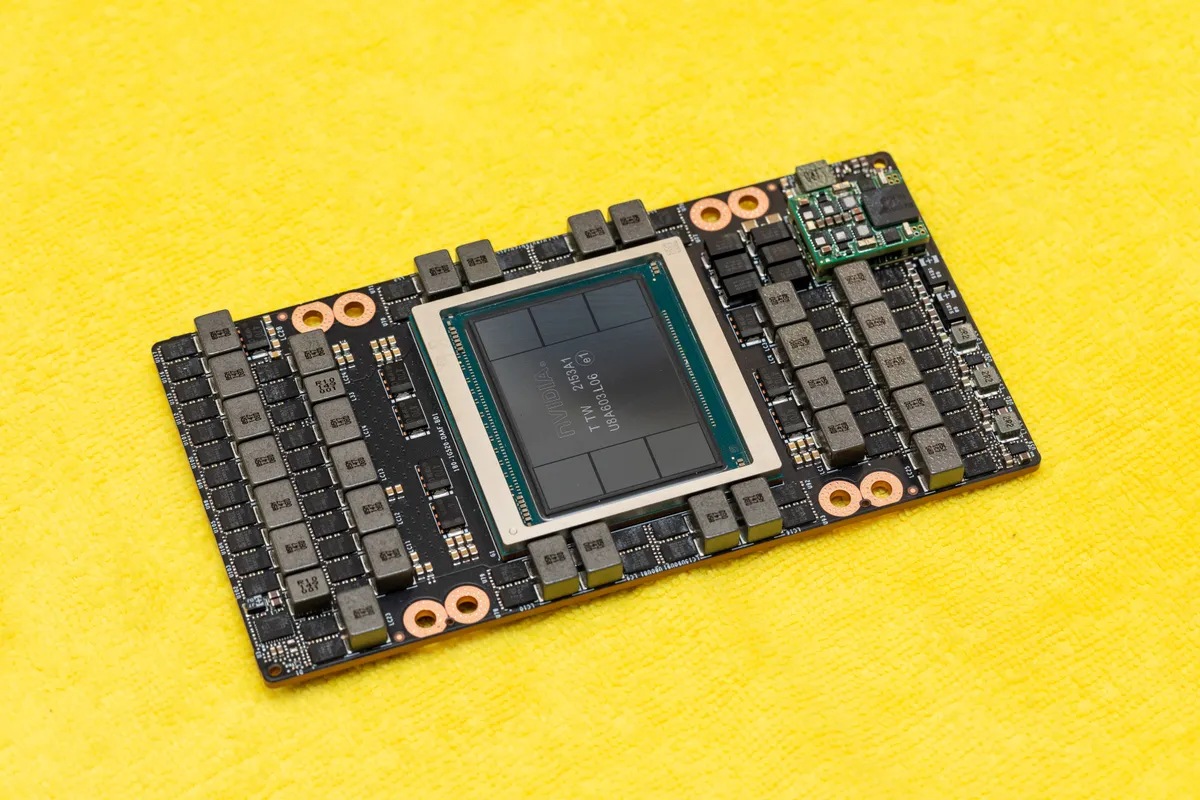

- The trigger: U.S.-imposed restrictions limiting the sale and export of high-end AI chips (e.g. advanced Nvidia GPUs) to Chinese firms. Since April 2025, Chinese companies faced tightened restrictions on access to such chips.

- By leasing data centers run by non-Chinese operators in foreign jurisdictions, these firms can legally deploy Nvidia hardware abroad — bypassing export bans while still accessing high computational power.

Importantly, while training happens abroad, many companies still handle “inference” or end-user deployment locally — or use local chips — to comply with domestic data laws.

🔍 Who’s Leading This Move & Who’s Standing Out

- Alibaba and ByteDance are the most cited firms reportedly using Southeast Asian data centers.

- An exception: DeepSeek — which had pre-stockpiled Nvidia chips before bans took effect; it continues domestic AI training and is reportedly collaborating with local chipmakers like Huawei to build China-based AI-ready hardware.

- The shift has triggered a surge in demand for data-center capacity across Southeast Asia — a region now becoming a global hub for training frontier AI models.

🧠 Why It Makes Strategic Sense — and What It Signals

✅ Access to Premium Compute Hardware

Nvidia GPUs remain the global standard for training large-scale AI models because of their unmatched performance and ecosystem. For companies aiming to stay competitive, access to such chips is non-negotiable. By moving training offshore, firms sidestep export restrictions while maintaining hardware quality.

✅ Regulatory & Geopolitical Workaround

With export controls restricting chip sales to China, offshore training becomes a legal — if politically charged — workaround. It’s a sign that companies are adapting fast, even if it means geographically disaggregating their AI stack.

✅ Growing Push for Domestic AI Self-Reliance

Meanwhile, firms like DeepSeek collaborating with Huawei and other domestic chipmakers indicate China is investing heavily in homegrown alternatives. This dual strategy buys time: continue global AI competitiveness now, while working toward long-term chip independence.

🔮 What This Means for the Future of Global AI

- AI development is becoming more globally distributed. Firms will increasingly split training, inference, and deployment across borders depending on hardware access and regulations.

- Southeast Asia is emerging as a key AI-training hub. Expect investments, data center growth, and infrastructure cost pressures in those regions.

- China’s AI hardware race will accelerate. Domestic chipmakers will escalate R&D to rival Nvidia, driven by strategic urgency and national policy.

- Geopolitics will shape AI supply chains. AI innovation — once purely technical — is now deeply tied to export policy, national security, and international alliances. – Nvidia chips export restrictions 2025

Read more🌐 about latest Tech updates on out Technology and Learning labs Category Section

Also read our previous article on Perplexity AI Unleashes Claude Opus 4.5 for Max Subscribers

AI #Nvidia #ChinaTech #Alibaba #ByteDance #DeepSeek #AIChips #TechNews #SoutheastAsia #GlobalAI