XRP ETF Crosses $1B in Assets as Inflows Accelerate and Investor Strategy Evolves

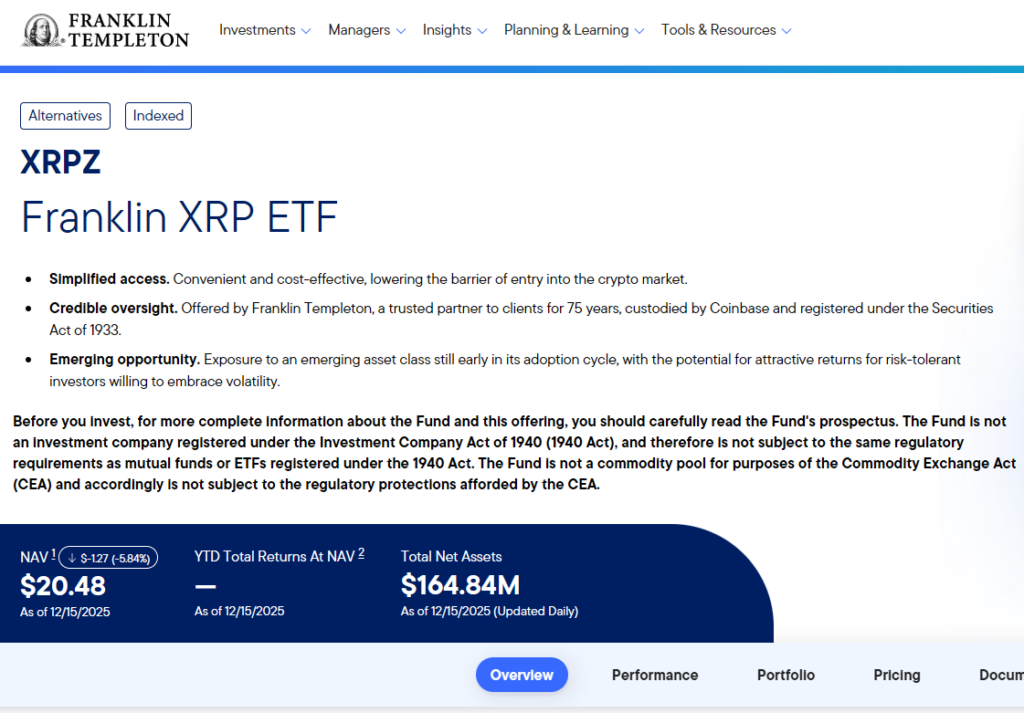

XRP is quietly having a moment. The XRP spot ETF has officially surpassed $1 billion in assets under management, marking a major milestone for the asset and signaling growing institutional confidence. With cumulative inflows nearing $991 million, analysts say the pace of adoption could reshape how investors approach long-term exposure to XRP (XRP price outlook).

While price action remains relatively stable, the surge in ETF assets suggests that attention is shifting from short-term speculation to structured, long-term positioning 📈.

XRP ETF Growth Signals Rising Institutional Interest

According to the latest data, continued inflows have pushed XRP ETF net assets beyond the $1 billion mark. Analysts note that if current trends persist, total inflows could exceed $10 billion by 2026, placing XRP ETFs among the most significant crypto-linked investment products.

Steven McClurg, CEO of Canary Capital, highlighted that despite Solana-based ETFs launching earlier, XRP ETFs have already overtaken competing products in assets under management. This shift points to increasing institutional participation and renewed confidence in XRP’s role within the broader digital asset ecosystem.

Market Sentiment Improves as Focus Shifts Beyond Price

As ETF inflows continue, overall sentiment around XRP has begun to improve.

Rather than focusing solely on short-term price movements, investors are increasingly evaluating liquidity structure, ecosystem development, and long-term demand potential. Some market observers believe that sustained asset growth could gradually support stronger return expectations, though they caution that this process will take time.

Industry analysts have also drawn comparisons between the current XRP ETF trajectory and the early growth phase of Bitcoin ETFs, suggesting XRP could attract additional institutional capital if the trend continues.

Investors Look Beyond ETFs Toward Yield Strategies

Alongside ETF adoption, investor behavior is evolving.

More participants are moving beyond passive speculation and exploring early positioning, asset accumulation, and sustainable income strategies. In this context, cloud mining and structured yield platforms have gained attention as complementary approaches to long-term crypto exposure.

One platform frequently mentioned in discussions is BI DeFi, which offers cloud-based mining participation without the need for physical equipment or technical expertise. The platform positions itself as an option for users seeking consistent returns while waiting for broader market confirmation.

Why BI DeFi Is Gaining Attention

BI DeFi has emerged as a fast-growing cloud mining platform, emphasizing green energy infrastructure, transparent computing power allocation, and compliance-focused operations.

Founded in 2019 and registered in the UK, the platform allows users to participate in mining by selecting computing power plans, removing the need to manage hardware or maintenance. BI DeFi reports a global user base across more than 180 countries, with over 2 million users worldwide.

Security measures include cold wallet custody, insured digital assets, AI-driven transaction monitoring, and third-party audits. These features have helped position the platform as a structured alternative for users seeking exposure to mining-based rewards 🔐.

A Shift Toward Long-Term Positioning

As the XRP ETF continues to grow, investors appear to be recalibrating their strategies.

Rather than waiting solely for ETF-driven price appreciation, many are combining long-term planning with diversified income approaches, aiming to balance volatility with consistency. This shift reflects a broader trend across crypto markets, where structure and sustainability are becoming as important as upside potential.

The Bottom Line

The rapid expansion of XRP ETF assets highlights rising institutional interest and a maturing market narrative around XRP. While short-term price action remains subdued, structural developments suggest that investor confidence is steadily building- XRP price outlook.

As ETFs, yield strategies, and long-term positioning converge, XRP is increasingly being viewed not just as a speculative asset, but as part of a broader, evolving investment framework.

CoinDCX: For traders and investors in India, CoinDCX is the best platform which has quick deposits and withdrawls, lowest fee and CoinDCX is the platform I trust to learn, invest & trade in Crypto. Buy your first crypto and win up to ₹5,00,000 in crypto rewards!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Read more updates and articles on our Crypto category page

Disclaimer: This content is for educational purposes only and does not constitute investment advice.

#XRP #XRPETF #CryptoETFs #InstitutionalCrypto #CryptoNews XRP ETF, XRP ETF inflows, XRP institutional adoption, crypto ETFs, XRP price outlook, digital asset ETFs