Ethereum Price Prediction: ETH USD Poised for Major Breakout as Altcoin season Looms

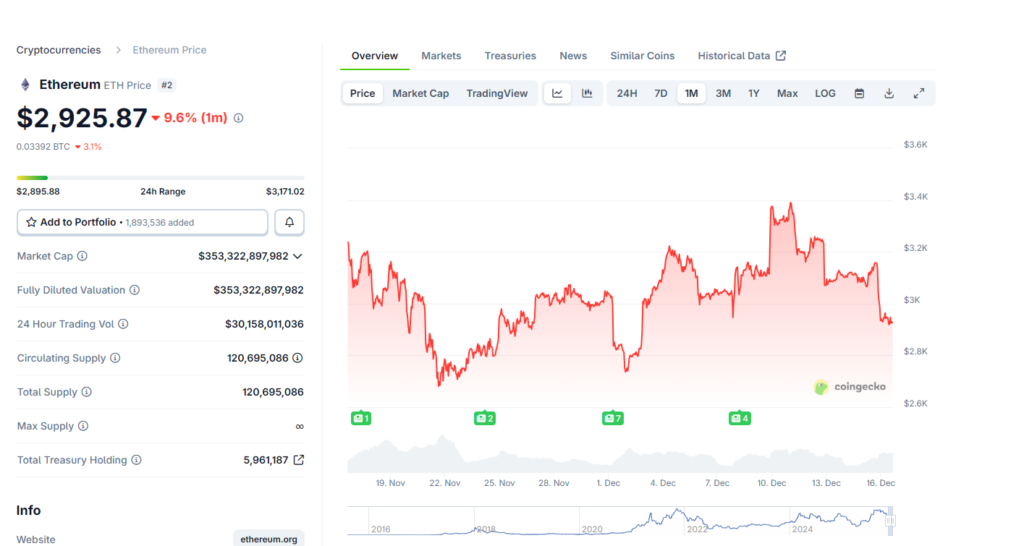

Ethereum has spent recent sessions hovering around the $3,200 region, and despite choppy market conditions, ETH has shown notable resilience. While broader crypto markets remain cautious, Ethereum has held up better than many traders expected (Ethereum price prediction).

This kind of price behavior often appears before large moves. Sideways action near support is not weakness by default. In many cases, it reflects accumulation as buyers quietly position ahead of a trend shift 🙂.

Still, the market is far from unanimous on what comes next.

Bullish Structure Versus Bearish Resistance

From a technical perspective, bulls point to the higher-timeframe structure that has remained intact since Ethereum bounced from the $2,700 zone. Momentum indicators show a bullish divergence that has been building for weeks, suggesting selling pressure is weakening even as price consolidates.

In this view, Ethereum is not stalling. It is coiling.

Bears, however, focus on a different level. As long as ETH USD remains below the $3,250–$3,300 resistance zone, they argue the move higher could still be a trap. Failure to break that area convincingly may open the door to a pullback toward $2,800, especially if broader risk sentiment weakens.

This tension between structure and resistance is what makes the current setup so important.

Bitcoin Dominance Signals Capital Rotation

One of the strongest arguments for an upcoming altseason lies outside the ETH chart itself.

Bitcoin dominance has been trending lower and is now sitting below the 60% level, while forming what some analysts see as a large head-and-shoulders pattern stretching back to late 2024. Historically, sustained drops in Bitcoin dominance often signal capital rotation into Ethereum and other altcoins.

When altseason begins, Ethereum is typically the first major beneficiary. It acts as the bridge between Bitcoin and the broader altcoin market, absorbing capital before it spreads further down the risk curve.

Early signs of that rotation are starting to appear 📊.

ETF Inflows and Institutional Interest Return

Fund flows are also adding to the bullish case.

Spot Ethereum ETFs have recently recorded their strongest inflows since October, suggesting renewed institutional interest. At the same time, discussions around a staked Ethereum ETF have resurfaced, with major asset managers pushing for structures that could offer yield alongside price exposure.

This matters because institutions do not chase short-term hype. They position around long-term infrastructure, and Ethereum continues to sit at the center of tokenization, DeFi, and on-chain settlement.

Tokenization Keeps Ethereum at the Center

Beyond price charts, Ethereum’s role in the tokenized economy remains unmatched.

Real-world assets such as bonds, real estate, funds, and equities are increasingly moving on-chain. Ethereum currently leads this sector, hosting the majority of tokenized asset value locked across networks.

Even with lower fees and competition from alternative chains, Ethereum remains the dominant settlement layer. The debate is no longer whether Ethereum stays relevant, but how much value ETH captures as adoption expands.

That long-term narrative continues to underpin investor confidence.

Altseason Expectations and Long-Term Outlook

Many market participants believe altseason is not a question of “if,” but “when.”

Once capital rotation accelerates, Ethereum often targets new highs ahead of smaller assets. A clean break above the $3,300 resistance could act as the trigger that confirms the next leg higher and shifts sentiment decisively bullish.

At the same time, patience remains important. Failed breakouts can still happen, and volatility is part of the process. The market is currently testing conviction on both sides.

Final Thoughts: A Critical Moment for ETH

Ethereum is sitting at a pivotal point- Ethereum price prediction.

The technical structure is constructive, institutional interest is improving, and macro signals like Bitcoin dominance favor altcoins. Yet resistance remains strong, and the next breakout attempt will likely define ETH’s direction into the next phase of the cycle.

If Ethereum clears resistance, the path toward a new all-time high becomes much more realistic. If not, further consolidation may be needed before altseason fully ignites.

For now, ETH USD is coiled, watched closely, and approaching a decision point.

Ethereum price prediction, ETH USD forecast, Ethereum breakout, altseason crypto, ETH technical analysis, Ethereum ETF inflows

CoinDCX: For traders and investors in India, CoinDCX is the best platform which has quick deposits and withdrawls, lowest fee and CoinDCX is the platform I trust to learn, invest & trade in Crypto. Buy your first crypto and win up to ₹5,00,000 in crypto rewards!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Read more updates and articles on our Crypto category page

#Ethereum #ETHPrice #Altseason #CryptoAnalysis #EthereumPrediction