Passive Income Myths vs Reality: What Actually Works for 2026

Everyone wants money that works while they sleep. Scroll Instagram for five minutes and you’ll be promised “₹1 lakh a month in passive income” with zero effort, zero skills, and zero risk (how to build passive income).

Here’s the uncomfortable truth 👇 Most passive income advice is either outdated, exaggerated, or flat-out misleading.

As we head into 2026, the rules of passive income are changing—fast. This article cuts through the hype and shows what actually works, what doesn’t, and how real people are building sustainable income streams today.

🚨 The Biggest Passive Income Myths (Still Fooling Millions)

❌ Myth 1: Passive Income Requires No Work

Reality check:

Every legit passive income stream requires either upfront work, capital, or both.

If someone says “zero effort,” what they usually mean is:

- The hard work is hidden

- Or the risk is ignored

👉 Passive ≠ effort-free. It means delayed effort.

❌ Myth 2: One Income Stream Is Enough

Relying on a single “passive” source is risky in 2026.

Algorithms change.

Markets fall.

Platforms shut down.

Real earners build multiple small streams, not one magical cash machine.

❌ Myth 3: Passive Income Is Fast

If it sounds fast, it’s usually:

- Extremely risky, or

- A sales funnel selling you a dream

Sustainable passive income is slow, boring, and compounding—which is exactly why it works.

💡 Passive Income Reality Check for 2026

Before we talk strategies, understand this rule:

Passive income is built, not discovered.

In 2026, the best-performing streams share three traits:

- Tech-enabled

- Scalable

- Semi-passive (not fully hands-off)

Let’s break down what actually works.

✅ What ACTUALLY Works for Passive Income in 2026

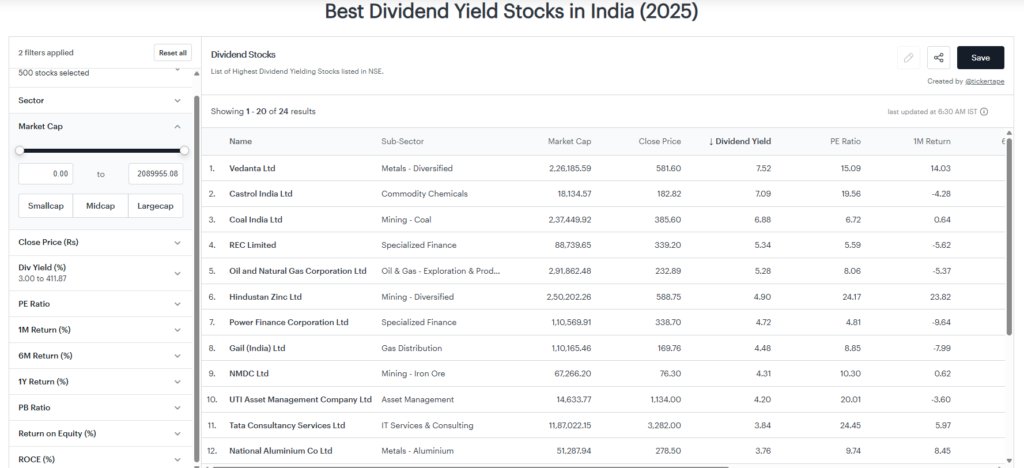

1. Dividend & Cash-Flow Investing (Low Drama, High Consistency)

This is the least sexy and most reliable method.

What works in 2026:

- Dividend-paying stocks & ETFs

- REITs (real estate investment trusts)

- Bond ladders for stability

Reality:

Returns are modest at first—but compounding turns small monthly income into serious cash over time.

✅ Best for: Long-term thinkers

❌ Not for: People chasing quick wins

2. Digital Products (High Leverage, High Skill)

This category is booming:

- E-books

- Online courses

- Templates, tools, and prompts

Why it works:

- Build once, sell infinitely

- AI reduces creation time

- Global reach, 24/7 sales

But here’s the truth:

👉 Marketing matters more than the product.

Most fail not because the product is bad—but because no one sees it.

3. Content + Monetization (The New-Age Asset)

Blogs, newsletters, YouTube, and podcasts are no longer “side hobbies.”

In 2026, creators monetize via:

- Ads

- Affiliates

- Sponsorships

- Premium communities

Key shift:

You don’t need millions of followers—just a focused niche and trust.

Passive?

Eventually.

At the start? Very active.

4. Rental Income (Still Works—If Done Smart)

Real estate hasn’t died—but it has evolved.

What works now:

- Long-term rentals in stable cities

- Co-living & niche rentals

- Professionally managed properties

What doesn’t:

- Overleveraged investments

- “Buy anywhere” strategies

Rental income is semi-passive, not hands-off—unless you outsource.

5. Automated Online Businesses (The Hybrid Model)

Think:

- Niche websites

- SaaS micro-tools

- Print-on-demand brands

These require:

- Systems

- Automation

- Delegation

But once set up properly, they generate predictable monthly income.

⚠️ Passive Income Ideas That Are Mostly Overhyped

Let’s be real.

❌ “Guaranteed” crypto yield platforms

❌ Zero-skill dropshipping

❌ Bot-based trading systems

❌ Copy-paste affiliate hacks

These may work for a tiny minority, but for most people, they lead to:

- Losses

- Burnout

- False expectations

🧠 The 2026 Passive Income Formula (That Actually Works)

Here’s a smarter framework:

Step 1: Start Active

Learn a skill. Build something. Create value.

Step 2: Systematize

Automate processes. Use tools. Remove manual effort.

Step 3: Scale

Increase reach, capital, or distribution.

Step 4: Diversify

Add new streams once the first is stable.

This is how passive income really happens.

How Much Can You Realistically Earn?

Honest numbers 👇

- Year 1: Minimal or zero profit

- Year 2: Small but consistent income

- Year 3+: Compounding kicks in

Anyone promising massive income in weeks is selling hope, not strategy.

🔮 Passive Income Trends to Watch in 2026

- AI-powered micro products

- Niche subscription communities

- Fractional investing platforms

- Creator-led finance brands

The opportunity isn’t gone—it’s just more competitive.

🧾 Final Verdict: Myth vs Reality

Myth: Passive income is easy

Reality: It’s strategic

Myth: One method fits all

Reality: Personal skill + patience matters

Myth: It’s quick

Reality: It compounds

🏁 Bottom Line

Passive income in 2026 isn’t about shortcuts. It’s about ownership, leverage, and patience.

If you’re willing to:

- Learn first

- Build systems

- Think long-term

Then yes—passive income still works. Just not the way social media makes it look (how to build passive income).

#Buildpassiveincome #PassiveIncome

Also read our article on –Scapia vs Niyo Credit Card (2025): Features, Rewards, Fees & Best Choice