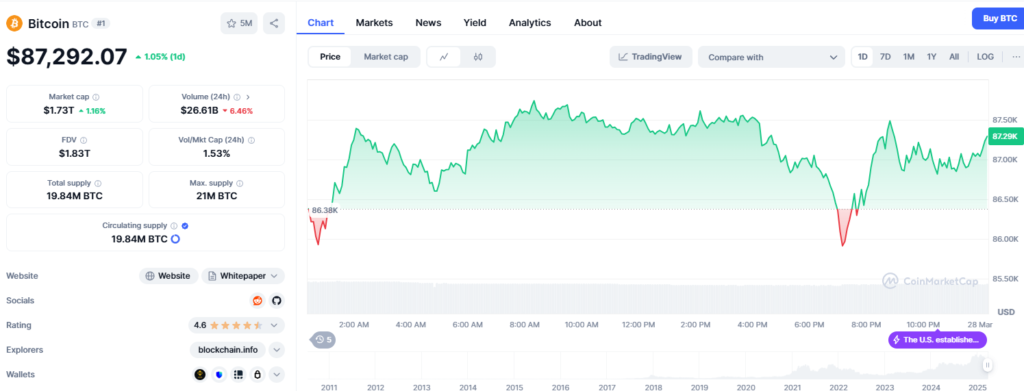

Bitcoin Price Forecast: Bitcoin Crash by 60%

It’s March 27, 2025, and Bitcoin’s riding a rickety rollercoaster through a fog of uncertainty. The crypto king barely caught its breath after a brutal March dip when whispers of April tariffs started rattling cages.

Picture this: a market teetering on the edge, with a 60% chance of tumbling into another abyss as U.S. trade policy throws a curveball on April 2. But hold onto your wallets—this tale’s got more twists than a blockbuster thriller, and a rebound might just steal the show.

The Tariff Tempest Brewing

The trouble starts with a date circled in red: April 2, 2025. That’s when the U.S. is set to unleash a fresh batch of tariffs, a move President Donald Trump’s touting as an economic grand slam. The last round hit like a sucker punch—markets wobbled, recession rumors swirled, and Bitcoin took a dive. Now, with trade policy uncertainty buzzing louder than a beehive, the crypto crowd’s bracing for round two. Economic jitters are spiking, and risky bets like BTC are caught in the crosshairs.

The odds? A nerve-wracking 50-60% chance that Bitcoin’s price takes another hit post-April 2. It’s not a wild guess—think of it as a storm warning based on the dark clouds of past tariff tantrums and today’s shaky vibes. The market’s still licking its wounds from March, and this could be the shove that sends it over the edge.

Chaos Unleashed: Why Bitcoin’s Vulnerable

Here’s the deal: tariffs are like kryptonite to volatile assets. When trade rules get messy, investors bolt for the exits, ditching Bitcoin for safer hideouts like gold or bonds. The last tariff scare proved it—crypto prices tanked as panic set in. With April 2 looming, the same script could play out: a sell-off frenzy, a price plunge, and a whole lot of “I told you so” from the skeptics.

Bitcoin price forecast has always been important as it influences the price and volatility of other Altcoins in the market. Now that many countries are accepting bitcoin, it has garnered more focus.

But this isn’t just doomscrolling fodder. The story’s got legs—after the dust settles, there’s a real shot at redemption. Imagine Bitcoin hitting a low, then clawing its way back as the tariff drama fades. The market’s got a knack for bouncing back when the macro winds shift, and this time might be no different.

The Plot Twist: A Crypto Comeback?

Not every chapter ends in tears. Sure, a 60% chance of a drop sounds grim, but that leaves a 30% glimmer of hope—and it’s a juicy one. What if March was the real bottom, and April’s just a fake-out? Or maybe the tariffs get watered down in last-minute talks, sparing Bitcoin the worst.

There’s no recession on the horizon—just a U.S. economy cooling from a sprint to a jog, say 3% growth down to 1.5-2%. Add in crypto’s slow-but-steady takeover in the States, and you’ve got the makings of a recovery arc.

Picture it: Bitcoin stumbles in April, then rises like a phoenix by summer, maybe even flirting with its all-time highs before 2025’s out. It’s not wishful thinking—it’s the kind of comeback crypto’s pulled off before, fueled by grit and a sprinkle of luck.

The Big Finish: What’s Bitcoin’s Fate?

As April 2 creeps closer, the crypto world’s holding its collective breath. Will Bitcoin crash and burn under tariff pressure, or will it dodge the bullet and strut into a bull run?

That 60% odds of a dip isn’t destiny—it’s a warning shot. If the tariffs hit hard, expect a rollercoaster drop. If they flop, BTC might just laugh it off.

This isn’t over till it’s over. Whether you’re stacking sats or watching from the sidelines, April’s shaping up as Bitcoin’s make-or-break moment. Buckle up—the next page of this crypto saga could be a wild one, and the ending’s still up for grabs.

Read more updates and articles on our Crypto category page and also for Bitcoin price Forecast

#BitcoinDrama #CryptoChaos #TariffTrouble #BitcoinForecast #CryptoComeback #BTCVolatility #MarketMayhem