Trump’s 90-Day Tariff Pause on 75+ Countries Sparks 9% Surge in U.S. Stock Market

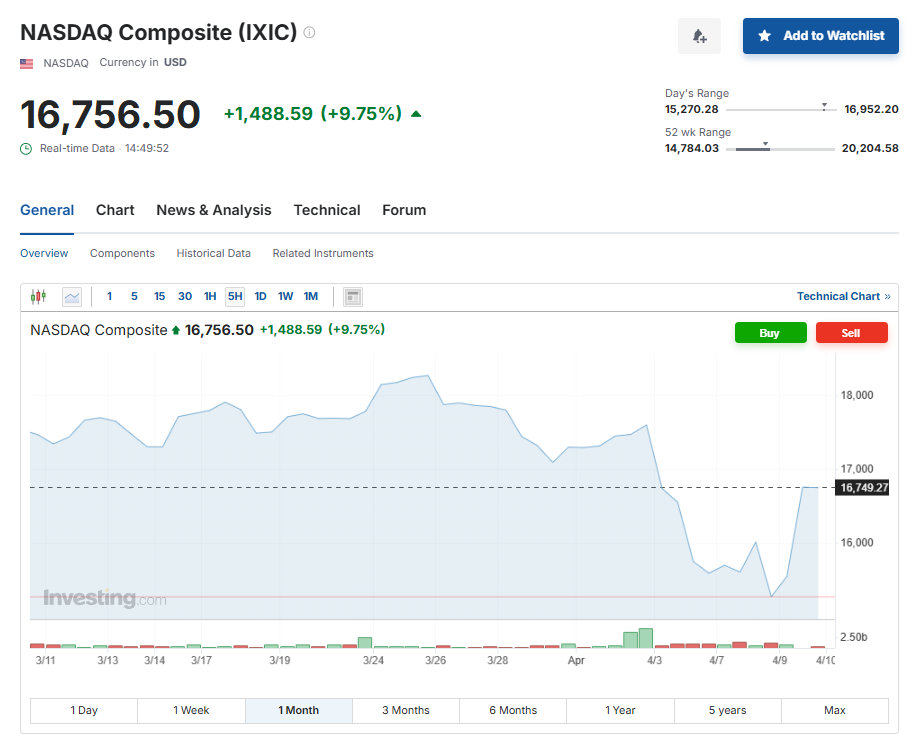

In a major shake-up of global trade dynamics, former President Donald Trump has temporarily suspended tariffs on over 75 countries for a period of 90 days. The immediate market response? A dramatic 9% surge in the U.S. stock market—signaling a new wave of investor optimism and suggesting that Trump’s economic blueprint may be regaining traction.

A Strategic Move with Global Ripples

Trump’s decision to ease trade barriers comes as a strategic play to reassert the United States’ dominance in international markets.

By pausing tariffs—many of which were previously seen as roadblocks for global trade—the U.S. appears to be extending an olive branch to its trading partners while positioning itself for renewed economic growth.

Experts speculate that this temporary relief could revive stalled negotiations and increase the import-export flow across vital sectors such as technology, manufacturing, and consumer goods. The tech sector, in particular, has seen rapid investor inflow, with major NASDAQ players experiencing sharp intraday gains.

NASDAQ, DOW JONES and other Indices has risen sharply and major IT and Tech stocks have seen a sharp jump. This is in line with what Trump had planned, it seems.

Wall Street Reacts: Market Momentum Reignited

Wall Street wasted no time in reacting to the news. The Dow Jones, S&P 500, and NASDAQ all witnessed significant upticks, closing the day with an average 9% increase across major indices. Analysts are crediting the surge to reduced trade tensions and revived confidence in the White House’s economic strategies.

“Investor sentiment has flipped almost overnight,” said Mark Keeler, a senior market analyst. “This 90-day window has created breathing space for corporations and global suppliers alike.”

Trump’s Vision: Making America Rich Again?

While the slogan “Make America Great Again” became a hallmark of Trump’s presidency, his latest move might add a financial twist: Make America Rich Again.

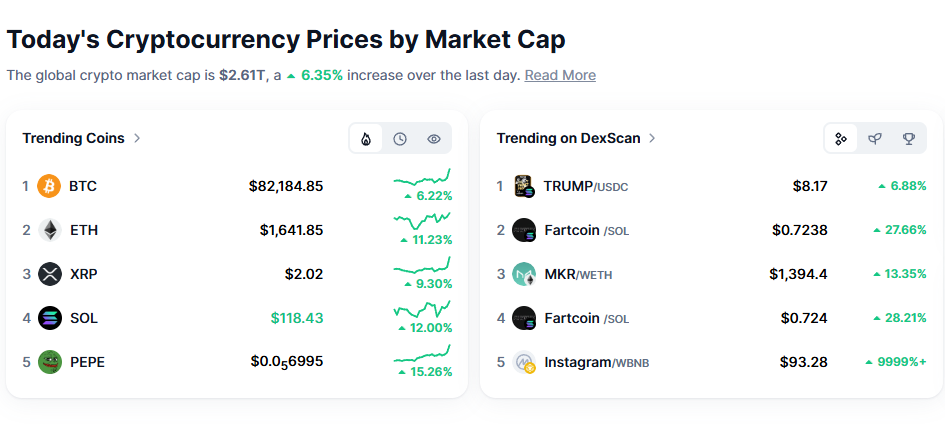

Even there was a huge jump seen in the Cryptocurrency market after Trump Tariff pause. All the major Cryptocurrencies jumped between 8-15% within 1 hour of the announcement.

Economic critics once skeptical of Trump’s tariff-heavy policies are now watching closely as this new approach seems to favor market growth and international cooperation. The stock rally could be a sign that Trump’s aggressive business-first strategy, when balanced with diplomatic flexibility, has the potential to deliver measurable economic gains.

What Comes After 90 Days?

The big question now is—what happens after the 90-day pause?

White House officials have remained tight-lipped on whether this tariff suspension is a temporary diplomatic maneuver or a test balloon for long-term policy reform. Either way, investors and global markets will be watching closely as the deadline approaches.

Tariff-war will be followed by selling US treasury followed by currency devaluation. Both US and China are big economies, and the increase in Tariff on China by 125% is a big move by US. Both nation are decoupling each other.

The next 2 months are critical to wait and watch. With so many global events chances are markets may still fall by 10-15%For now, one thing is certain: the markets have spoken—and they like what they see.

📌Key Takeaways:

- Trump Tariff pause is on over 75 countries for 90 days.

- The U.S. stock market surged by 9% in response.

- Economic optimism and global trade sentiment have improved.

- Wall Street analysts view this as a possible turning point for U.S. economic strategy.

- The long-term outcome will depend on future trade decisions after the 90-day period ends.

Also, read our other article –Bitcoin and Crypto Plunge: Why Trump’s Tariffs Are Shaking the Market

Check out more article on Finance on our Finance Category section.

#TrumpTariffPause #USStockMarketSurge #GlobalTradeNews #EconomicGrowth #WallStreetUpdate #TechMarketBoom #TrumpPolicy2025 #TradeWarsPaused