Crypto Comeback: Trump’s Policy Shifts Spark Rebound, But Experts Urge Caution

The cryptocurrency market has been on a wild ride, and recent policy moves by former President Donald Trump have kept investors on their toes. After decisions that initially sent digital assets into a tailspin, we can now see the crypto market rebound.

Bitcoin, Ethereum, and other major cryptocurrencies are posting impressive gains, painting a hopeful picture for enthusiasts. But be cautious, the experts are sounding the alarm, warning that the next 3 months could be a make-or-break period for crypto. Let’s dive into what’s driving this resurgence and why caution is still the name of the game.

The Trump Effect: From Crash to Comeback

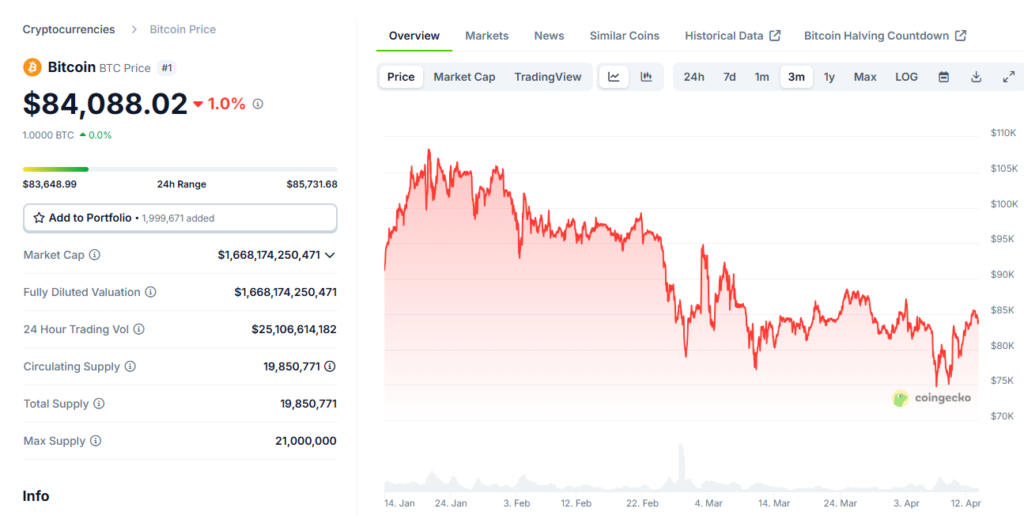

Trump’s recent policy announcements sent shockwaves through the crypto world. New regulations and trade decisions created uncertainty, causing Bitcoin to plummet and altcoins to follow suit. The market looked bleak, with investors scrambling to make sense of the chaos. Fast forward to today, and the tide has turned.

Trump’s pivot—easing some of the restrictive measures—has breathed new life into digital assets. Bitcoin has clawed its way back to healthier levels, with Ethereum and others like Solana and Cardano flexing their resilience.

This rebound isn’t just a fluke. The crypto market thrives on sentiment, and the rollback of certain policies has restored confidence. Blockchain analytics show trading volumes spiking, with retail and institutional investors jumping back in.

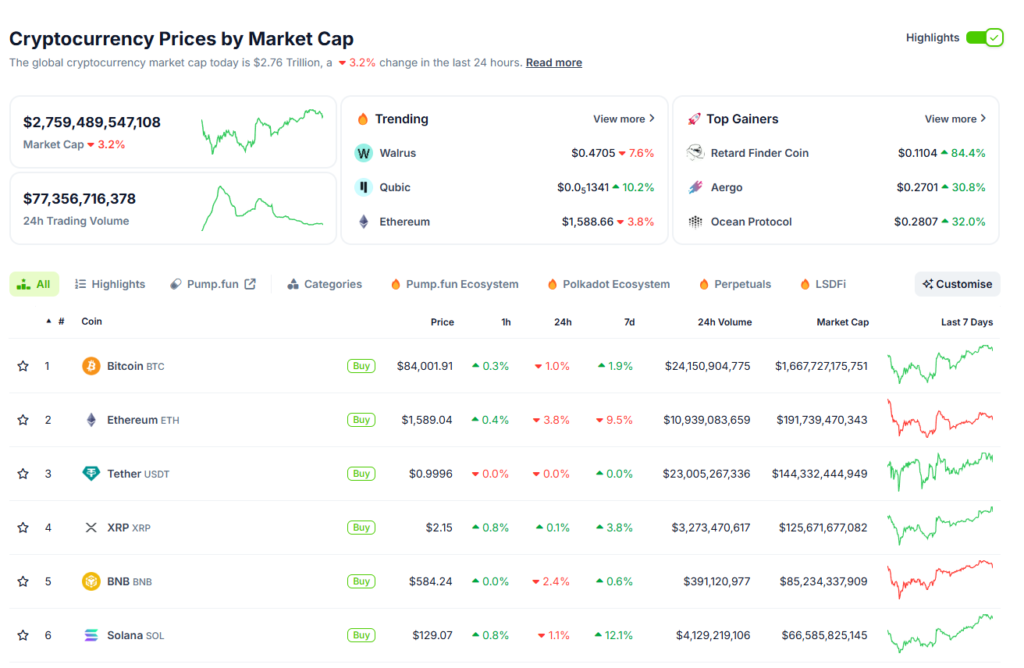

The numbers don’t lie: the global crypto market cap is climbing steadily and on its was for crypto market rebound, reflecting renewed optimism. But what’s fueling this turnaround, and how long can it last?

Why the Market Is Buzzing Again

Several factors are powering this crypto renaissance.

First, Trump’s softened stance has eased fears of heavy-handed regulation. His administration’s hints at fostering innovation in blockchain tech have sparked excitement, with some even speculating about a U.S. crypto reserve.

Second, macroeconomic shifts—like stabilizing trade policies—have reduced the panic that gripped markets earlier. Investors are seeing crypto as a hedge against uncertainty, driving demand for Bitcoin and its peers.

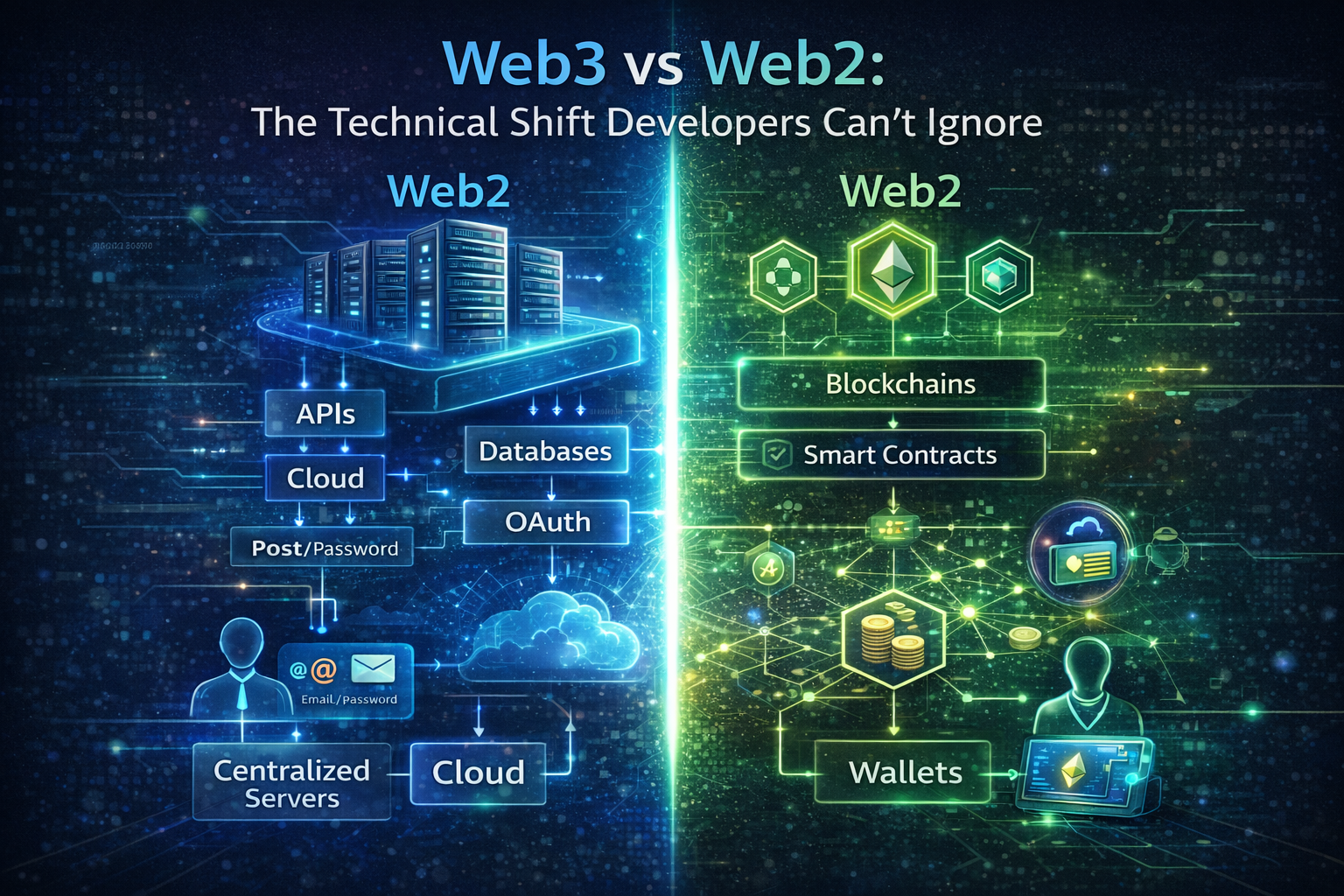

The tech side is also playing a role. Decentralized finance (DeFi) platforms are gaining traction, with Ethereum’s ecosystem leading the charge. Meanwhile, layer-1 blockchains like Solana are showcasing blazing-fast transactions, attracting developers and investors alike. These technological strides are bolstering the market’s foundation, making it more than just a speculative frenzy.

The Catch: Why Experts Are Wary

Before you go all-in on crypto, listen up: experts are waving red flags. The next three months could be a minefield, and here’s why. Policy volatility is a big concern—Trump’s track record shows he’s not afraid to flip the script, and new decisions could rattle markets again.

Regulatory uncertainty looms large, with global governments still grappling with how to handle digital assets. A sudden crackdown or unexpected tax policy could derail the rally.

Market dynamics are another worry. Crypto’s notorious volatility means today’s gains could vanish tomorrow. Analysts point to overleveraged traders and speculative meme coins as potential triggers for a correction. Plus, macroeconomic factors—like inflation or interest rate hikes—could sap momentum.

How to Navigate the Crypto Rollercoaster

So, what’s the play? Here are some practical tips to ride this wave without getting wiped out:

- Stay Informed: Follow credible crypto news sources like CoinDesk or Cointelegraph for real-time updates. Policy changes can hit fast, and knowledge is power.

- Diversify Your Portfolio: Don’t bet the farm on one coin. Spread your investments across Bitcoin, Ethereum, and promising altcoins to mitigate risk.

- Set Clear Goals: Are you in for the long haul or a quick flip? Define your strategy to avoid panic-selling during dips.

- Use Stop-Losses: Protect your gains with automated sell orders. Volatility is crypto’s middle name, and stop-losses can save you from a freefall.

- Watch the Macro Picture: Keep an eye on global economic trends. Trade wars, inflation, or Federal Reserve moves can sway crypto prices.

What’s Next for Crypto?

The crypto market’s rebound is a thrilling development, but it’s not a victory lap yet. Trump’s policy shifts have opened a window of opportunity, with Bitcoin and altcoins basking in the glow.

Yet, the road ahead is bumpy, and the next three months will test the market’s mettle. Will we see a sustained bull run, or is another storm brewing? Only time will tell.

For now, the smart move is to enjoy the rally but tread carefully amid this small crypto market rebound. Stay educated, diversify, and don’t let FOMO cloud your judgment. The crypto world is full of surprises, and being prepared is your best bet for coming out on top.

Also read our previous article of Pi Coin future price prediction: Pi Coin: Can It Soar to New Heights by March 2025?

Read more updates and articles on our Crypto category page

#CryptoRebound #TrumpCrypto #BitcoinRecovery #Cryptocurrency2025 #BlockchainTrends #InvestSmart