Could Bitcoin Skyrocket to $1M by 2035? Kiyosaki’s Prediction

A Crypto Fortune in the Making?

Robert Kiyosaki, the financial mastermind behind ‘Rich Dad Poor Dad,’ has made a stunning prediction: Bitcoin could soar to $1 million per coin by 2035. That’s not all—gold might hit $30,000 per ounce, and silver could reach $3,000 per ounce. “It’ll be the easiest money you ever made,” he claims. But there’s a dark twist: this windfall hinges on what he calls “the biggest stock market crash in history.”

Kiyosaki’s Warning: Economic Storm Ahead

In recent posts on X, Kiyosaki sounded the alarm on troubling economic trends. He points to record-high U.S. credit card debt ($1.13 trillion as of Q4 2024, per the Federal Reserve), a national debt surpassing $34 trillion, and unemployment creeping up to 4.1% (U.S. Bureau of Labor Statistics, March 2025). Retirement accounts are also under strain, with 401(k) balances dropping 3% on average in 2024 due to market volatility.

“The USA may be heading for a GREATER DEPRESSION,” Kiyosaki warned, blaming a “global banking cartel” including the Federal Reserve, Bank of England, and European Central Bank. He argues their policies, like quantitative easing and low interest rates, are inflating asset bubbles and eroding trust in fiat currencies.

Why Bitcoin, Gold, and Silver?

Kiyosaki sees Bitcoin, gold, and silver as safe havens in a turbulent economy. “If you act now, even a small investment could make you very rich,” he says. His logic? These assets thrive when trust in traditional systems falters. Bitcoin, powered by blockchain technology, operates on a decentralized network, immune to central bank control. Gold and silver, historically stable stores of value, hedge against inflation, which hit 3.2% annually in the U.S. in 2024.

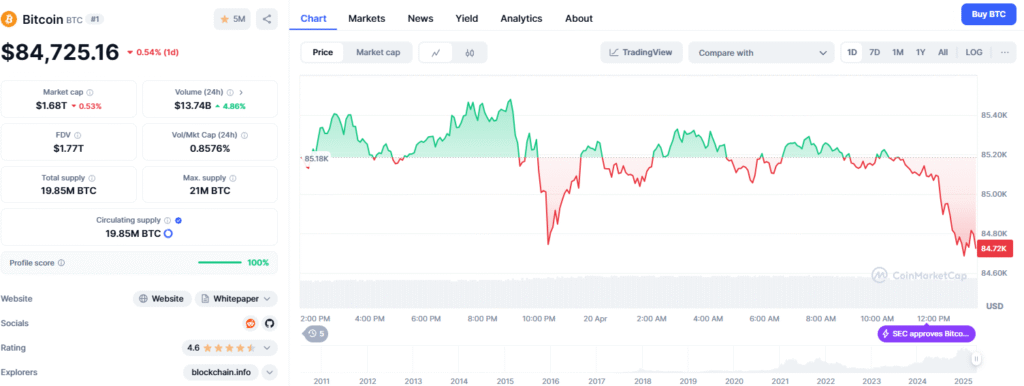

Recent data backs his enthusiasm. Bitcoin surged 120% in 2024, reaching $85,000 by April 2025. Gold hit an all-time high of $2,700 per ounce, while silver climbed to $32 per ounce. Kiyosaki interprets these gains as signals of deeper financial instability.

Tech Behind the Bitcoin Boom

Bitcoin’s potential isn’t just about market sentiment—it’s rooted in tech. Its blockchain ensures transparency and security, with over 1 million daily active addresses in 2025 (Glassnode). The Lightning Network, a layer-2 scaling solution, now processes 10,000 transactions per second, making Bitcoin more viable for everyday use.

Meanwhile, institutional adoption is skyrocketing—MicroStrategy holds 252,000 BTC ($21 billion), and BlackRock’s Bitcoin ETF saw $5 billion in inflows in Q1 2025.

Kiyosaki also nods to decentralized finance (DeFi), which grew to a $200 billion total value locked in 2024 (DeFiLlama). DeFi platforms, built on Ethereum and compatible with Bitcoin via wrapped tokens, offer alternatives to traditional banking, aligning with Kiyosaki’s distrust of centralized systems.

Skeptics Push Back

Not everyone buys Kiyosaki’s doomsday scenario. Analysts like Peter Schiff argue Bitcoin’s volatility (30% annualized standard deviation) makes it a risky bet compared to gold. Others call Kiyosaki’s $1 million target “sensationalist,” noting Bitcoin would need a 1,200% increase from its current price—a tall order, though not unprecedented given its 2017 rally of 1,900%.

Still, Kiyosaki’s case for alternative assets resonates with crypto enthusiasts and inflation-wary investors. His predictions align with growing interest in Bitcoin as “digital gold,” especially as central banks hold $16 trillion in negative-yield bonds globally.

What’s an Investor to Do?

Kiyosaki’s advice is straightforward: don’t wait. He believes modest investments in Bitcoin, gold, or silver today could yield massive returns by 2035. For perspective, one Bitcoin at $85,000 today would need to grow 11.8x to hit $1 million. Gold at $2,700 would need an 11.1x increase, and silver at $32 would require a 93.8x jump—ambitious but plausible in a crisis.

Tech advancements bolster the case for crypto. Meanwhile, Taproot upgrades have enhanced smart contract capabilities, opening doors to DeFi integration. These factors could drive adoption and price growth.

Final Thought on the Bitcoin Prediction

Whether you see Kiyosaki as a prophet or an alarmist, his call to diversify into Bitcoin, gold, and silver taps into real concerns about economic stability. With blockchain tech advancing and market uncertainty rising, alternative assets might just be the hedge you need.

Read our other similar article Bitcoin and Crypto Plunge: Why Trump’s Tariffs Are Shaking the Market

Read more updates and articles on our Crypto category page

#Bitcoin #Cryptocurrency #RobertKiyosaki #GoldInvestment #SilverInvestment #EconomicCrisis #StockMarketCrash #Blockchain #DeFi #InflationHedge