How AI Is Changing Personal Finance and Investment Decisions

For decades, managing money followed a familiar pattern: spreadsheets, gut instinct, and advice from human experts that wasn’t always accessible to everyone. Today, that model is being quietly rewritten. Artificial Intelligence is transforming personal finance and investing, making decisions faster, more data-driven, and increasingly personalized – AI in investing.

What once required a financial advisor, hours of research, or years of experience can now be done in minutes—often from a smartphone. But this shift isn’t just about convenience. It’s fundamentally changing how people understand, manage, and grow their money.

AI Is Making Personal Finance Smarter—and More Personal

One of the biggest changes AI has brought to personal finance is hyper-personalization. Traditional financial advice was largely generic, based on age, income, or broad risk categories. AI systems, however, analyze thousands of data points at once—spending habits, cash flow patterns, debts, goals, and even behavioral tendencies.

As a result, budgeting apps powered by AI can now predict monthly expenses, flag unusual spending in real time, and suggest adjustments before financial stress appears. Instead of reacting to money problems after they happen, users are being nudged ahead of time to make better decisions.

Over time, these systems learn from user behavior. The advice evolves, becoming more accurate and more relevant with every interaction.

Investing Is No Longer Just for Experts

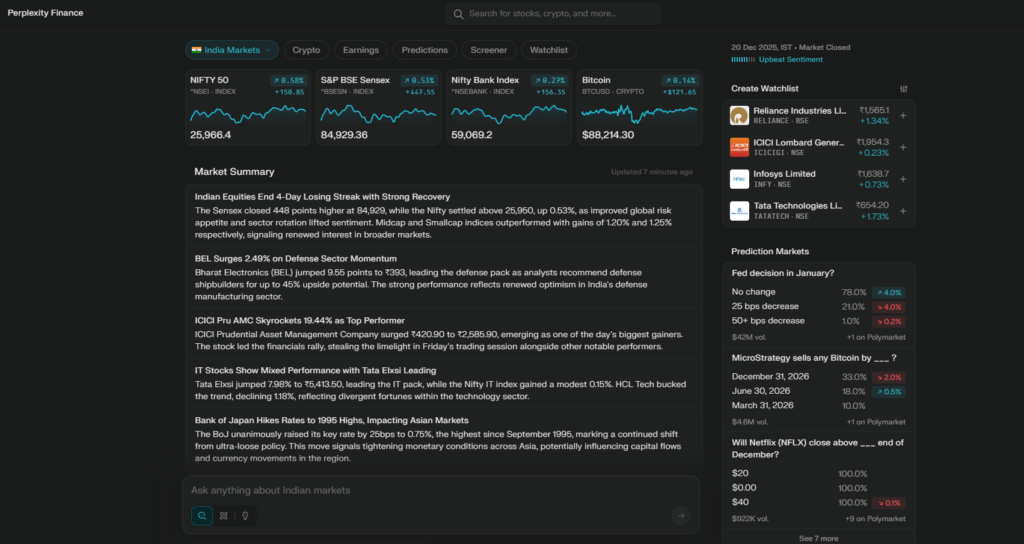

Perhaps the most visible impact of AI is in investing. Tools once reserved for hedge funds and institutional players are now available to everyday investors.

AI-driven platforms analyze market trends, earnings data, macroeconomic signals, and historical performance at a scale no human can match. This allows investors to receive portfolio suggestions that balance risk and return dynamically, rather than relying on static strategies.

Robo-advisors are a clear example of this shift. They automatically rebalance portfolios, optimize asset allocation, and adjust strategies as market conditions change. For many investors, this removes emotion from the equation—reducing panic selling during downturns and overconfidence during market highs.

Data, Not Emotion, Is Driving Decisions

Human investors are emotional by nature. Fear, greed, and overconfidence often lead to poor financial outcomes. AI doesn’t eliminate emotion entirely, but it acts as a counterbalance.

By relying on probabilities, patterns, and long-term data, AI systems help investors stick to disciplined strategies. They highlight risks that may not be obvious and identify opportunities that traditional analysis might miss.

This doesn’t mean AI is always right—but it does mean decisions are increasingly based on evidence rather than impulse.

Credit, Loans, and Risk Assessment Are Being Rewritten

AI is also reshaping how lenders assess creditworthiness. Instead of relying solely on credit scores, modern systems evaluate a broader financial picture, including income stability, spending behavior, and repayment patterns.

For consumers, this can mean:

- Faster loan approvals

- More accurate interest rates

- Improved access to credit for underbanked individuals

In the long run, this approach has the potential to make financial systems more inclusive, while also reducing default risk for lenders.

The Rise of Predictive Financial Planning

Traditional financial planning focused on static projections: retirement at 60, fixed savings targets, and average market returns. AI introduces predictive planning, where strategies adapt continuously.

Life events such as job changes, medical expenses, or economic shifts can now be factored into real-time forecasts. Instead of reworking a financial plan once a year, AI updates it constantly, offering scenario-based guidance that reflects current realities.

This makes long-term goals feel more achievable—and less abstract.

Where Human Judgment Still Matters

Despite its power, AI is not a replacement for human judgment. Algorithms rely on historical data, which means they can struggle with unprecedented events or sudden structural changes in markets.

Ethical concerns, data privacy, and overreliance on automation remain real challenges. The most effective approach is not choosing between humans and AI, but combining both—using AI for analysis and efficiency, while humans provide context, values, and judgment.

What This Means for the Future of Money

AI is not just changing tools; it’s changing behavior. People are becoming more aware of their finances, more engaged with their investments, and more confident in decision-making.

As AI systems become more transparent and regulated, their role in personal finance will only expand. The winners in this new era won’t be those who blindly follow algorithms—but those who learn how to use them wisely.

Final Thoughts

AI is turning personal finance from a reactive task into a proactive system. It’s helping people spend smarter, invest with discipline, and plan with clarity. While it won’t eliminate risk or guarantee profits, it is redefining how financial decisions are made—making sophisticated strategies accessible to millions- AI in investing.

In the end, AI isn’t taking control of your money.

It’s giving you better tools to control it yourself.

Also read our article on –Scapia vs Niyo Credit Card (2025): Features, Rewards, Fees & Best Choice

#AIinFinance #Finance #AIInvesting