The Best Crypto Portfolio Strategy for 2025: Balancing Safety & Growth

Cryptocurrency investments can be highly rewarding but also carry inherent risks. Constructing a well-balanced portfolio is crucial to managing these risks while maximizing potential gains. In this guide, we break down the best crypto portfolio strategy for both conservative and aggressive investors, with a focus on safety and high-growth opportunities.

The Ideal Crypto Portfolio Allocation

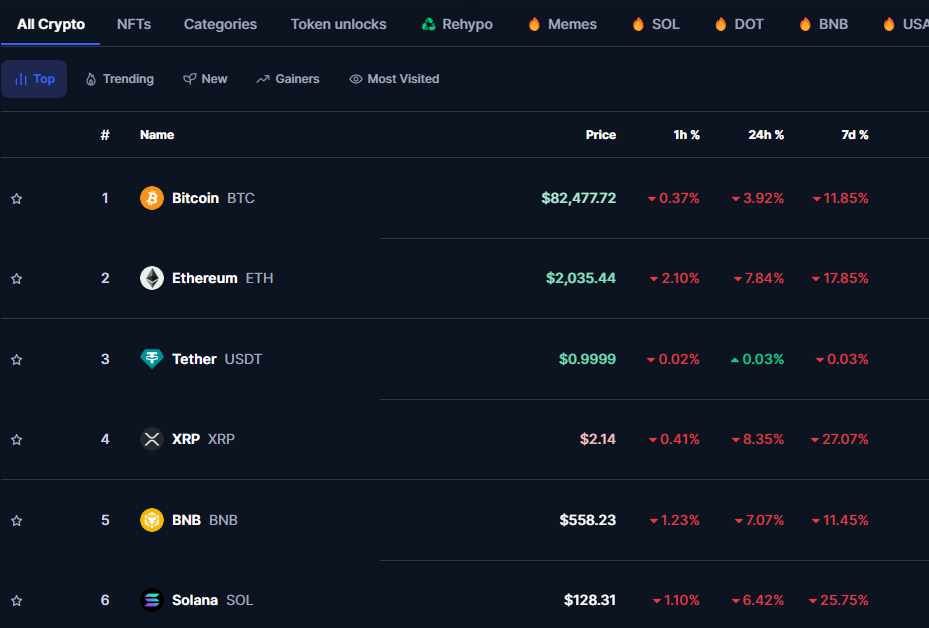

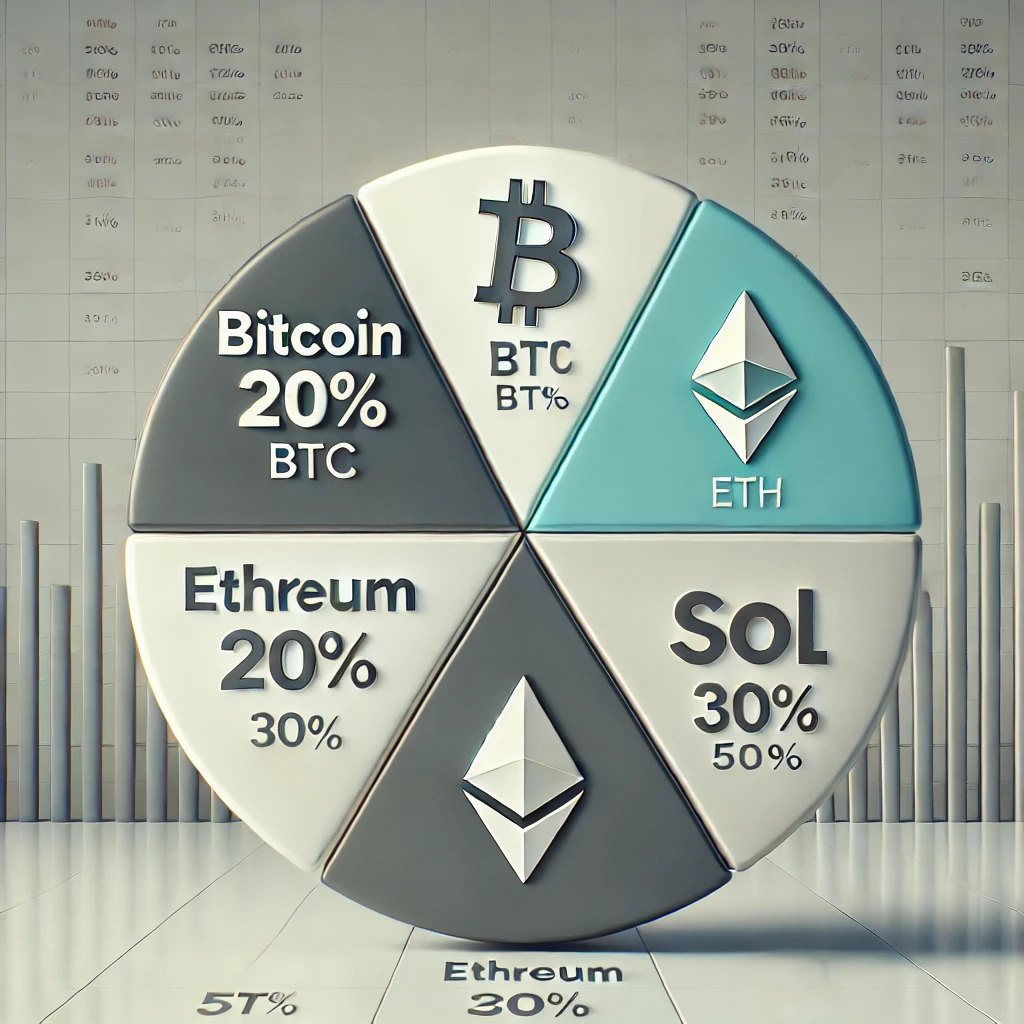

Conservative & Balanced Approach (Lower Risk, Stable Growth)

For investors who prioritize long-term stability, a balanced portfolio should be allocated as follows:

- 50% Bitcoin (BTC) – Bitcoin remains the safest bet in the crypto market, acting as a store of value and hedge against inflation. BTC’s historical performance and institutional adoption make it a must-have in any portfolio.

- 20% Ethereum (ETH) – As the leading smart contract platform, Ethereum is essential for DeFi, NFTs, and enterprise blockchain applications. With upcoming updates and ETF approvals, ETH remains a strong, long-term asset.

- 30% Solana (SOL) – Known for its high transaction speeds and growing developer ecosystem, Solana has emerged as a major competitor to Ethereum, making it an ideal choice for diversification.

Aggressive Growth Portfolio (Higher Risk, Higher Reward)

For investors willing to take more risk in pursuit of substantial returns, a diversified strategy includes:

- 50% Safe Coins (BTC, ETH, SOL) – A combination of these three assets provides stability while allowing room for growth.

- 30% Memecoins (High-Risk, High-Reward) – Investing in trending memecoins can yield exponential gains, but they also come with extreme volatility. Coins like Dogecoin (DOGE), Shiba Inu (SHIB), or newer trending memecoins could lead to a make-or-break scenario.

- 20% AI-Based & Tech-Driven Altcoins – The rise of AI and blockchain innovation has led to the emergence of promising projects such as:

- SUI – A Layer-1 blockchain with high scalability and a developer-friendly ecosystem.

- TON (The Open Network) – Backed by Telegram, TON has gained traction for its Web3 and NFT-based solutions.

- Injective (INJ) – A high-performance blockchain optimized for DeFi applications.

- Render Network (RNDR) – An AI-driven platform leveraging blockchain for decentralized GPU rendering.

Expert Suggestions & Key Takeaways

- Diversification is Key – Even in a stable portfolio, keeping a mix of BTC, ETH, and SOL is crucial. For risk-takers, investing in trending memecoins and AI-based altcoins can provide significant upside potential.

- Stay Updated with Market Trends – Emerging technologies, regulations, and macroeconomic factors influence crypto prices. Following industry news is essential for making informed investment decisions.

- Only Invest What You Can Afford to Lose – Crypto markets are volatile, and speculative investments carry risks. Always manage your portfolio with a risk-adjusted approach.

- Long-Term Holding vs. Short-Term Gains – A portion of your portfolio should be allocated for long-term gains (BTC, ETH, SOL), while high-risk investments should be closely monitored for short-term trading opportunities.

Conclusion

A well-structured crypto portfolio should balance safety with high-growth opportunities. Conservative investors should allocate a majority of their holdings to Bitcoin, Ethereum, and Solana, while risk-takers can diversify into memecoins and AI-powered altcoins. Regardless of your risk appetite, staying informed and strategically managing your portfolio will maximize your chances of success in the evolving crypto landscape.

CoinDCX: For traders and investors in India, CoinDCX is the best platform whihc has quick deposits and withdrawls, lowest fee and CoinDCX is the platform I trust to learn, invest & trade in Crypto. Buy your first crypto and win up to ₹5,00,000 in crypto rewards!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Read more updates and articles on our Crypto category page

#CryptoPortfolio #Bitcoin #Ethereum #Solana #CryptoInvesting #Altcoins #Memecoins #CryptoStrategy #Blockchain #CryptoNews