Bitcoin and Major Cryptos Crash to New Lows: What’s Driving the Fall, Market Outlook, and What Comes Next

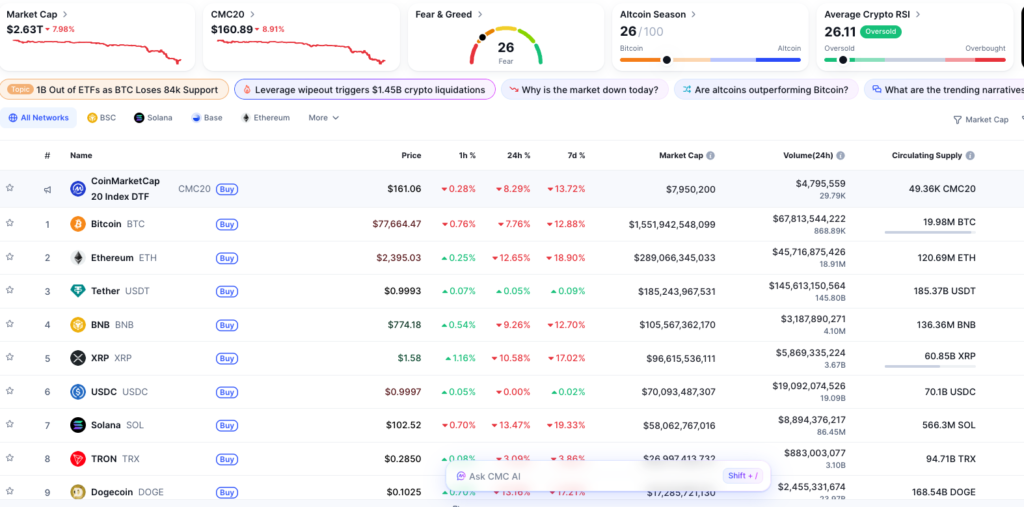

Bitcoin and major cryptocurrencies have once again slid to fresh lows, sending shockwaves across the crypto market. Prices dropped sharply, sentiment weakened, and risk appetite evaporated almost overnight (Bitcoin crash).

But this move didn’t happen in a vacuum.

The current crypto sell-off is the result of multiple macro, market, and structural pressures converging at the same time. Understanding why this happened is far more important than reacting emotionally.

Let’s break it down.

Why Bitcoin and Major Cryptos Crashed

1️⃣ Global Risk-Off Sentiment Is Back

Crypto remains a risk asset, especially in the short to medium term.

When global markets turn cautious due to:

- Tight financial conditions

- Equity market weakness

- Flight to safety

capital flows out of high-risk assets first — and crypto is often at the front of that exit.

This crash mirrors broader risk-off behavior, not just crypto-specific weakness.

2️⃣ Persistent Macro Pressure: Rates, Liquidity, and Policy

High interest rates and tighter liquidity continue to weigh on speculative assets.

Key effects:

- Less cheap money entering markets

- Lower leverage across trading platforms

- Reduced appetite for long-duration, volatile bets

Crypto thrives on liquidity. When liquidity tightens, prices feel the pressure fast.

3️⃣ Forced Selling and Liquidations

Once prices start falling:

- Leveraged positions get liquidated

- Stop-losses are triggered

- Panic selling accelerates

This creates a cascade effect, pushing prices lower than fundamentals alone would justify.

These sharp drops are often mechanical — not purely emotional.

4️⃣ Altcoins Are Amplifying the Downside

When Bitcoin weakens:

- Altcoins usually fall harder

- Liquidity dries up faster

- Confidence erodes quickly

Many altcoins lack:

- Strong balance sheets

- Long-term holders

- Institutional support

As a result, they act as volatility multipliers during downturns.

5️⃣ Sentiment Fatigue and Unrealistic Expectations

After years of bold predictions and delayed recoveries, investor patience is thinner.

Markets are now:

- Less tolerant of weak narratives

- More focused on delivery than promises

- Quick to punish underperforming projects

This has made the downturn deeper and more selective.

What This Crash Tells Us About the Crypto Market

This move is not just about prices — it’s about market maturity.

Key takeaways:

- Crypto is behaving more like a macro asset class

- Liquidity matters more than hype

- Weak projects are being filtered out faster

Painful? Yes.

Healthy long-term? Possibly.

Short-Term Outlook: Expect Volatility to Stay High

In the near term:

- Sharp rallies and pullbacks are likely

- Sentiment will remain fragile

- News-driven moves will dominate

Markets need time, not headlines, to stabilise.

Trying to time exact bottoms remains extremely difficult.

Medium-Term Outlook: Stabilisation Over Speed

Before any sustained recovery:

- Liquidity conditions must improve

- Forced selling needs to exhaust

- Confidence must slowly rebuild

This phase often feels boring and frustrating — but it’s where strong bases are formed.

Historically, long-term opportunities emerge during periods of disinterest, not excitement.

Long-Term Outlook: Crypto Isn’t Going Away

Despite crashes, crypto continues to:

- Attract institutional infrastructure

- Power blockchain-based innovation

- Evolve in regulation and custody

Bitcoin, in particular, still plays a unique role as:

- A decentralised digital asset

- A hedge narrative (long term)

- The anchor of the crypto ecosystem

Crashes reset excess — they don’t erase the technology.

What Should Investors Do Now?

✔ Avoid Panic Decisions

Selling purely out of fear often locks in losses.

✔ Focus on Quality

If you’re exposed to crypto, prioritise:

- Strong networks

- Real usage

- Transparent teams

Not all tokens deserve to survive the next cycle.

✔ Manage Risk Ruthlessly

- Reduce over-leverage

- Avoid over-concentration

- Size positions realistically

Survival matters more than perfect timing.

✔ Zoom Out

Every major crypto cycle has included:

- Deep drawdowns

- Sentiment collapse

- Periods of disbelief

They are uncomfortable — but not unprecedented.

Final Thoughts

The current crypto crash is a reminder that – Bitcoin crash:

- Crypto is volatile

- Liquidity drives price

- Patience is a competitive advantage

Whether this move marks a temporary shakeout or a longer consolidation phase, one thing is clear:

The next phase of crypto growth will reward discipline, fundamentals, and long-term thinking — not hype.

For investors, the biggest edge in 2026 won’t be speed —

it will be understanding the trends before they go mainstream.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Read more updates and articles on our Crypto category page and also read Layer-2 Blockchains Explained: Why They Matter for Crypto’s Future

#crypto #crash #bitcoincrash #investing #ethereum #altcoin