Bitcoin Hits New ATH Again as Dow Jones Rises Amid Trump’s Tariff Threats: What This Means for Crypto Investors

Bitcoin Hits $113K: Why the Surge?

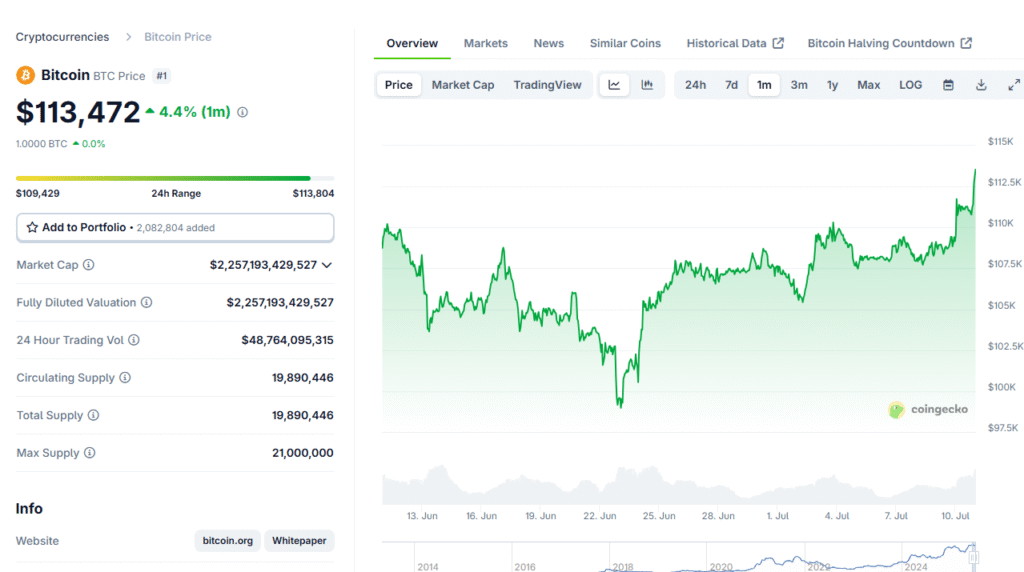

Bitcoin has once again defied expectations, climbing to $113,358.50 on July 10, 2025 — its second consecutive all-time high. The leading cryptocurrency is up 3.65% in the last 24 hours and has surged a staggering 96.2% year-on-year, reaffirming its status as a powerful hedge in times of macroeconomic tension.

💼 Institutional Demand Drives Momentum

Several factors are fueling Bitcoin’s record-breaking rally:

- ETF inflows are accelerating, bringing in billions in fresh capital from institutional investors.

- A weakening U.S. dollar is pushing investors toward hard assets like Bitcoin.

- Major corporations are expanding BTC in their treasuries, enhancing legitimacy and trust.

- Retail traders are joining the momentum, buoyed by a broader positive sentiment in the crypto space.

These bullish drivers have helped push the total crypto market capitalization to $3.52 trillion, marking a 3.64% gain in a single day.

📊 Altcoins Join the Party: Ethereum Leads the Pack

Ethereum (ETH) notably outperformed Bitcoin, gaining 5.54% within the same timeframe. Other Layer 1s and DeFi tokens also rallied, supported by growing investor confidence and ecosystem upgrades.

💼 Wall Street Reacts: Dow Rises Despite Tariff Jitters

The U.S. stock market saw parallel growth:

- Dow Jones gained 270 points (+0.61%)

- S&P 500 added 0.28%

- Nasdaq remained flat (-0.01%)

This shows a growing synergy between crypto and traditional markets as investors diversify portfolios amid economic shifts.

🌎 Trump’s Tariff Threats Stir Global Tensions

Former President Donald Trump reignited trade fears by threatening 50% tariffs on Brazil, citing political tensions over Jair Bolsonaro. Brazil responded with its own warnings, raising concerns about a renewed trade war.

Trump has recently escalated threats toward other key trade partners — Japan, South Korea, and the Philippines — hinting at tariffs between 20% and 30%.

🌐 Potential Economic Fallout:

- Rising tariffs could trigger inflationary pressures in global trade.

- Commodities and fiat currencies may weaken.

- Bitcoin may benefit from its “digital gold” narrative during economic instability.

🔮 What’s Next for Bitcoin and Crypto?

Despite external political pressures, the crypto market remains bullish heading into Q3 2025:

- BTC’s next technical target sits at $120,000 if current volume sustains.

- Ethereum may breach $3,200, with smart contract usage at record highs.

- Altcoin rotations could intensify as investors seek higher ROI bets.

⚠️ Risks to Watch:

- U.S. political shifts leading to stricter regulation.

- ETF inflow volatility.

- Escalation of trade wars dragging global liquidity.

🧠 Final Thoughts

Bitcoin’s historic climb, paired with rising altcoins and traditional stock gains, indicates a robust investment climate for digital assets. However, looming trade wars and geopolitical strife serve as crucial reminders of volatility.

Investors would do well to diversify, monitor global signals, and maintain long-term strategies in this fast-changing landscape.

📢 Stay Updated

Follow the latest on crypto market insights, macro analysis, and regulatory shifts right here.

Read more updates and articles on our Crypto category page and also for Bitcoin price Forecast

#BitcoinATH #CryptoNews #BTCPrice #EthereumRally #TrumpTariffs #DowJones #CryptoMarket2025 #ETFs #Altcoins #FinancialNews