Bitcoin & Ethereum ETFs Record Highest Inflows of 2025: Over $1 Billion in a Day

Bitcoin and Ethereum exchange-traded funds (ETFs) have roared back to life in 2025, witnessing the most significant daily inflows since November 2024. On May 22, the crypto investment space saw a whopping $1 billion in net ETF inflows — a sign of growing confidence and investor enthusiasm during the cryptocurrency investment trends.

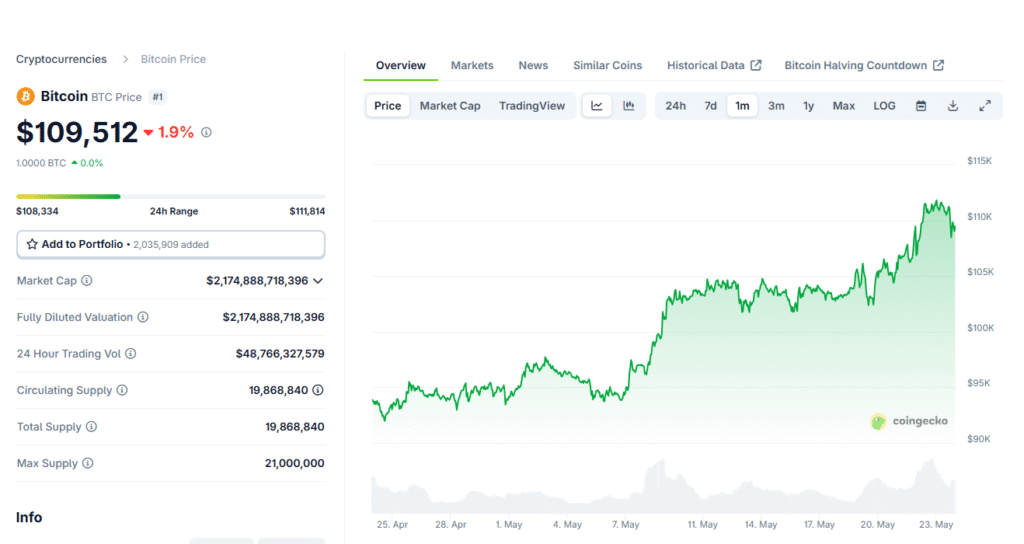

Bitcoin ETFs Lead the Charge

Spot Bitcoin ETFs saw $934 million in daily inflows, their best showing since January 17. These massive inflows have pushed the total assets under management (AUM) for spot Bitcoin ETFs to an impressive $104 billion.

BlackRock’s IBIT fund emerged as the star performer, now holding 651,620 Bitcoins. This milestone places BlackRock as the second-largest Bitcoin holder, trailing only the legendary, inactive Satoshi Nakamoto wallet. Even Michael Saylor’s Strategy fund now holds 576 Bitcoins, falling behind BlackRock’s aggressive accumulation.

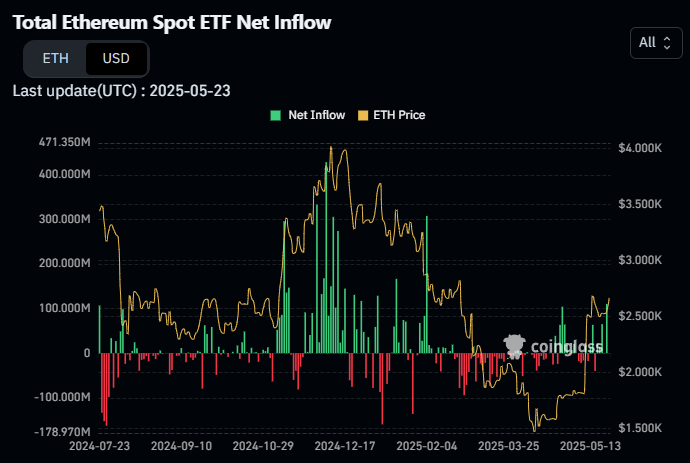

Ethereum ETFs Make a Strong Comeback

Ethereum ETFs aren’t staying in Bitcoin’s shadow. They logged $110 million in net inflows—the highest single-day gain since February 4. Grayscale’s ETHE fund led the way with $43.7 million of that surge.

Even more notable? This is the fifth consecutive day of positive inflows into Ethereum ETFs, bringing their total AUM to over $10 billion. Ethereum’s own strong price movement, boasting a 44% rally since early May, is fueling this investor interest.

Market Momentum: Crypto Resilience vs. Stock Market Retreat

Bitcoin hit a new all-time high of $111,970 on May 22, which has undoubtedly stoked investor sentiment. Remarkably, this crypto surge is happening even as traditional stock markets face turbulence due to mounting U.S. government debt concerns and trade tariffs.

Traders and institutional investors appear to be repositioning their portfolios, eyeing crypto as a hedge and high-growth asset in a shifting macroeconomic landscape.

What’s Next?

As the demand for crypto ETFs continues to rise, and with Ethereum’s strong momentum in tandem with Bitcoin’s record-breaking performance, the market could be preparing for an extended bull run. The growing institutional presence and inflows also signal that digital assets are cementing their role in mainstream finance in cryptocurrency investment trends.

If you’re looking to ride the wave of this crypto resurgence, now might be the time to keep a close watch on ETF activity and price movements — the next big move could be just around the corner.

Read more updates and articles on our Crypto category page and also for Bitcoin price Forecast

#Bitcoin #Ethereum #CryptoETFs #CryptoNews #BTC #ETH #InvestmentTrends #CryptoBullRun #BitcoinAllTimeHigh #ETFinflows