Bitcoin Breaks $110,000: Why Crypto Whales Are Buying More and What the Future Holds

Bitcoin Hits $110K: Crypto Whales Dive In—What’s Next for BTC?

BTC future forecast: Bitcoin has surged past the $110,000 milestone for the first time in history, marking a pivotal moment for the cryptocurrency market. This remarkable price jump has reignited optimism among traders and long-term investors, while also drawing significant interest from crypto whales—large holders who typically influence market momentum.

As the market prepares for the next phase of this bull run, the question arises: What’s fueling the surge? And more importantly, where is Bitcoin headed next?

What’s Driving Bitcoin’s $110K Breakout?

1. Increased Institutional Adoption

Institutions have become key players in the crypto space. Bitcoin ETFs, large treasury allocations, and increasing acceptance by hedge funds and sovereign wealth funds are driving sustained demand. BlackRock, Fidelity, and ARK Invest continue to funnel billions into BTC-based assets.

2. Scarcity and Halving Effect

With the most recent Bitcoin halving in April 2024, mining rewards were cut from 6.25 BTC to 3.125 BTC. This has decreased the circulating supply of new Bitcoin entering the market, while demand continues to rise — a classic setup for price appreciation.

3. Crypto Whales Are Accumulating

According to Glassnode and Whale Alert, wallet addresses holding 1,000 BTC or more have steadily increased over the past 30 days. These whales have added over 120,000 BTC, signaling strong conviction in further upside.

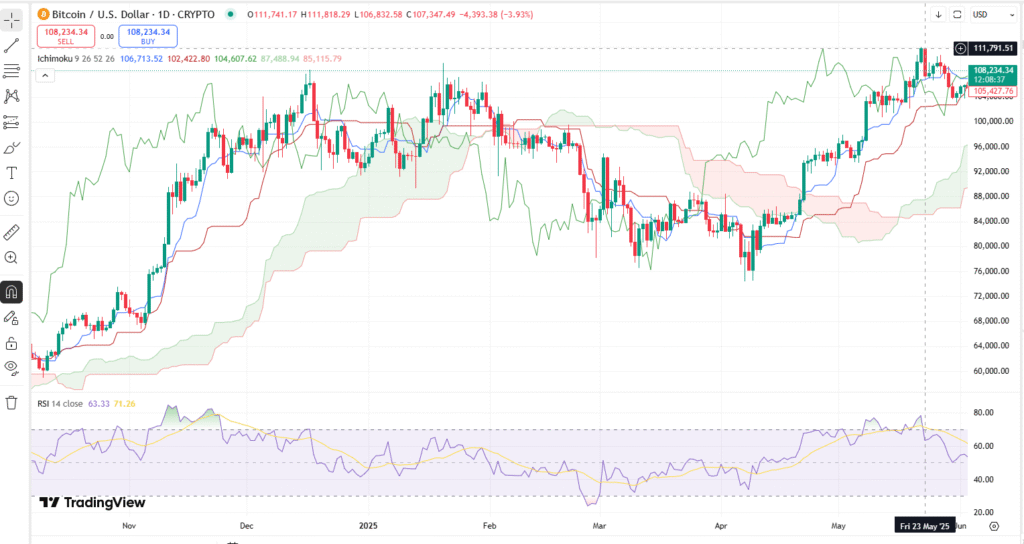

Technical Analysis: Can Bitcoin Hit $150K Next?

Bitcoin’s current breakout aligns with a bullish flag pattern confirmed in late May. The price has broken resistance at $105,000 and now trades comfortably above key Fibonacci retracement levels.

- Immediate Resistance: $115,000 and $120,000

- Support Zones: $106,500 and $100,000

- Bullish Indicators:

- RSI remains strong at 72, showing bullish momentum

- MACD histogram is in green with a rising slope

- 50-day EMA has crossed above the 200-day EMA (Golden Cross)

Forecast:

If BTC maintains its current pace, a push toward $130,000–$150,000 by Q4 2025 is not off the table, especially if macroeconomic conditions continue to favor alternative stores of value.

Bitcoin’s Long-Term Future: Is $200K Possible?

While $110,000 is a historic achievement, many analysts believe this is just the beginning. Factors that could propel Bitcoin even further include:

- US regulatory clarity and potential tax advantages

- Stablecoin adoption driving more BTC pairings

- De-dollarization trends globally, positioning Bitcoin as a hedge

- Lightning Network expansion improving Bitcoin’s scalability and utility

Long-term holders (LTHs) are also showing confidence. Data shows over 72% of Bitcoin hasn’t moved in the past 12 months, reinforcing a belief in future value appreciation.

What Should Investors Do Now?

✔️ Hold or Accumulate:

DCA (Dollar-Cost Averaging) remains the safest strategy for new investors.

✔️ Stay Updated:

Follow whale wallet movements and ETF inflows for early signals of market momentum shifts.

✔️ Watch the Macros:

Interest rate decisions, inflation reports, and geopolitical tension all impact Bitcoin’s next big move.

Final Thoughts

BTC future forecast: Bitcoin’s climb past $110,000 isn’t just a number — it’s a testament to the growing institutional trust, technological development, and global financial transformation led by decentralized assets. As crypto whales continue to accumulate, one thing is clear: The next phase of Bitcoin’s evolution has just begun.

Stay informed. Stay invested. The future of finance is digital.

Read more updates and articles on our Crypto category page and also for Bitcoin price Forecast

#Bitcoin #BTC #CryptoWhales #BitcoinForecast #CryptoMarket #BTCAnalysis #Blockchain #CryptoNews #BullRun2025