Bitcoin Oversold After Israel-Iran Conflict: Will BTC Bounce Back or Plunge Further?

Bitcoin Falls Amid Israel-Iran Conflict: Oversold or the Start of a Trend?

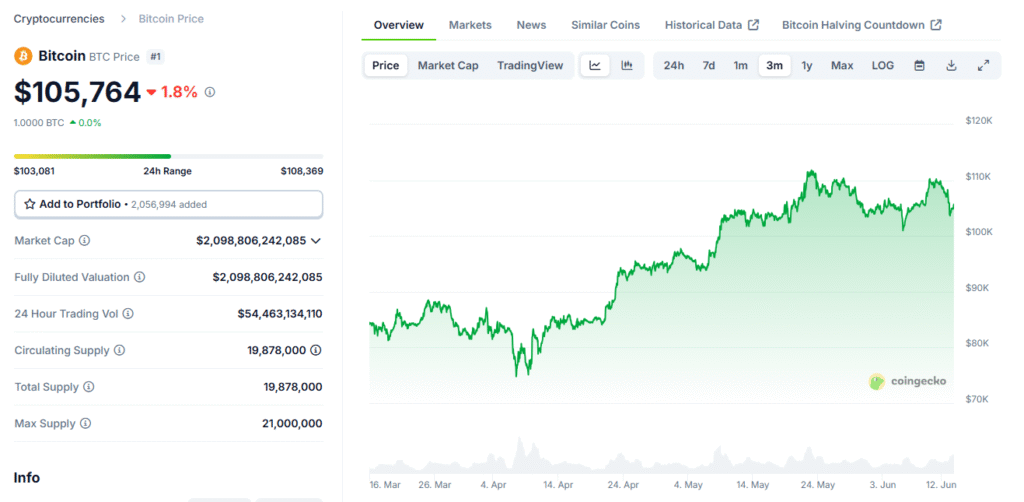

Middle East conflict Bitcoin: Bitcoin (BTC) witnessed a sharp 5% decline on Friday, June 13, 2025, dropping to a daily low of $102,822. The sudden downturn followed Israel’s military strike on Iran, a move that heightened fears of an all-out regional war in the Middle East.

While traditional safe-haven assets like gold (+1.74% to $3,438.36/oz) and crude oil (+14%) rallied, Bitcoin and Ethereum (ETH) saw heavy sell-offs, with Ethereum plunging as much as 7.6%. The question now being asked across the financial world: Is Bitcoin oversold, or is this a warning sign of deeper corrections?

📊 Why Did Bitcoin Drop?

According to Marcin Kazmierczak, COO of RedStone, the geopolitical tensions caught the market off guard:

“Bitcoin dropped as much as 5% to $102,900, falling below the psychologically important $103,000 level,” he stated. Over $427 million in long positions across BTC and ETH were liquidated in a short period – Bitcoin Crypto analysis.

The market’s reaction is typical of a “risk-off” event where investors flee from volatile assets, seeking safety in gold, USD, or oil. This move has historically been seen during Middle Eastern geopolitical crises.

💡 Is This an Opportunity in Disguise?

Interestingly, Kazmierczak believes this drop may be temporary and represents a buying opportunity—similar to what happened in April 2024 during earlier tensions between the same nations:

“Past incidents created temporary dislocations. Once tensions eased, the crypto market rebounded sharply.”

However, he also noted that this situation is different, with Israel directly targeting Iran’s nuclear infrastructure and stating its intent to continue operations, adding uncertainty to any recovery timeline.

🔄 Analysts Split on What’s Next for Bitcoin

While some analysts warn of further downside if tensions escalate, others see Bitcoin as a potential safe haven.

🛡️ Bitunix Analysts’ Take:

Experts at Bitunix argue that Bitcoin could benefit from ongoing geopolitical conflict:

“Risk-averse capital may flow into the crypto market. If the conflict continues, we might see Bitcoin challenge the $110,350 liquidity zone,” a Bitunix note revealed.

This suggests that a “flight to safety” narrative could apply to Bitcoin, despite its high volatility—especially in regions or economies with weak financial systems.

📌 Technical Insight: Oversold or Trend Reversal?

Support & Resistance Levels:

- Key Support: $102,000

- Psychological Barrier: $103,000

- Next Resistance: $110,350 (as noted by Bitunix)

Technical Sentiment:

- Relative Strength Index (RSI): Entered oversold territory

- MACD Indicator: Near bearish crossover

- Volume Spike: Increased selling pressure but flattening, suggesting exhaustion

These technicals suggest the market could bounce on short-term de-escalation, especially if global investors see value at current levels.

🧭 Macro Factors to Watch

- U.S. response to Israel’s actions (currently distanced but cautiously watching)

- Iran’s retaliation, if any

- Federal Reserve policy shifts and inflation impact on crypto sentiment

- Institutional investment trends (BlackRock, Grayscale, and ETF inflows)

🧠 Expert Tips for Traders and Investors

- Avoid emotional trading: Volatility may persist in coming days.

- Track global headlines: Major political decisions can heavily influence BTC prices.

- Watch safe-haven metrics: Compare Bitcoin’s performance to gold and USD indexes.

- Use risk management tools: Set stop losses and maintain portfolio balance.

📣 Final Thoughts: Volatility, Yes — But Opportunity Too

Middle East conflict Bitcoin: Bitcoin is currently facing external pressure from geopolitical volatility, but this isn’t unfamiliar territory. In fact, previous crises have led to strong rebounds in the crypto market once tensions cooled. The narrative now hinges on whether Bitcoin can evolve from being a risky asset to a perceived hedge against geopolitical uncertainty.

With price levels near oversold zones and analysts divided, caution is key, but so is preparedness. For traders and long-term investors alike, this might be one of those defining market moments.

While the crypto market may recover from the initial dip, this episode is a stark reminder that in 2025, crypto is no longer isolated—it’s intertwined with the most powerful figures on Earth.

Stay tuned. Because if politics is volatility, crypto is now its mirror.

Read more updates and articles on our Crypto category page and also for Bitcoin price Forecast

#Bitcoin #CryptoCrash #BTCPrice #CryptoAnalysis #MiddleEastCrisis #BitcoinRebound #SafeHaven #Ethereum #CryptoNews #GeopoliticsAndCrypto