Bitcoin Price Drops: Crypto Market Faces Billions in Decline

Bitcoin Price Drops to $83,500 as Crypto Market Faces $659 Billion Decline

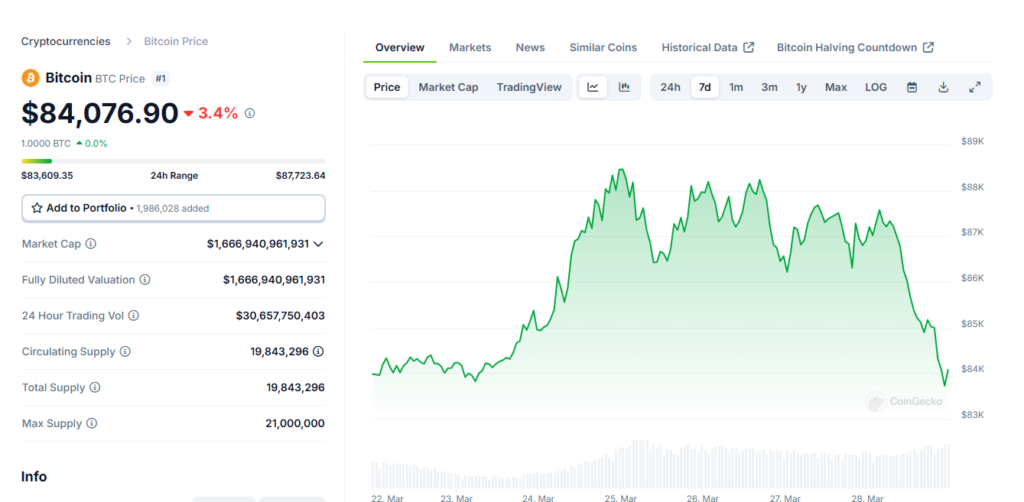

The cryptocurrency market has experienced a sharp downturn, with Bitcoin dropping from its recent high of $89,000 to $83,500. This drop has contributed to an overall market loss of $659 billion, significantly impacting the top five cryptocurrencies.

Ethereum and Solana Lead Crypto Market Decline

Among the hardest-hit cryptocurrencies, Ethereum (ETH) and Solana (SOL) suffered the most substantial losses. Ethereum’s market capitalization fell by 44% to $240 billion, while Solana saw a 43% decline to $73 billion.

On the other hand, Bitcoin (BTC) and Binance Coin (BNB) demonstrated relative resilience. BTC’s market cap declined by 18% to $1.735 trillion, while BNB registered a 15% drop to $91 billion.

Reasons Behind the Market Drop

1. Profit-Taking by Long-Term Holders

As Bitcoin approached the psychological barrier of $100,000, long-term holders started offloading their holdings. Data reveals that approximately $60 billion worth of Bitcoin was distributed in the last 30 days, leading to increased selling pressure.

2. Liquidation of Leveraged Long Positions

The crypto futures market saw mass liquidations as prices started to fall. Within 24 hours, total liquidations reached $577.39 million, with long positions accounting for $468.98 million. These liquidations intensified the price drop, leading to further volatility.

3. Decline in Institutional Demand

Market analysis indicates that institutional demand has slowed, with reduced large-scale buying activity. The weakening buying pressure has allowed prices to slide further.

Ethereum Faces Steep Underperformance Against Bitcoin

Ethereum’s underperformance compared to Bitcoin is another key highlight from recent studies. The ETH/BTC ratio has declined by 72% since September 2022, marking Ethereum’s lowest valuation against Bitcoin since January 2020. This has fueled debates over Ethereum’s long-term valuation and potential recovery.

XRP’s Initial Surge Stagnates After 2024 Election Optimism

XRP initially saw a bullish rally following the 2024 U.S. presidential election, surging from $30 billion to $142 billion by March 2025.

However, activity on the XRP Ledger has cooled off, with daily active addresses now in the 20K-40K range. This decline in network engagement has limited XRP’s sustained growth potential.

Bitcoin Market Sentiment Remains Weak

A key market sentiment indicator, the Bull Score Index, currently stands at 20—the lowest level since January 2023. The study on bitcoin price drops suggests that if the index remains below 40 for an extended period, it could indicate prolonged bearish conditions similar to past market downturns.

What’s Next for Crypto Investors?

With Bitcoin struggling to regain momentum and altcoins facing sharper declines, the market outlook remains uncertain. The study emphasizes that future price movements will depend on a rebound in investor sentiment, institutional participation, and broader macroeconomic conditions.

Read more updates and articles on our Crypto category page and also for Bitcoin price Forecast

#Bitcoin #CryptoMarket #Ethereum #Solana #CryptoCrash #BTC #CryptocurrencyNews #MarketAnalysis