Bitcoin Breaks $118K: Future Growth Forecast & Market Analysis

Bitcoin Crosses $118,000 – A Defining Moment in Crypto History

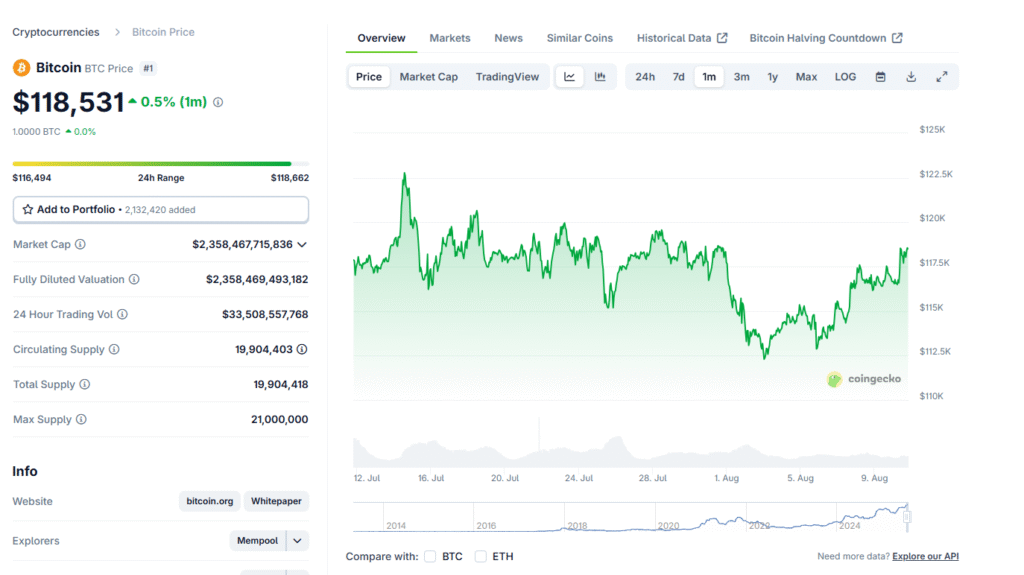

Bitcoin, the world’s largest cryptocurrency by market capitalization, has surged past $118,000, marking one of the most significant price milestones in its 15-year history. This breakout has sparked renewed investor confidence, increased institutional participation, and discussions about the next possible price targets – Bitcoin 2025 forecast.

The surge reflects not just speculative momentum but also deeper macroeconomic and technological shifts driving Bitcoin adoption.

Why Bitcoin’s Price is Soaring

- Institutional Adoption

- Major financial firms, including BlackRock, Fidelity, and Ark Invest, have increased Bitcoin exposure through spot ETFs, pushing demand to new heights.

- Corporate treasuries are diversifying with Bitcoin holdings as a hedge against inflation and currency devaluation.

- Macroeconomic Factors

- Global inflationary pressures and geopolitical uncertainties are driving investors toward decentralized, non-sovereign assets like Bitcoin.

- The weakening of major fiat currencies against the U.S. dollar has made Bitcoin more attractive as a store of value.

- Scarcity and Halving Effect

- The Bitcoin Halving in April 2024 reduced mining rewards from 6.25 BTC to 3.125 BTC, tightening supply and fueling bullish sentiment.

Technical Market Analysis

- Support Level: $110,000 – This zone has emerged as a strong psychological support, with institutional buy orders stacked.

- Resistance Level: $125,000 – Analysts predict short-term consolidation before a potential breakout beyond this threshold.

- RSI Indicator: Bitcoin is in the overbought zone, suggesting a possible short-term pullback before the next rally.

Trend Outlook: The upward momentum remains intact as long as BTC stays above $110,000. A breach of $125,000 could open doors to $150,000 in the medium term.

Expert Growth Predictions for Bitcoin

- Cathie Wood (Ark Invest): Predicts BTC could reach $250,000 by 2026, citing mass institutional adoption.

- Standard Chartered: Forecasts Bitcoin at $150,000 by late 2025 if current ETF inflows continue.

- PlanB (Stock-to-Flow Model): Suggests Bitcoin could touch $500,000 in this cycle based on scarcity metrics.

Risks and Challenges Ahead

- Regulatory Pressures: Countries like the U.S., EU, and India are tightening cryptocurrency regulations, which could impact market liquidity.

- Market Volatility: Even with bullish trends, Bitcoin’s price history shows steep corrections of 20–30% are common.

- Competition from Altcoins: Emerging projects in DeFi, AI, and blockchain infrastructure could divert investor attention.

Long-Term Investment Perspective

For long-term investors, Bitcoin’s fundamentals remain strong:

- Limited Supply: Only 21 million BTC will ever exist.

- Growing Institutional Trust: Increased ETF adoption enhances legitimacy.

- Global Acceptance: More countries and businesses are integrating BTC payments.

Historically, Bitcoin has rewarded patient investors who can withstand short-term volatility. Dollar-cost averaging (DCA) remains a popular strategy to mitigate risk.

Conclusion – The Road Beyond $118,000

Bitcoin 2025 forecast – Bitcoin crossing $118,000 is more than a price event—it’s a signal of shifting economic power toward decentralized assets. Whether you’re a seasoned trader or a cautious investor, understanding the macro, technical, and adoption-driven forces behind BTC’s rise will be key in navigating the road to its next potential all-time high.

Also, read our other article EPF Interest Rate for FY25 Stays at 8.25%: How Much You’ll Earn & When It Gets Credited

Check out more article on Finance on our Finance Category section.

#Bitcoin #BTC #CryptoNews #BitcoinPrice #CryptoInvestment #BTCForecast #CryptoMarketAnalysis #Bitcoin2025