Bitcoin Defends $85K as Liquidations Spike Ahead of Key U.S. Jobs Report

Bitcoin is back in the danger zone. The world’s largest cryptocurrency slid more than 4% on Tuesday, repeatedly testing the $85,000 support level as traders braced for the release of crucial U.S. jobs data. Rising uncertainty across macro markets triggered heavy liquidations, shaking out overleveraged positions and rattling short-term sentiment (crypto market volatility).

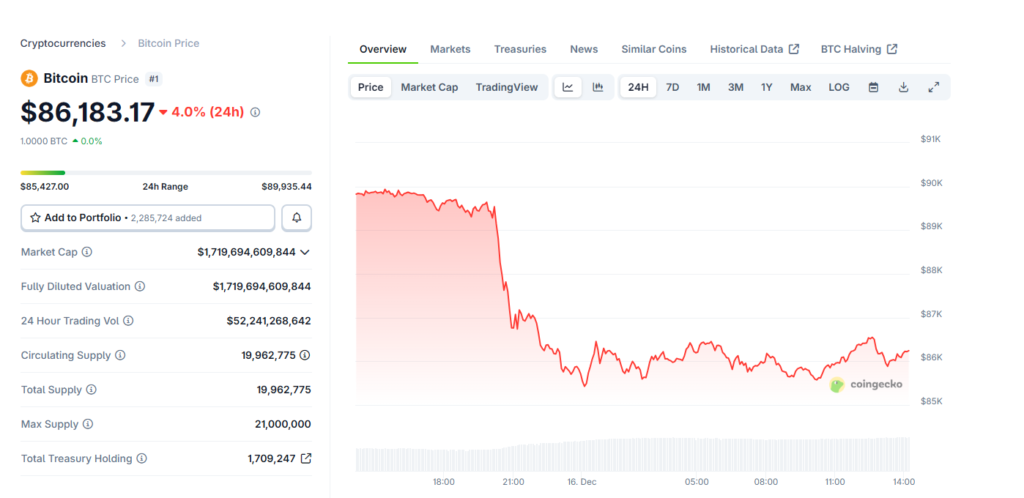

At its lowest point, Bitcoin dropped to $85,427 before staging a modest bounce to around $85,800. Even with the rebound, BTC remains down roughly 9% from last week’s high and nearly 32% below its year-to-date peak.

Macro Anxiety Takes Control of the Market

The sell-off comes as investors stay cautious ahead of the U.S. non-farm payrolls report, scheduled for release later today. According to economists surveyed by Reuters, job growth likely slowed sharply in October, with expectations of around 55,000 new jobs, nearly half of the previous month’s figure.

Normally, weaker labor data would ease inflation fears and give the Federal Reserve more flexibility to cut rates. But markets aren’t fully convinced.

Despite a recent 0.25% rate cut, the Fed has hinted that only one rate cut may be on the table for 2026, keeping risk assets like crypto under pressure. Historically, Bitcoin thrives when rate cuts are expected and struggles when monetary policy tightens or stalls.

Liquidations Surge as Leverage Gets Flushed

As prices dipped, leverage unwound fast.

Data from CoinGlass shows the broader crypto market saw $653 million in liquidations, with a massive $576 million coming from long positions alone. Bitcoin accounted for $169 million of those liquidations, highlighting how crowded bullish trades had become.

This type of forced selling often creates a liquidation cascade, where falling prices trigger stop-outs, pushing the market even lower in a short time frame.

Adding to the pressure, Bitcoin futures open interest dropped 2% to $59.8 billion, a sharp contrast from the $94 billion levels seen in early October. Traders are clearly reducing exposure.

Institutional Demand Also Shows Cracks

Institutional flows aren’t offering much support either.

According to SoSoValue data, U.S. spot Bitcoin ETFs have recorded $158.8 million in net outflows so far in December, following nearly $3.5 billion in outflows in November. Reduced institutional demand removes an important pillar of price stability during volatile periods.

Some market commentators believe the sell-off may not be entirely organic.

A widely followed analyst known as Tracer claimed that large players, including major exchanges and whales, sold nearly $2 billion worth of BTC in a single day, potentially amplifying the move lower. While unproven, such claims are fueling further uncertainty 🧊.

Analysts Split on What Comes Next

Short-term outlooks remain divided and also peaks the crypto market volatility.

Komodo Platform CTO Kadan Stadelmann warned that Bitcoin could still fall toward $75,000 if fear continues to dominate. He noted that overall sentiment across crypto markets remains deeply pessimistic.

That pessimism is reflected in the Crypto Fear and Greed Index, which currently sits at 11, firmly in “Extreme Fear” territory. Historically, such levels often precede volatility — and sometimes major reversals.

On the more optimistic side, analyst Ted Pillows believes Bitcoin may successfully defend the $85K zone, citing large buy orders stacked between $80,000 and $85,000 on Binance.

The Bottom Line

Bitcoin is standing at a critical crossroads.

With macro uncertainty, fading institutional flows, and leveraged traders retreating, volatility is likely to remain high until markets get clearer signals from the Fed and the U.S. economy.

For now, $85,000 is the line in the sand — and the next move could set the tone for the rest of the quarter 📊.

CoinDCX: For traders and investors in India, CoinDCX is the best platform which has quick deposits and withdrawls, lowest fee and CoinDCX is the platform I trust to learn, invest & trade in Crypto. Buy your first crypto and win up to ₹5,00,000 in crypto rewards!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Read more updates and articles on our Crypto category page

Disclaimer: This content is for educational purposes only and does not constitute investment advice.

Bitcoin price today, Bitcoin $85k support, BTC liquidations, crypto market volatility, US jobs data crypto, Bitcoin futures.

#Bitcoin #CryptoNews #BTCPrice #CryptoMarket #BitcoinAnalysis