Crypto Crash: What Causes Cryptocurrency Markets to Plummet?

If you’ve been watching the cryptocurrency market, you’ve probably witnessed the stomach-dropping moments when digital currencies lose significant value in a matter of hours or days. These dramatic price crashes can be confusing and scary, especially for new investors. But what exactly causes these crashes? Let’s break down the main reasons in simple terms. (bitcoin crash explained)

What Is a Crypto Crash?

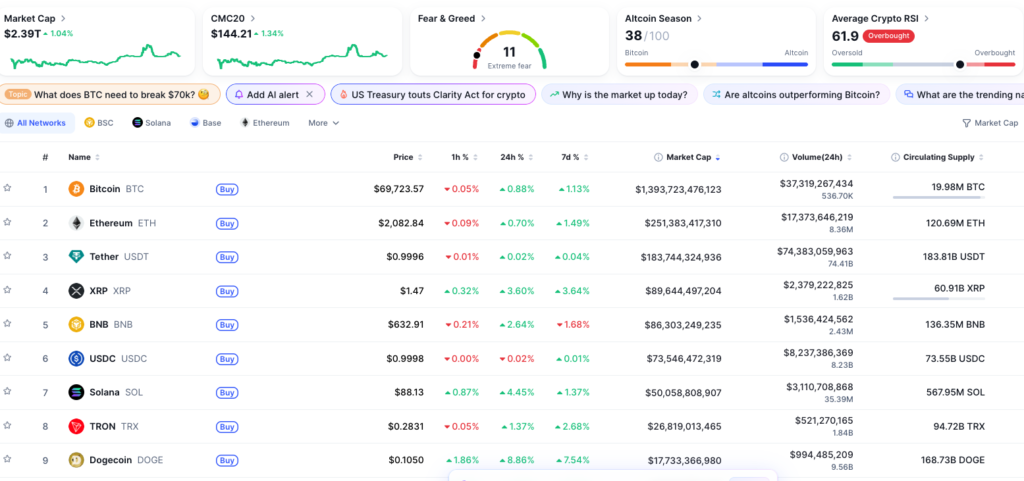

A crypto crash happens when cryptocurrency prices fall sharply and quickly across the market. Unlike traditional stocks, crypto markets operate 24/7 and can be extremely volatile. A crash might see Bitcoin, Ethereum, and other digital currencies lose 20%, 30%, or even 50% of their value in days or weeks.

Major Reasons Behind Crypto Crashes

1. Regulatory Crackdowns and Government Actions

One of the biggest triggers for crypto crashes is when governments announce new regulations or restrictions on cryptocurrencies.

Why it happens: Governments and financial regulators worry about money laundering, tax evasion, and investor protection. When countries like China ban crypto trading or the U.S. announces stricter regulations, it creates panic in the market.

The impact: Traders fear they won’t be able to buy, sell, or use their crypto freely, so they rush to sell before prices drop further. This selling pressure creates a domino effect.

2. Exchange Failures and Security Breaches

Cryptocurrency exchanges are platforms where people buy and sell digital currencies. When these exchanges fail or get hacked, it shakes investor confidence.

Examples of problems:

- Exchange bankruptcies (like FTX in 2022)

- Major hacking incidents where millions of dollars are stolen

- Exchanges freezing withdrawals due to liquidity issues

The ripple effect: When people can’t access their money or fear their funds aren’t safe, panic selling begins. Trust is everything in crypto, and exchange failures destroy that trust quickly.

3. Market Manipulation and Whale Activity

“Whales” are individuals or organizations that hold massive amounts of cryptocurrency. When they make moves, the market feels it.

How it works: A whale might suddenly sell billions of dollars worth of Bitcoin. This flood of supply without matching demand causes prices to drop. Other investors see the price falling and panic sell too, accelerating the crash.

Pump and dump schemes: Some groups artificially inflate coin prices (pump), then sell everything at once (dump), leaving regular investors holding worthless assets.

4. Economic Uncertainty and Traditional Market Crashes

Cryptocurrencies don’t exist in a bubble. They’re affected by what’s happening in the broader economy.

Triggers include:

- Rising interest rates

- Inflation concerns

- Stock market crashes

- Global recessions

- Banking crises

The connection: When traditional markets struggle, investors often pull money out of risky assets like crypto to protect their wealth or cover losses elsewhere. Crypto is still seen as a high-risk investment, so it’s often the first thing people sell during tough economic times.

5. Negative News and Media Influence

The crypto market is highly sensitive to news and public perception.

What causes panic:

- Major companies abandoning crypto projects

- Celebrity influencers dumping their holdings

- Negative mainstream media coverage

- Environmental concerns about crypto mining

- Reports of fraud or scams in the crypto space

Social media effect: Twitter, Reddit, and other platforms can amplify fear. When negative sentiment spreads online, it can trigger mass selling within hours.

6. Leverage and Liquidations

Many crypto traders use leverage, meaning they borrow money to make bigger bets on price movements.

The danger: If the market moves against them, their positions get automatically closed (liquidated) to prevent further losses. When thousands of leveraged positions get liquidated at once, it creates massive selling pressure that drives prices down even faster.

The cascade effect: Lower prices trigger more liquidations, which push prices lower, triggering even more liquidations. It’s a vicious cycle.

7. Technological Issues and Network Problems

Sometimes crashes happen due to technical problems with the blockchain networks themselves.

Examples:

- Network congestion making transactions slow and expensive

- Software bugs or vulnerabilities discovered in blockchain code

- Failed upgrades or hard forks that split communities

- Scalability issues that prevent mass adoption

8. Loss of Stablecoin Stability

Stablecoins are cryptocurrencies designed to maintain a stable value, usually pegged to the U.S. dollar. When they lose their peg, chaos ensues.

The problem: If a stablecoin that’s supposed to be worth $1 suddenly trades at $0.70, it creates panic across the entire crypto market. People question whether any crypto has real value.

Famous example: The Terra/Luna collapse in 2022 wiped out billions in value and triggered a broader market crash.

9. Reduced Institutional Investment

When large institutions like hedge funds, investment banks, or corporations reduce their crypto holdings, it signals trouble.

Why it matters: Institutional money brought legitimacy and stability to crypto markets. When big players exit, it suggests they see problems ahead, causing retail investors to follow suit.

10. Fear of Missing Out (FOMO) Reversal

Crypto markets are driven by emotion. After rapid price increases fueled by FOMO, a reversal is often inevitable.

The cycle:

- Prices rise quickly

- More people buy fearing they’ll miss out

- Prices become unsustainably high

- Early investors take profits

- Prices start falling

- Fear takes over and everyone rushes to sell

- Crash happens

How to Protect Yourself During Crypto Crashes

While you can’t prevent crashes, you can prepare for them:

- Never invest more than you can afford to lose – Crypto is extremely risky

- Diversify your investments – Don’t put everything in crypto

- Avoid leverage trading – Borrowed money amplifies losses

- Do your research – Understand what you’re investing in

- Think long-term – Many investors who held through crashes eventually recovered

- Use reputable exchanges – Stick to well-established platforms

- Keep emotions in check – Don’t panic sell at the bottom

The Bottom Line

Crypto crashes are complex events with multiple contributing factors. Usually, it’s not just one reason but a combination of regulatory fears, market manipulation, economic conditions, and investor psychology that creates the perfect storm. (bitcoin crash explained)

Understanding these reasons doesn’t mean you can predict the next crash, but it helps you make more informed decisions. The crypto market is still young and evolving. Volatility and crashes are part of its nature, at least for now.

Whether you’re a crypto investor or just curious about digital currencies, remember that knowledge is your best defense against panic. Stay informed, invest wisely, and never let fear or hype drive your financial decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Read more updates and articles on our Crypto category page and also read Layer-2 Blockchains Explained: Why They Matter for Crypto’s Future

#crypto #bitcoin #ethereum #Solana #altcoins