Crypto Market Shaken: Is This the Time to Buy or Exit?

Markets are falling!

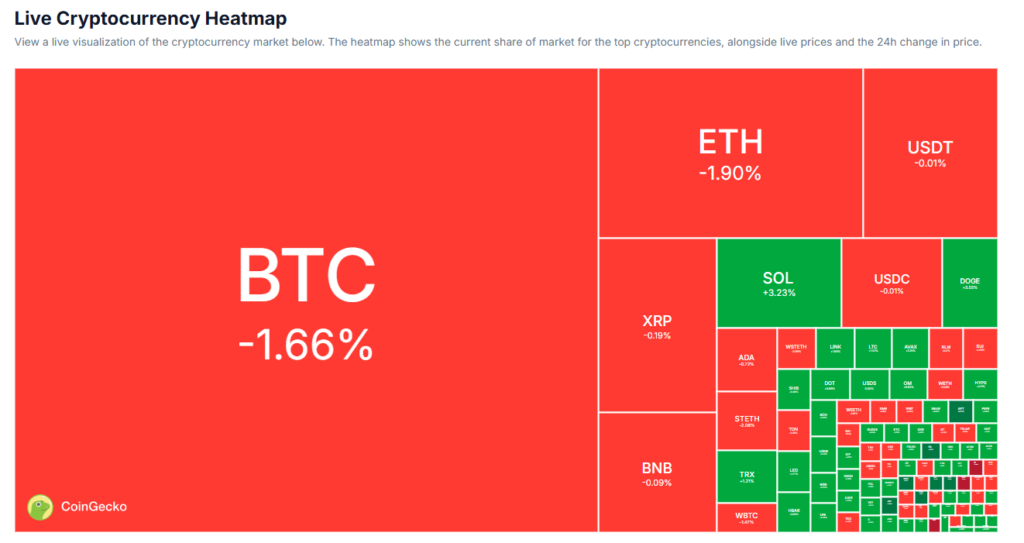

The crypto market is going through one of its toughest phases, and fear is gripping investors. Bitcoin has dropped over 20% from its January peak of $109,350, plummeting to an intraday low of nearly $83,000 before slightly recovering to around $85,000. Solana has also seen a steep decline, dipping below $140. The sell-off has wiped out nearly $300 billion in market value, shaking confidence and raising the question: Is this the beginning of a prolonged bear market?

The Psychology of Market Cycles: We Are in the Depression Stage

Right now, we are deep in what’s known as the depression stage of the market cycle. Investors are feeling hopeless. It seems like every time you invest, the price drops further. And when you wait for the right moment, prices suddenly surge, leaving you in frustration. This is the phase where people start believing that crypto is over, that it’s all a scam, and that selling off everything is the only way out.

The Fear and Greed index is showing a 20 point but it is actually even lower than that, and people are in the process of liquidation.

But here’s the twist—this is the moment when great fortunes are built. When fear is at its peak, when you feel like you might lose all your money, that’s when smart investors make their move. Buying during these fearful moments leads to the highest gains in the long run.

Retail vs. Institutional Sentiment: A Huge Gap

A major reason for the current market turmoil is the difference in sentiment between retail and institutional investors. Retail traders are getting wrecked, especially those gambling on meme coins. They don’t study market fundamentals, blockchain development, or institutional activity. A small pullback in major coins like Bitcoin or Solana wipes out altcoins and meme tokens, leading to panic selling.

Meanwhile, institutional players—BlackRock, Grayscale, major governments, and corporate investors—are doing the opposite. They are accumulating, building, and positioning themselves for the next wave of adoption. Bitcoin ETFs are gaining traction, signaling a shift toward mainstream acceptance. While retail investors panic, institutions are buying the dip and expanding their presence in the space.

Fear & Greed Index at Extreme Lows: A Massive Buying Opportunity in Crypto

The Fear & Greed Index is currently at extreme lows, meaning investors are overwhelmingly fearful. Historically, these moments have been the best buying opportunities. When the market was euphoric, people were buying Bitcoin at $109,000. Now that it’s at a discount, people are afraid to touch it. This is where smart investors take advantage.

Portfolio Strategy: How to Allocate Your Crypto Investments

If you’re looking to navigate this volatile market wisely, consider layering your portfolio into three parts:

- Long-term holds: 60% of your portfolio in Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). These are solid, high-utility coins that have stood the test of time.

- Growth opportunities: 30% in promising new projects with real-world applications, upcoming trends, and institutional backing.

- High-risk, high-reward plays: 10% in meme coins and speculative investments. These should be treated as potential lottery tickets—fun, but not the core of your investment strategy.

Final Thoughts: Be a Bull When Others Are Fearful

The key takeaway? This is not the end of crypto. This is a temporary shakeout. Retail investors are panicking, but the real players—institutions, funds, and seasoned traders—are accumulating. The market is maturing, and this phase will pass. If you have the patience to withstand the turbulence, you will be in a prime position when the next bull run kicks off.

If you are planning for a portfolio for long term, then you should allocate 60% to $BTC, 30% to $ETH and 20% to SOL. This is a good diversification.

So ask yourself: Are you going to be part of the panic? Or are you going to take advantage of the opportunity that so many others are missing?

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Read more updates and articles on our Crypto category page

#Crypto #Bitcoin #Ethereum #Solana #CryptoInvesting #BuyTheDip #CryptoMarket #Blockchain #InvestSmart #HODL