Crypto Price Outlook: Will Bitcoin Hit $100K Again? Ethereum and XRP at Risk Amid Bearish Signs

The cryptocurrency market is navigating a critical juncture as Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) consolidate near key technical levels. After recent pullbacks, all three assets are showing signs of fading bullish momentum, raising questions about whether the next move will be a recovery or a deeper correction. Bitcoin is struggling to hold above $105,000, Ethereum is clinging to its 200-day EMA, and XRP faces resistance at $2.27. In this analysis, we break down the price action, technical indicators, and potential outcomes for these top cryptos as investors await clarity on the next big move for Bitcoin price prediction, among ETH and XRP.

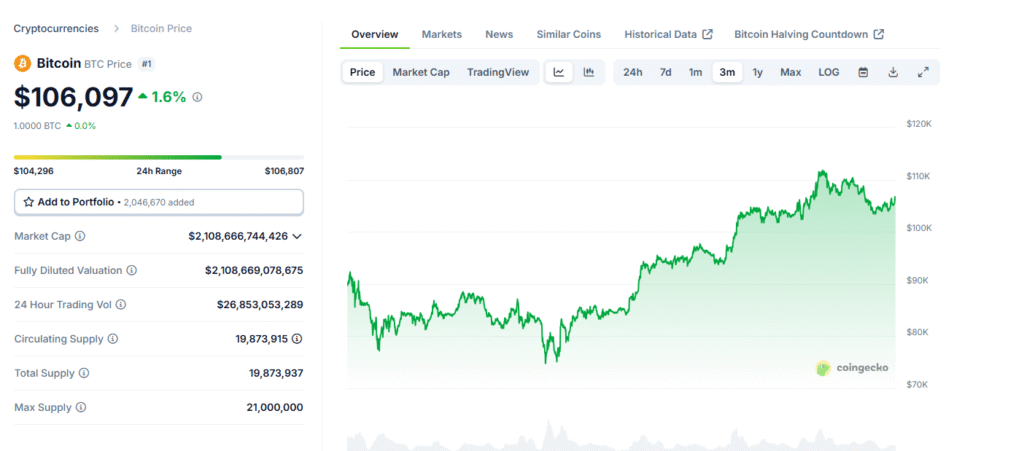

Bitcoin (BTC) Eyes $100K as Bulls Face Resistance

Bitcoin continues its consolidation phase around the $105,000 mark after a 3% dip last week. After slipping below the crucial $106,406 daily support on Thursday, BTC dropped another 1.5% on Friday. Though a slight weekend recovery followed, bearish indicators remain in play.

The Relative Strength Index (RSI) has dropped to 53 and is trending toward the neutral 50 level, signaling weakening buying pressure. A bearish crossover on the MACD, coupled with red histogram bars below the zero line, reinforces the potential for a downward move.

If BTC fails to break above the $106,406 resistance, it could slide further and test the psychologically important $100,000 level. Conversely, a decisive daily close above $106,406 could trigger a rally toward its all-time high of $111,980.

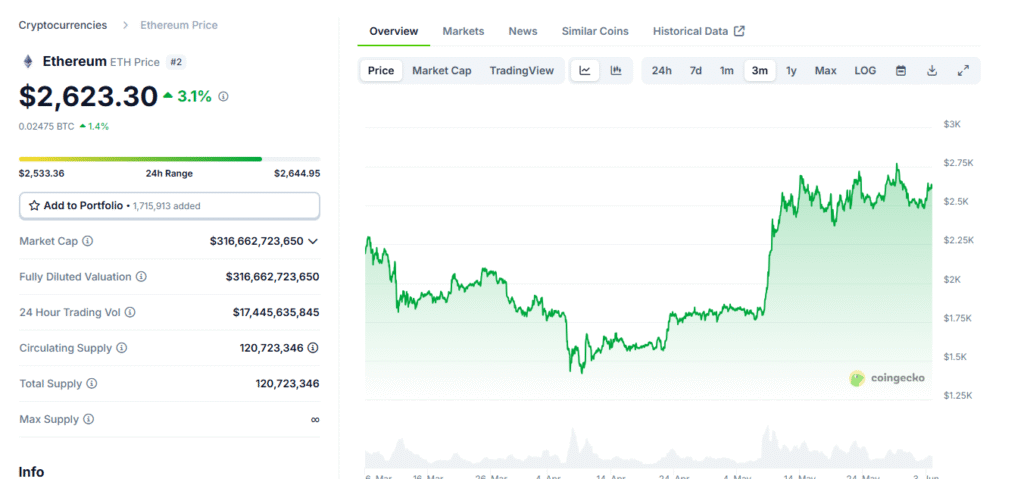

Ethereum (ETH) Hangs by a Thread at the 200-Day EMA

Ethereum recently faced rejection at $2,724 and saw a sharp 5.7% drop. Currently trading near $2,456, ETH is holding on to support at its 200-day Exponential Moving Average. Losing this level could spell deeper losses.

Should ETH close below $2,456, the next significant support lies at $2,302, where its 50-day EMA awaits. The RSI, currently at 54, is descending from overbought territory, and a bearish MACD crossover adds to the bearish bias.

However, a strong breakout above the $2,724 resistance could breathe new life into ETH’s momentum, setting up a retest of the $3,000 psychological barrier.

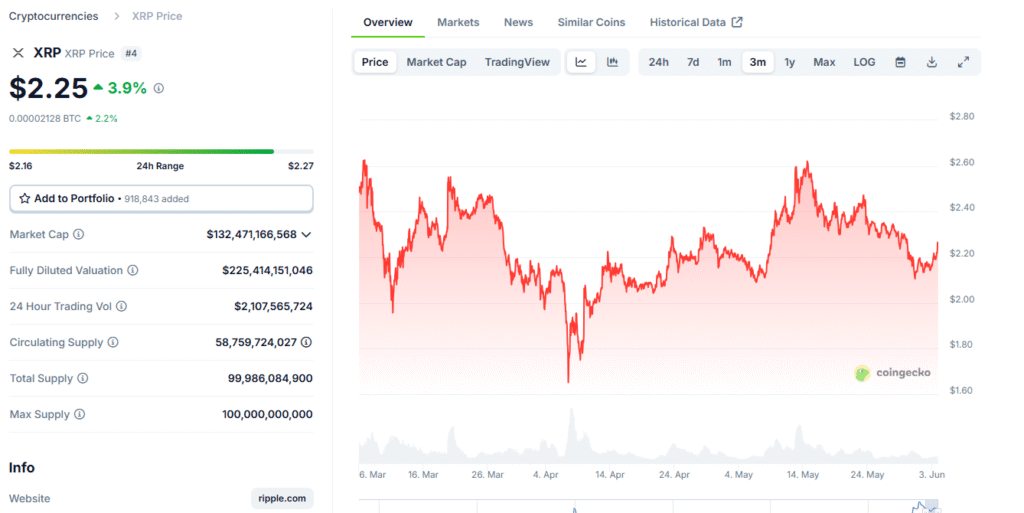

Ripple (XRP) Teeters Below Key Resistance

Ripple is under pressure, trading at around $2.15 after falling below the $2.25 support level. A 4.65% decline on Friday was followed by sideways movement over the weekend, indicating uncertainty.

With the RSI plunging to 39 and pointing lower, XRP is showing clear bearish momentum. The MACD has also flipped bearish, signaling the possibility of further downside. If XRP remains under $2.27, it could descend to the next support level at $1.96.

On the flip side, a break above $2.27 could pave the way for a rebound toward the 50-day EMA at $2.40.

Conclusion:

As Bitcoin price prediction flirts with a major psychological level, Ethereum defends its 200-day EMA, and XRP wrestles with resistance, traders and investors must brace for potential volatility. Momentum indicators across all three assets suggest caution, but key resistance and support levels could offer pivot points for the next major move. Stay tuned and keep a close eye on these critical price zones.

Read more updates and articles on our Crypto category page and also for Bitcoin price Forecast.

#Bitcoin #Ethereum #XRP #CryptoNews #PricePrediction #BTC #ETH #Ripple #CryptoAnalysis #Blockchain