Digital Form 16: How to Download, Use & Maximize Tax Benefits for Hassle-Free ITR Filing [2025 Guide]

Form 16 in 2025: Your Key to Seamless and Smarter Tax Filing

The Indian tax landscape is transforming, and Form 16 is at the center of this evolution. As salaried individuals gear up for income tax return (ITR) filing, having access to Digital Form 16 2025 makes the process smoother, more transparent, and less error-prone.

In this article, we’ll walk you through:

- How to download digital Form 16

- How to use it for e-filing

- The new tax regime benefits reflected in Form 16 for FY 2024-25

- Insights on deductions via NPS and TDS adjustments on other incomes

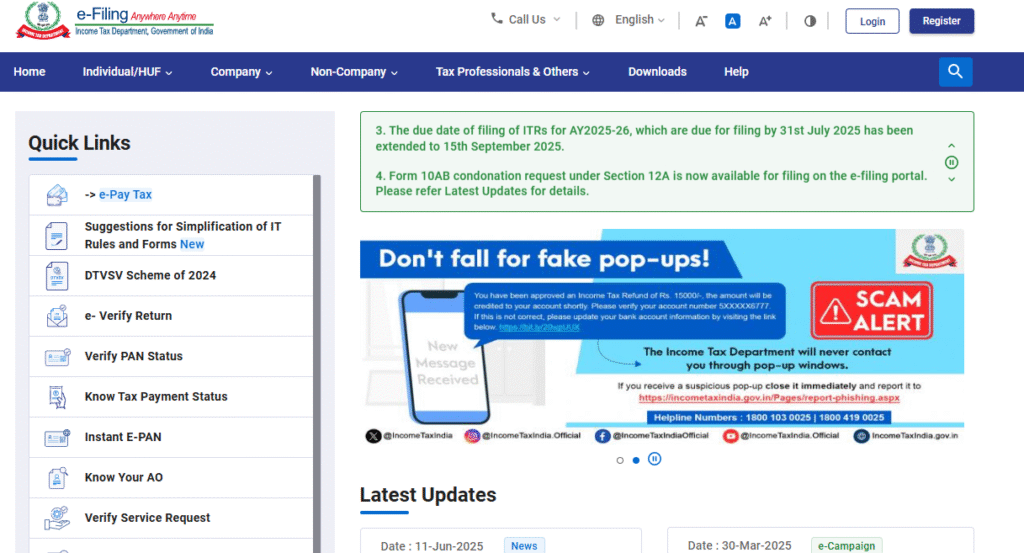

📲 How to Download Digital Form 16 from TRACES

Accessing Form 16 has gone digital—no more waiting for physical documents. Here’s how you can download it:

✅ Steps to Download Form 16:

- Visit TRACES Portal: Go to https://www.tdscpc.gov.in

- Login Credentials: Use your TAN (for employers) or PAN details via the employee login option if made available by your employer.

- Navigate to Downloads: Select the ‘Form 16’ option.

- Choose Financial Year: For current filing, choose FY 2024-25.

- Select Part A & B: These contain tax details and salary breakdowns.

- Download: Once processed, the file will be available in PDF format.

💡 Employers usually issue Form 16 by June 15 of each assessment year.

📄 Understanding the Structure of Form 16

Form 16 is split into two main parts:

🧩 Part A:

- Employer and employee details (TAN, PAN, name, address)

- TDS summary and deposit confirmation

📊 Part B:

- Complete breakdown of salary

- Deductions under various sections (80C, 80D, etc.)

- Taxable income

- Tax payable/refundable

This format ensures transparency and helps taxpayers verify their tax liability and exemptions.

🧮 What’s New in Form 16 for FY 2024-25 (AY 2025-26)?

🔸 1. TDS & TCS from Other Income Sources

Thanks to Budget 2024 amendments, if you’ve submitted Form 12BAA, your Form 16 will now reflect:

- TDS from other income (e.g., interest on FDs)

- TCS on expenses like foreign travel or luxury items

This helps in:

- Reducing total TDS from salary

- Accurately reflecting your total income for tax purposes

🎯 Key Tip: Submit Form 12BAA early to benefit from this adjustment.

🔸 2. Higher Standard Deduction Under New Tax Regime

Under the new tax regime, from FY 2024-25:

- Standard deduction increased to ₹75,000 (from ₹50,000 earlier)

- Applicable only if opted for the new regime via employer declaration

However, if you switch back to the old regime while filing, deduction drops to ₹50,000.

🧾 Choose your regime wisely when comparing total benefits.

🔸 3. Bigger NPS Deduction via Employer Contribution

Form 16 now reflects a larger deduction under Section 80CCD (2):

- Under new regime: Claim up to 14% of basic salary on employer’s NPS contribution

- Under old regime: Limited to 10%

This can significantly lower your taxable income and is especially beneficial for high-salaried individuals.

🧑💻 Using Form 16 for Effortless ITR Filing

Many online tax platforms (like ClearTax, TaxBuddy, or official Income Tax e-filing site) allow you to upload Form 16, simplifying the process:

Benefits:

- Auto-import of salary, TDS, exemptions

- Real-time validation with IT department records

- Fewer manual errors, ensuring smoother filing

E-verification:

- Aadhaar OTP

- Net banking

- Sending signed ITR-V form to CPC Bengaluru

🛡️ Pro Tips to Maximize Your Tax Savings with Form 16

✅ Submit Form 12BAA early

✅ Declare tax regime choice before April

✅ Track NPS contributions (14% vs 10%)

✅ Verify all figures before filing to avoid notices

✅ Use e-filing platforms with auto-validation

📌 Final Thoughts: Embrace Digital, File Smart

Digital Form 16 2025 – The evolution of Form 16 into a digital, intelligent tax document is a big win for salaried individuals in India. With the inclusion of new regime benefits, wider deduction visibility, and real-time integrations, filing your income tax returns has never been easier.

As financial rules become more data-driven, leveraging digital tools like Form 16 ensures you’re not just compliant, but also strategically optimizing your taxes.

Got questions? Drop them below—I’m all ears!

Also, read our other article EPF Interest Rate for FY25 Stays at 8.25%: How Much You’ll Earn & When It Gets Credited

Check out more article on Finance on our Finance Category section.

#Form16 #ITRFiling2025 #DigitalTaxIndia #NewTaxRegime #TRACES #NPSDeduction #Form12BAA #IncomeTaxIndia #TaxSeason #FileITREasy