EPFO 8.25% Interest Credited: Check Your PF Balance Instantly with These 5 Easy Methods [2025 Guide]

EPFO interest credited:- In a major relief for salaried individuals across India, the Employees’ Provident Fund Organisation (EPFO) has started crediting 8.25% interest for the financial year 2024-25 into member accounts. According to Labour Minister Mansukh Mandaviya, this crediting process is almost complete, with over 96.51% of EPF accounts already updated.

This update comes ahead of schedule, demonstrating a more efficient rollout compared to previous years. For the remaining 1.17 crore accounts, interest will likely be reflected within this week.

📈 What This Means for EPF Subscribers

With 32.39 crore accounts updated across 13.86 lakh establishments, salaried professionals can expect a noticeable boost in their EPF corpus. The credited 8.25% interest rate is among the highest among risk-free savings instruments in India today.

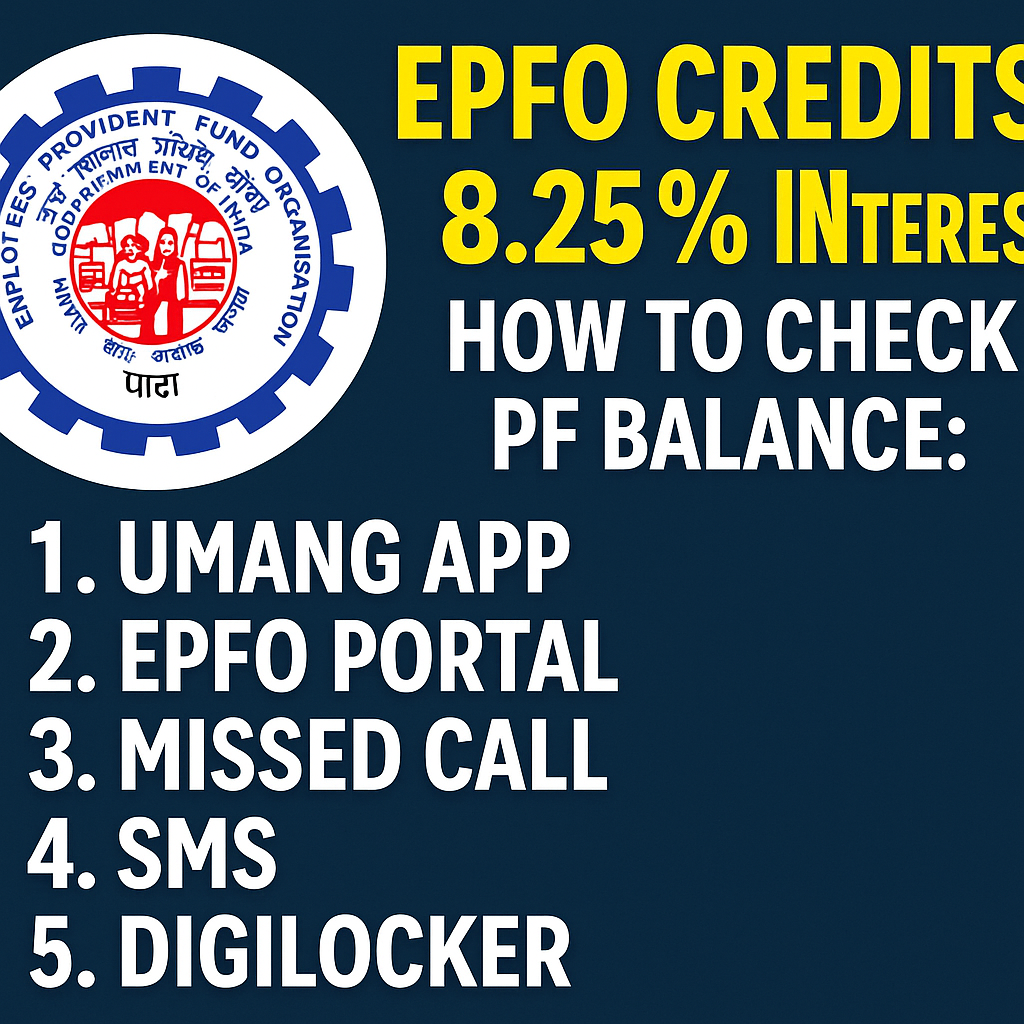

🔍 How to Check Your EPFO PF Balance in 2025 – 5 Easy Methods

Whether or not the EPFO website is functioning, here are five simple and reliable ways to check your updated PF balance:

1. ✅ UMANG App

- Download the UMANG App from Google Play or App Store.

- Sign in using your mobile number and OTP.

- Navigate: EPFO → View Passbook

- Enter your UAN and OTP to view the balance.

2. 💻 EPFO Official Website

- Go to https://www.epfindia.gov.in

- Click: Services → For Employees → Member Passbook

- Log in using your UAN and password to view your passbook.

3. 📞 Missed Call Service

- Dial 9966044425 from your registered mobile number.

- Your call disconnects automatically.

- You’ll receive an SMS with your current PF balance.

4. 📲 SMS Service

- Send the message:

EPFOHO UAN ENGto 7738299899 - Replace “ENG” with your preferred language code (e.g., HIN for Hindi, TAM for Tamil).

- Make sure your UAN is activated and linked to your mobile number.

5. 📂 DigiLocker

- Link your UAN with DigiLocker.

- Access PF statements and balance directly from the DigiLocker app or website.

How to Withdraw PF Online in 2025

1. EPFO UAN Portal

- Visit the UAN Member Portal

- Login → Online Services → Claim (Form-31, 19, 10C)

- Enter bank details, select reason, and submit using Aadhaar OTP.

2. UMANG App

- Navigate to EPFO → Raise Claim

- Fill the form and complete Aadhaar eKYC verification.

Eligibility Criteria for PF Withdrawal

| Purpose | Eligibility | Limit |

|---|---|---|

| Full Withdrawal | 2 months unemployed | 100% |

| Partial Withdrawal | Medical, home, education, marriage | Varies |

| Advance | After 1 month of job loss | Up to 75% |

Processing Time

Typically, 5 to 10 working days. Track claim status via UMANG or the EPFO portal.

Tips to Avoid Delays in PF Updates or Withdrawals

- Ensure UAN is active and KYC details are complete

- Link your Aadhaar, PAN, and bank account

- Always keep your mobile number updated with your UAN profile

Final Thoughts

With EPFO crediting interest earlier than usual, and digital tools making access more efficient, managing your Provident Fund has never been easier. Whether you’re a seasoned professional or just starting out, make sure your UAN is active and KYC-compliant to enjoy seamless updates, withdrawals, and balance tracking – EPFO interest credited.

🔗 Helpful Links:

🔔 Take charge of your EPF account today—check your UAN and keep your profile updated!

Got questions? Drop them below—I’m all ears!

Also, read our other article Smart Money Moves in Your 40s: 5 Intelligent Investment Strategies to Secure Your Financial Future

Check out more article on Finance on our Finance Category section.

#EPFO2025 #PFInterest #CheckPFBalance #EPFOUpdate #UMANGApp #EPFWithdrawal #EPFGuide2025 #PFInterestCredited #UANActivation #FinancialPlanningIndia