Ethereum’s 95% Surge: The Dawn of a $10,000 Era or a Fleeting Technical Spike?

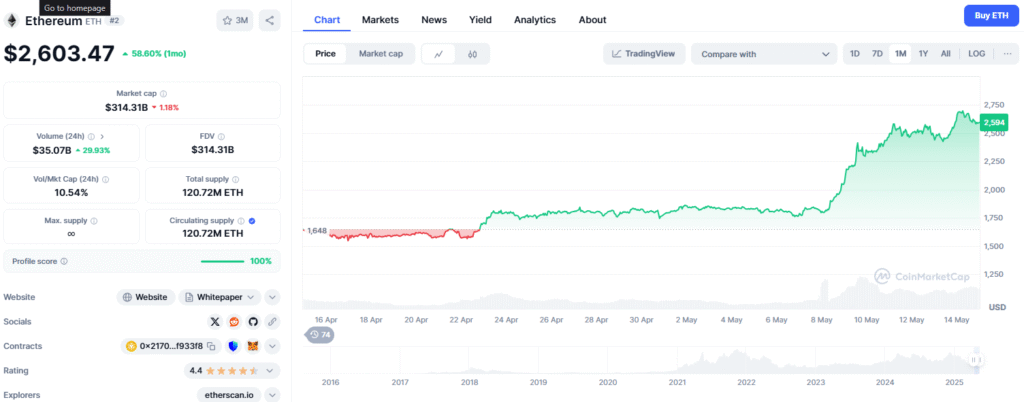

Ethereum is back in the spotlight, staging a jaw-dropping 95% rally in just one month. From a low of $1,336 on April 9, 2025, ETH has soared to $2,613 as of May 14, with a peak of $2,736 on May 13—its highest since February kinda like a Ethereum Bull Run. This meteoric rise has reignited debates: Is Ethereum gearing up for a $10,000 cycle, fueled by technical upgrades and real-world adoption, or is this a temporary spike driven by market mechanics? Let’s unpack the catalysts, technical signals, and long-term outlook shaping Ethereum’s trajectory.

A Resurgent Ethereum: What’s Driving the Rally?

After months of lagging behind Bitcoin and newer layer 1 competitors, Ethereum is reclaiming its mojo. The rally coincides with a stabilizing macro environment, as U.S. inflation eased to 2.3% annually in April, and a U.S.-China trade truce calmed market jitters. But the real firepower comes from Ethereum’s ecosystem, where recent upgrades and shifting use cases are rewriting its narrative.

The Pectra upgrade, activated in May 2025, has supercharged Ethereum’s scalability. By doubling blob capacity for layer 2 networks, Pectra slashes transaction fees and congestion, making Ethereum a more efficient backbone for decentralized applications. Account Abstraction, another Pectra feature, lets users pay gas fees in stablecoins like Dai or USDC, enhancing accessibility. Meanwhile, increasing the maximum validator stake from 32 ETH to 2,048 ETH streamlines operations for institutional players.

Trading volumes are rising steadily, with no signs of speculative froth. This measured pace suggests Ethereum’s rally is grounded in fundamentals, not hype. But can it sustain the momentum?

Upgrades and Roadmap: Scaling for the Future

Ethereum’s technical evolution is accelerating. The Pectra upgrade builds on 2022’s Merge, prioritizing scalability and usability. By expanding blob capacity, Pectra empowers layer 2 networks like Arbitrum, Optimism, and Base to process transactions off-chain at lower costs while leaning on Ethereum for security. Account Abstraction and higher validator stakes further streamline operations, attracting developers and institutions.

Looking ahead, the Fusaka upgrade, slated for late 2025, promises to push Ethereum’s scalability further. Its centerpiece, Peer Data Availability Sampling (PeerDAS), optimizes off-chain data management. Validators will verify small data samples instead of full sets, boosting bandwidth efficiency without sacrificing decentralization. This could unlock complex, high-throughput applications, cementing Ethereum’s edge.

However, Ethereum’s history of delays—Pectra itself was postponed from 2024—raises concerns. Competing blockchains with faster release cycles and simpler governance challenge Ethereum’s agility. The Ethereum Foundation’s decentralized approach, while robust, often slows progress. Will Fusaka stay on track, or will rivals steal Ethereum’s thunder?

Ethereum Bull Run Price Prediction: Technical Signals and Targets

Ethereum Bull Run has analysts buzzing, but technical signals offer mixed clues. Daan Crypto Trades notes a massive weekly candle, driven by short-position unwinds, but cautions that this could distort near-term trends. He advises monitoring demand over the next few weeks to gauge sustainability. Michaël van de Poppe highlights a 40% rise in the ETH/BTC ratio, signaling capital rotation toward Ethereum. He views 20-30% corrections as normal volatility, not weakness.

Titan of Crypto points to a filled CME gap between $2,540 and $2,620, with the next gap at $2,890-$3,230. These levels could act as demand zones if momentum persists. VirtualBacon argues ETH was mispriced during its underperformance, projecting $10,000 if Bitcoin hits $200,000 and the ETH/BTC ratio reaches 0.05. A stretch to $12,000 is possible with Bitcoin at $250,000 or a 0.06 ratio. VanEck’s earlier forecast of $6,000+ in 2025 adds institutional credence.

The Road Ahead: Ethereum Bull Run or Squeeze?

Ethereum’s 95% surge is no fluke—it’s rooted in technical upgrades, growing stablecoin and RWA adoption, and a maturing layer 2 ecosystem. Yet, the rally’s sustainability hinges on broader market sentiment and Ethereum’s ability to deliver on its roadmap. A $10,000 cycle is plausible if adoption accelerates and Bitcoin’s rally lifts all boats, but a technical squeeze remains a risk if demand falters.

Investors should tread carefully. Ethereum’s potential is immense, but volatility is a given. Never invest more than you can afford to lose, and stay tuned for Fusaka’s impact. Is Ethereum on the cusp of a new era, or is this a fleeting spike? The answer lies in its ability to balance innovation with execution.

Read more updates and articles on our Crypto category page and also for Bitcoin price Forecast

#Ethereum #ETH #CryptoNews #Blockchain #PectraUpgrade #Layer2 #Stablecoins #CryptoInvesting #PricePrediction