FAANG Stocks: Deep Dive into Market Dominance and Investment Potential

What Are FAANG Stocks?📈

FAANG is an acronym that stands for Meta (formerly Facebook), Apple, Amazon, Netflix, and Alphabet (Google). These companies represent the titans of the tech industry, reshaping digital landscapes, consumer behavior, and global economies. Over the years, FAANG stocks have evolved into a benchmark for tech-driven growth and innovation, often used by investors as a gauge of the broader market’s health.

Initially coined as FANG by Jim Cramer in 2013, the term expanded in 2017 with the inclusion of Apple, forming the now widely recognized FAANG designation. These companies, also known as the Big Five, MAMAA (Meta, Apple, Microsoft, Amazon, Alphabet), or simply Big Tech, have demonstrated remarkable resilience, even amid economic uncertainty.

Why Do FAANG Stocks Matter?💸

FAANG companies dominate their respective industries, boasting immense market capitalizations, innovative business models, and consistent revenue streams. Their influence extends beyond technology, impacting advertising, e-commerce, cloud computing, entertainment, and even artificial intelligence.

FAANG stocks have historically outperformed the broader market, providing impressive returns for investors. Here’s a look at their performance over the past decade compared to the S&P 500 index:

| Stock/Index | Total Return Since June 19, 2013 |

|---|---|

| Meta (META) | 2,110% |

| Amazon (AMZN) | 1,180% |

| Apple (AAPL) | 1,390% |

| Netflix (NFLX) | 1,900% |

| Alphabet (GOOGL) | 620% |

| Microsoft (MSFT) | 1,120% |

| S&P 500 | 240% |

While FAANG stocks have historically provided strong returns, they are not immune to volatility. Tech stocks experienced significant corrections in 2022, underperforming the broader market. However, their long-term growth potential continues to attract investors worldwide.

The Power of FAANG: Competitive Advantages

Each FAANG company holds unique competitive advantages that contribute to its market dominance:

1. Meta (META) – The Social Media Giant🌐

- Owns Facebook, Instagram, WhatsApp, and Messenger, serving billions of users globally.

- Generates revenue primarily through targeted advertising, benefiting from massive amounts of user data.

- Expanding into the metaverse through virtual reality (VR) and augmented reality (AR) with its Reality Labs division.

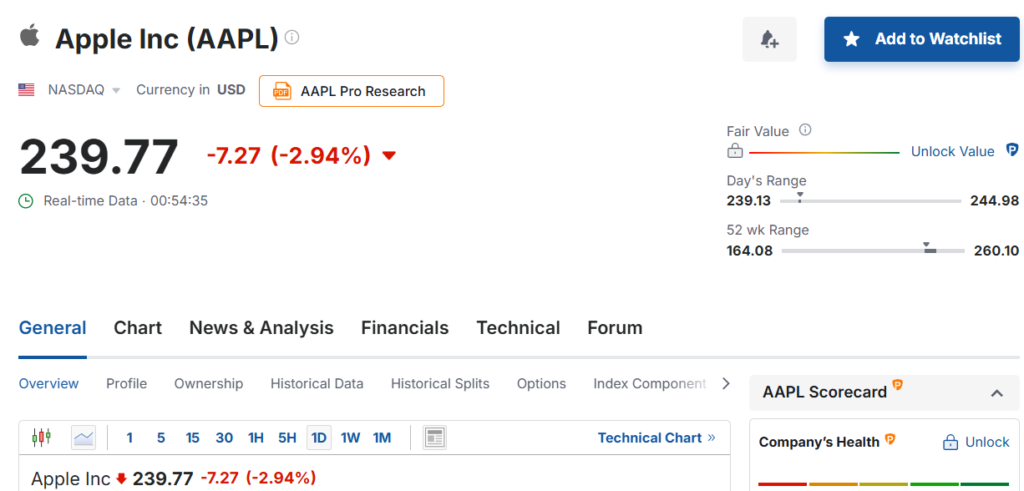

2. Apple (AAPL) – The Innovation Powerhouse🍎

- The world’s most valuable company, with a market cap exceeding $2.8 trillion.

- Strong ecosystem with iPhones, iPads, MacBooks, Apple Watch, and services like iCloud, Apple Music, and the App Store.

- High customer loyalty and a robust subscription-based revenue model.

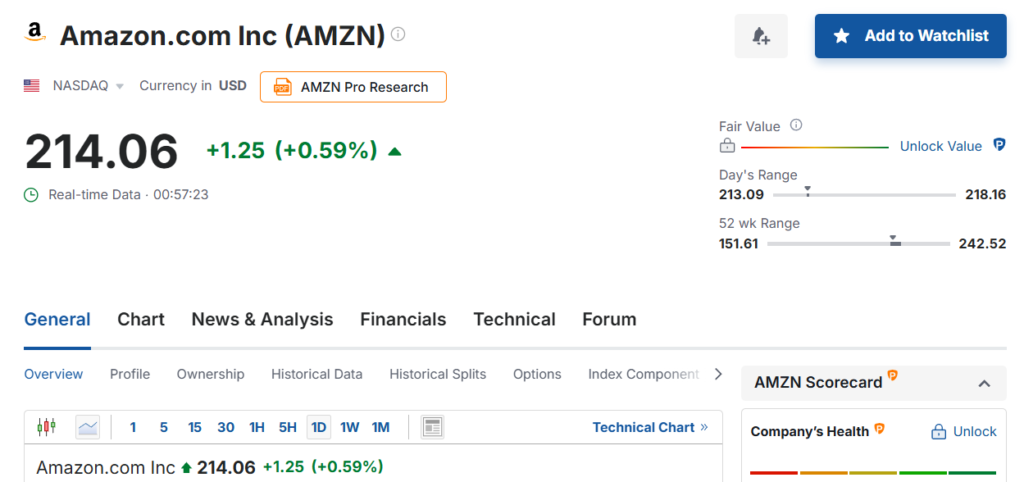

3. Amazon (AMZN) – The E-Commerce and Cloud Computing Leader📦

- Dominates online retail, with over 200 million Amazon Prime subscribers worldwide.

- Amazon Web Services (AWS) is a global leader in cloud computing, accounting for a significant portion of its profits.

- Expanding into artificial intelligence, robotics, and healthcare.

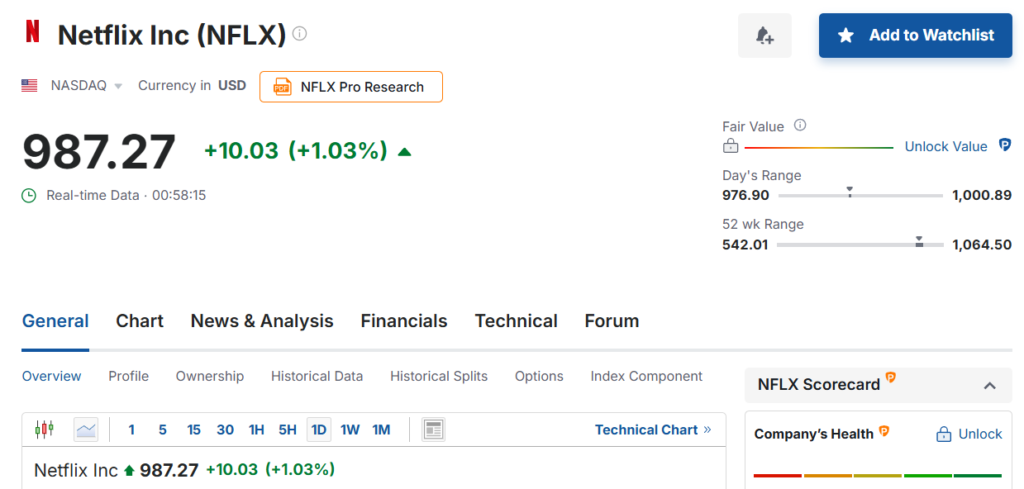

4. Netflix (NFLX) – The Streaming King🎬

- A pioneer in online streaming with over 230 million subscribers worldwide.

- Strong proprietary content with Netflix Originals, keeping users engaged and reducing churn.

- Monetizing through ad-supported plans and password-sharing crackdowns.

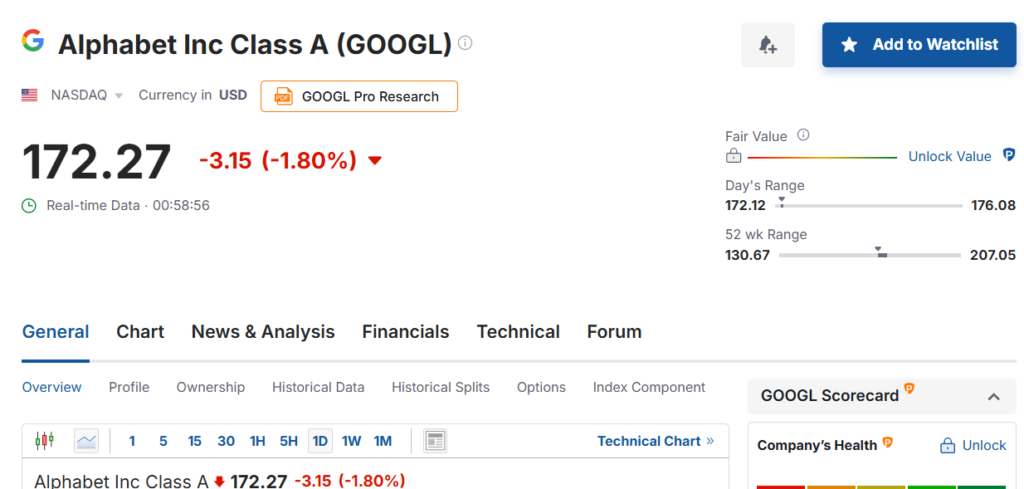

5. Alphabet (GOOGL) – The Search and AI Leader🌐

- Owns Google, the world’s largest search engine, processing over 8.5 billion searches per day.

- YouTube, Google Cloud, and Android contribute significantly to its diversified revenue streams.

- Leading in AI with innovations like Google Bard and DeepMind.

FAANG Stocks as an Investment: Are They Still Worth It?💸🤑💰

FAANG stocks make up about 20% of the S&P 500 and 40% of the Nasdaq-100 index. If you replace Netflix with Microsoft, those percentages rise to 26% and 50%, respectively. But are they still a good investment today?

1. Are FAANG Stocks Overvalued?

- Some investors argue that FAANG stocks are priced too high, making it difficult to generate long-term profits.

- However, proponents believe their valuations are justified due to their strong fundamentals and growth potential.

- The pandemic accelerated tech adoption, leading to record-high stock prices, but rising interest rates and inflation have introduced market volatility.

2. Are FAANG Stocks Profitable?

- All FAANG companies generate billions in annual profits and have strong competitive moats.

- Their intangible assets, such as user data, software ecosystems, and proprietary technology, give them a lasting edge over competitors.

- Meta, Google, and Amazon leverage targeted advertising, while Netflix and Apple thrive on content and ecosystem lock-ins.

3. Risks and Challenges

- Regulatory Scrutiny: Governments worldwide are cracking down on Big Tech’s market power, with antitrust investigations and data privacy laws tightening.

- Market Saturation: Growth in some segments, like smartphones and streaming, is slowing as markets become saturated.

- Rising Competition: Rivals like Microsoft, TikTok, Disney+, and cloud computing startups are eroding FAANG’s dominance in key areas.

How to Invest in FAANG Stocks

If you’re considering investing in FAANG stocks, here are a few ways to get started:

- Direct Stock Purchase – Buy individual FAANG stocks through brokerage platforms like Fidelity, Robinhood, or E-Trade.

- Exchange-Traded Funds (ETFs) – Invest in ETFs that include FAANG stocks, such as the Invesco QQQ Trust (QQQ) or S&P 500 ETFs.

- Mutual Funds – Choose actively managed funds that focus on tech and growth stocks.

- Fractional Shares – Platforms like M1 Finance allow investors to buy a portion of high-priced stocks.

Conclusion: Are FAANG Stocks Still a Good Bet?

FAANG stocks remain some of the most influential and well-established companies in the world. Despite periodic downturns and concerns over valuation, their history of innovation, strong financials, and dominant market positions make them attractive for long-term investors.

However, diversification is key—while FAANG stocks have delivered incredible returns, tech stocks are inherently volatile. Investors should weigh their risk tolerance, keep an eye on market trends, and consider a balanced portfolio strategy.

As technology continues to evolve, FAANG companies will play a crucial role in shaping the future—whether in AI, cloud computing, e-commerce, or digital media. Investing in FAANG stocks isn’t just about riding past success—it’s about betting on the future of technology itself. 🚀

Check out more article on Finance on our Finance Category section.

#FAANG #TechStocks #Investing #StockMarket #Apple #Amazon #Meta #Netflix #Google #Finance #Trading #NASDAQ #InvestSmart #ElonMusk