Israel-Iran Conflict: How War Could Shake the Crypto Market if the U.S. Gets Involved

Israel-Iran Conflict and Its Potential Ripple Effect on the Crypto Market

Tensions in the Middle East have escalated rapidly following direct military engagements between Israel and Iran. As global financial systems brace for impact, cryptocurrencies—often seen as both speculative assets and alternative safe havens—are under the spotlight; Israel Iran war crypto impact.

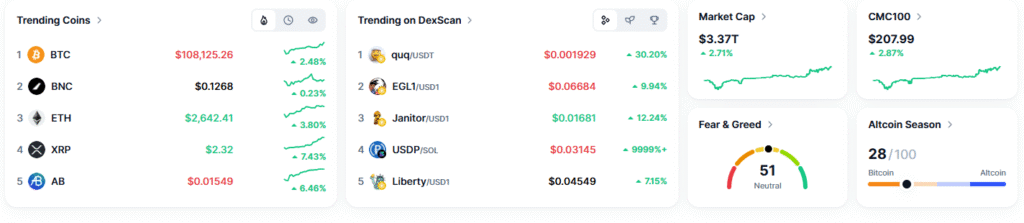

With Bitcoin, Ethereum, and other crypto assets already showing signs of volatility, investors are asking one critical question: What happens if the U.S. steps into the conflict?

Initial Market Reaction: Risk-Off Mode

Historically, geopolitical unrest has triggered risk-off sentiment across markets. Traders often flee volatile assets and park funds into safe havens like gold or the U.S. dollar. On the day of Israel’s strike on Iran in June 2025:

- Bitcoin dropped nearly 5%, briefly dipping below $103,000

- Ethereum fell over 7.5%, reacting faster and more sharply

- Gold surged by 1.74%

- Crude oil spiked 14%, as energy supply fears resurfaced

This pattern mimics similar events from 2024 and earlier, where global instability caused short-term dips in crypto prices due to liquidity flight.

📈 Short-Term vs Long-Term Impact: A Dual Narrative

Short-Term Outlook (Volatility Expected)

If the conflict intensifies and the U.S. gets involved, short-term crypto losses could worsen:

- Increased liquidations in Bitcoin and ETH futures

- Algorithmic trading bots may trigger sell-offs

- Traders might rotate capital into cash or commodities

However, such sell-offs often create “temporary dislocations”, presenting buy-the-dip opportunities for seasoned investors.

Long-Term Outlook (Safe Haven Potential)

Paradoxically, crypto could benefit in the long run if the war leads to:

- De-dollarization movements

- Institutional distrust in centralized financial systems

- Search for decentralized, non-sovereign stores of value

Crypto analysts argue that Bitcoin could gain appeal as “digital gold”, especially if fiat currencies are impacted by inflation or sanctions-related instability.

If the U.S. Gets Involved: Scenarios and Impact

Scenario 1: Limited Support, No Direct Combat

The U.S. providing logistical or strategic backing (e.g., intelligence, weapons) may:

- Increase geopolitical pressure but not panic markets

- Cause moderate crypto volatility due to investor uncertainty

- Lead to further correlation between BTC and traditional safe havens

Scenario 2: Full U.S. Military Involvement

A direct U.S.-Iran confrontation would escalate things significantly:

- Global markets could enter crisis mode

- Bitcoin might dip further in the short term, but stabilize as capital seeks safety from inflation or capital controls

- Altcoins and DeFi tokens may suffer larger drawdowns due to higher risk perception

Technical Analysis: What the Charts Say

- BTC/USD Support Zones: $102,000, $95,000

- Resistance Levels: $110,000, $115,500

- Volatility Index (Crypto VIX Equivalent): Spiking, suggesting large price swings

- Bitcoin Dominance: Could rise if altcoins bleed while BTC stabilizes

Strategic Takeaways for Crypto Investors

- Avoid emotional trading during geopolitical events.

- Watch for capitulation signals—volume spikes + extreme fear often precede rebounds.

- Monitor global macro indicators: oil prices, gold, USD index, and treasury yields.

- Stay updated on the U.S. stance and policy decisions.

- Keep some capital in stablecoins or cash for opportunistic buys.

Conclusion: War Is Unpredictable, But Strategy Isn’t

Israel Iran war crypto impact: The Israel-Iran conflict has already rocked crypto markets, and the potential for U.S. involvement only raises the stakes. In the short term, volatility will dominate, but if Bitcoin’s “safe haven” narrative strengthens, it may emerge more resilient than before.

While nobody roots for war, history shows that global disruption often accelerates shifts in financial power and technology adoption. Crypto—especially decentralized, censorship-resistant assets—could once again prove their value.

Stay tuned. Because if politics is volatility, crypto is now its mirror.

Read more updates and articles on our Crypto category page and also for Bitcoin price Forecast

#CryptoNews #IsraelIranConflict #BitcoinCrash #GeopoliticsAndCrypto #Ethereum #MiddleEastTension #SafeHavenAssets #CryptoVolatility #USInvolvement #CryptoStrategy