Jupiter vs Raydium: Which Solana DEX Wins Your 2025 Investment?

Introduction

The competition between Jupiter and Raydium, two leading decentralized exchanges (DEXs) on Solana, is heating up in 2025. With Jupiter recently surpassing Raydium in total value locked (TVL) and both tokens showing distinct price movements, investors are eager to know which offers the better investment opportunity.

Current Prices and Market Position

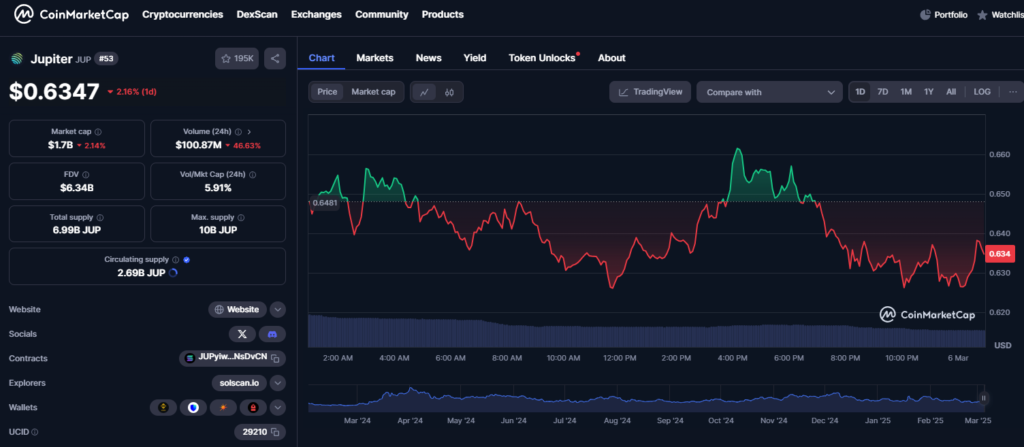

As of today, Jupiter’s JUP token trades at $0.64, while Raydium’s RAY is at $2.16. Jupiter made headlines in January 2025 by overtaking Raydium in TVL, reaching $2.87 billion compared to Raydium’s $2.70 billion.

This shift came after Jupiter’s strategic moves, including a 24% price surge, while Raydium has seen a -27.26% weekly drop, possibly due to competition from new AMMs like Pump.fun.

Price Predictions for 2025

Price forecasts suggest both tokens have growth potential, but with different timelines:

- Jupiter (JUP): Analysts predict JUP could reach $1.88 by the end of 2025, a 194% increase from $0.64, driven by Solana’s memecoin boom and Jupiter’s buyback strategy.

- Raydium (RAY): RAY is expected to climb to $5.79, a 168% rise from $2.16, if Solana’s DeFi sector matures, though short-term dips pose risks.

Technological Comparison

Jupiter and Raydium differ in their tech approaches:

- Jupiter: A liquidity aggregator since 2021, it finds the best swap rates across Solana DEXs, with recent integrations like a portfolio tracker and token burns enhancing its appeal.

- Raydium: Launched in 2021, it combines AMM with Serum’s order book for fast trades and deep liquidity, supporting yield farming and partnerships like Bonsai with SushiSwap.

Investment Analysis

For short-term gains, Jupiter seems promising with its lower entry price and recent momentum. However, Raydium’s higher price and established presence make it a solid long-term hold. Both carry risks, like market volatility, so research is key before investing.

Detailed Analysis

The rivalry between Jupiter and Raydium, two prominent decentralized exchanges (DEXs) on the Solana blockchain, has intensified in 2025, capturing the attention of crypto investors. As of March 05, 2025, at 11:30 AM PST, Jupiter’s JUP token is priced at $0.64, while Raydium’s RAY stands at $2.16. This analysis delves into their recent activities, price predictions, technological underpinnings, and investment potential, providing a comprehensive comparison to guide your decision-making.

Recent Developments and Market Dynamics

The landscape shifted in late January 2025 when Jupiter surpassed Raydium to become Solana’s second-largest protocol by TVL, reaching $2.87 billion compared to Raydium’s $2.70 billion. This milestone followed Jupiter’s strategic announcements at the Catstanbul 2025 event, including acquiring a majority stake in Moonshot and SonarWatch to develop a Solana portfolio tracker, allocating 50% of protocol fees to JUP buybacks, and initiating a 3-billion-token burn. These moves catalyzed a 24% price surge for JUP, reflecting strong market confidence.

Price Predictions: A Tale of Two Tokens

Price forecasts are critical for investment decisions, and both JUP and RAY offer distinct outlooks for 2025:

- Jupiter (JUP): Currently at $0.64, JUP’s bullish signals include positive on-balance volume (OBV) and Chaikin money flow (CMF) indicators, as noted by BeInCrypto. Coinpedia predicts JUP could reach $1.88 by year-end, a 194% upside, driven by Solana’s memecoin frenzy and Jupiter’s growing trading volume. Long-term, by 2030, JUP might hit $5.50, a 760% increase, if adoption accelerates.

- Raydium (RAY): At $2.16, RAY’s outlook is mixed. AMBCrypto forecasts a high of $5.79 in 2025, a 168% rise, while CCN warns of a potential drop to $1.25 if bearish trends persist. Coinpedia’s bullish scenario sees RAY climbing to $5.79 by December, supported by Solana’s DeFi growth. By 2030, RAY could reach $27, an 1150% jump, if it leverages its liquidity strengths.

To visualize these predictions, consider the following table:

| Token | Current Price (March 05, 2025) | Predicted Price (End of 2025) | Potential Upside | Long-Term Prediction (2030) |

|---|---|---|---|---|

| JUP | $0.64 | $1.88 | 194% | $5.50 |

| RAY | $2.16 | $5.79 | 168% | $27.00 |

This table underscores JUP’s higher short-term percentage gain, while RAY offers a larger absolute increase, appealing to different investor profiles.

Technological Underpinnings: Jupiter vs Raydium

Technology is the backbone of any DEX, and Jupiter vs Raydium reveals distinct approaches:

- Jupiter: Launched in 2021, Jupiter is a liquidity aggregator, sourcing the best swap rates across Solana DEXs, including Raydium. Its user-friendly interface and advanced routing algorithms ensure optimal pricing, while recent integrations like the portfolio tracker enhance user experience. The token burn and fee allocation to buybacks create a deflationary mechanism, potentially boosting JUP’s value over time. Jupiter’s agility makes it a favorite for traders seeking efficiency.

- Raydium: Also debuting in 2021, Raydium combines an automated market maker (AMM) with Serum’s order book, offering fast execution and deep liquidity. This hybrid model supports yield farming, staking, and partnerships like Bonsai with SushiSwap (Raydium Partnerships), expanding its ecosystem. Raydium’s robust infrastructure appeals to both retail and institutional traders, though it may lack Jupiter’s aggregator flexibility.

This comparison highlights Jupiter’s versatility versus Raydium’s liquidity depth, a trade-off investors must weigh.

Investment Analysis: Which Wins in 2025?

Deciding between Jupiter vs Raydium requires balancing risk and reward:

- Jupiter Pros: At $0.64, JUP offers a low entry point with a 194% potential upside to $1.88 by year-end, per Coinpedia. Its recent TVL dominance ($2.87B) and aggressive strategies (buybacks, burns) signal growth. However, volatility is a risk, especially if Solana’s memecoin hype fades.

- Jupiter Cons: Dependency on Solana’s market performance and short-term fluctuations could derail gains, particularly if competition intensifies.

- Raydium Pros: RAY’s $2.16 price and predicted 168% rise to $5.79 offer stability, with a history of performance in Solana’s DeFi sector. Its $2.70B TVL and hybrid model ensure longevity, appealing to long-term holders.

- Raydium Cons: Recent price dips (-18.55% daily) and competition from new AMMs like Pump.fun’s could erode market share, posing short-term risks.

Given these factors, Jupiter seems poised for short-term gains due to its momentum and lower price, making it ideal for risk-tolerant investors. Raydium, however, suits those seeking steady growth over the long haul, given its established presence and higher price base. Both carry inherent crypto risks, so thorough research and risk assessment are essential before investing.

Conclusion and Final Thoughts

The Jupiter vs Raydium duel in 2025 is a Solana saga worth watching. Jupiter’s $0.64 price and 194% upside to $1.88 offer quick wins, while Raydium’s $2.16 to $5.79 path (168% gain) promises steady growth. Technologically, Jupiter’s aggregator edge suits traders, while Raydium’s liquidity depth appeals to stakers. For 2025, Jupiter edges out for short-term potential, but Raydium could be the long-term champion. Always research deeply and consider your risk tolerance before diving in.

Binance: When you sign up using my referral link and make your first deposit, you’ll receive a $100 USDT fee rebate voucher! It makes it easy to trade, invest, and earn passive income with crypto, so don’t miss this additional bonus.

CoinDCX: For traders and investors in India, CoinDCX is the best platform whihc has quick deposits and withdrawls, lowest fee and CoinDCX is the platform I trust to learn, invest & trade in Crypto. Buy your first crypto and win up to ₹5,00,000 in crypto rewards!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Read more updates and articles on our Crypto category page

#JupiterVsRaydium #SolanaDEX #JUPPrice #RAYPrice #CryptoInvestment #DeFi2025 #crypto #bitcoin #solana