Pi Coin $12B Controversy: Binance Listing Rumors, Missing Tokens & Ponzi Claims

What’s the story behind Pi Coin

Pi Coin has taken the crypto world by storm, boasting a $12 billion market cap despite widespread skepticism, delays in migration, and growing security concerns. While some see it as an innovative project democratizing mining, others fear it’s the next crypto catastrophe. Adding to the chaos are Binance listing rumors and a CEO outright calling it a Ponzi scheme. So, is Pi Network a revolutionary digital asset or an elaborate trap? Let’s dive into the controversy surrounding Pi Coin.

Pi Coin’s Meteoric Rise and Market Volatility

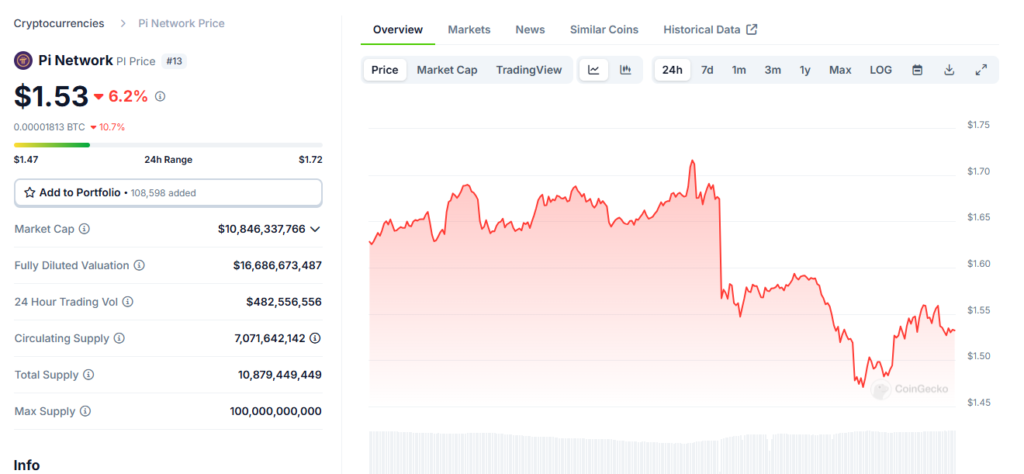

Pi Network, a smartphone-based mining project, recently made its long-awaited debut on exchanges. On February 20, its native token Pi Coin was listed, sending its price soaring from $1.45 to $2.10 in under an hour. However, the hype was short-lived, and the token’s price plummeted to $1.01, slashing its market cap to $7.02 billion.

Despite this rollercoaster ride, Pi Coin has remained resilient. As of March 12, its price stabilized at $1.71, marking a 45% drop from its all-time high of $2.99. However, its market cap surged past $12 billion, making it the 11th largest cryptocurrency. Speculation of a Binance listing on March 14 has further fueled excitement, with Pi Coin posting a 20% gain over the past 24 hours, defying the broader bearish trend.

Is Pi Network a Game-Changer or the Next Crypto Collapse?

Founded in 2019 by Stanford graduates Dr. Nicolas Kokkalis and Dr. Chengdiao Fan, Pi Network set out to make crypto mining accessible through a mobile app. Unlike Bitcoin’s energy-intensive proof-of-work model, Pi Network uses the Stellar Consensus Protocol, allowing users to mine coins with minimal effort by simply tapping a button daily.

This user-friendly approach helped Pi Network amass over 60 million users through a referral-based model. However, critics argue that this system bears similarities to a multi-level marketing (MLM) scheme, with early adopters benefiting from the recruitment of new users.

Despite these concerns, Pi’s transition to an open mainnet triggered exchange listings, with OKX, Bitget, Gate.io, and MEXC embracing the token. However, major exchanges like Binance and Coinbase have yet to support Pi, leaving its liquidity in question. The rumored Binance listing, if true, could be a turning point, bringing Pi Coin into the mainstream and increasing its credibility.

Bybit CEO Calls Pi Network a Scam

Not everyone is convinced of Pi Coin’s legitimacy. Bybit CEO Ben Zhou has outright labeled Pi Network a scam, citing privacy concerns, questionable operations, and the potential for pension fund losses. He compared Pi to memecoins but argued that it is even more dangerous because it misleads users with promises of effortless wealth.

Zhou also questioned the credibility of Pi Network’s team, claiming that no verifiable public appearances or statements have been made to establish their legitimacy. He further suggested that Pi Network operates similarly to a Ponzi scheme, where new participants fund the rewards of earlier adopters.

Pi Network responded by denying all allegations, asserting that the project has worked methodically over six years to build a legitimate ecosystem. However, Zhou remains firm in his stance, warning users that Pi lacks transparency and could ultimately leave many investors empty-handed.

Vanishing Tokens and Migration Nightmares

Beyond the controversy, Pi Network is facing technical and security issues. Users have reported vanishing tokens after unlocking their balances, with scammers exploiting old phishing attacks to drain accounts. Many victims unknowingly interacted with fake Pi-related sites in the past, only to lose their assets when they became transferable.

Additionally, Pi users are struggling with delayed migrations. Some have been waiting months—or even years—to move their tokens to the mainnet. Critics argue that while major blockchains like Solana and Polygon handle thousands of transactions per second, Pi Network’s infrastructure remains opaque and sluggish.

These delays have led to growing frustration within the Pi community, with users demanding fixes and some even calling for regulatory intervention. Blockchain developers have accused Pi Network of being deceptive, arguing that it profits from ad revenue while failing to deliver a functional ecosystem.

Conclusion: Will Pi Coin Survive the Scrutiny?

Pi Coin’s journey has been anything but smooth. While its market cap and trading volume are impressive, the project is plagued by technical issues, security concerns, and allegations of fraud. The rumored Binance listing could serve as a turning point, but unless Pi Network addresses migration failures, improves transparency, and ensures the safety of its users’ assets, its credibility may continue to erode.

As the March 14 migration deadline looms, the crypto world watches closely. Will Pi Network prove its doubters wrong and cement itself as a legitimate blockchain project, or is it destined to become the next major crypto fallout? Time will tell.

But researchers and price prediction suggest that Pi Coin can definitely shoot upto $10 in next year.

CoinDCX: For traders and investors in India, CoinDCX is the best platform which has quick deposits and withdrawls, lowest fee and CoinDCX is the platform I trust to learn, invest & trade in Crypto. Buy your first crypto and win up to ₹5,00,000 in crypto rewards!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Read more updates and articles on our Crypto category page