Is Russia Using Crypto for Oil Trade? The Truth Behind the Claims

Introduction to Russia and Crypto

Recent reports suggest that Russia may be leveraging cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and stablecoins (USDT) to facilitate oil trade with China and India.

According to unnamed sources, crypto assets are being used to bypass Western sanctions, enabling smoother transactions between the Russian ruble, Chinese yuan, and Indian rupee.

While the details remain unverified due to the anonymity of these sources, the potential use of crypto in international trade raises crucial questions about the evolving role of digital assets in the global financial system.

The Alleged Use of Crypto in Oil Trade

According to five sources cited by Reuters, Russia, China, and India have reportedly turned to crypto assets as an alternative payment method for oil transactions.

Some Russian oil companies are allegedly utilizing Bitcoin (BTC), Ethereum (ETH), and stablecoins (USDT) to convert Chinese yuan and Indian rupees into Russian rubles, circumventing financial restrictions imposed by the West.

Key Allegations:

- Crypto as a Sanctions Bypass: Cryptocurrencies provide a decentralized payment alternative, allowing transactions to occur outside of the traditional financial system.

- USDT in the Equation: One source claimed that stablecoins like Tether (USDT) are part of the strategy, providing liquidity and a stable exchange medium.

- Secretive Nature: The sources remain anonymous, citing NDAs and the sensitive nature of the topic.

While these claims offer an intriguing perspective on Russia’s financial strategy, the lack of transparency raises concerns about the credibility and motivation behind these reports.

Russia’s Changing Stance on Crypto

Russia has had a complicated relationship with cryptocurrencies. While the country has previously restricted crypto transactions, recent developments indicate a shift in policy:

- Testing Digital Gold: Russia has explored using digital gold-backed assets for trade.

- Rejecting Crypto in Wealth Funds: The National Wealth Fund has excluded crypto, signaling mixed sentiments within the government.

- Experimental Crypto Framework: The Bank of Russia recently proposed an experimental framework allowing qualified investors to trade crypto, hinting at a more flexible stance.

These policy shifts suggest that Russia is exploring multiple avenues to manage international payments in response to global financial pressures.

The Role of Crypto in Global Trade

The alleged use of crypto in oil trade highlights the broader implications of digital assets in global commerce:

- Decentralization & Financial Freedom – Crypto offers an alternative payment system that is beyond the control of central banks and governments.

- Stablecoins as a Bridge – Stablecoins like USDT provide a less volatile, liquid medium for cross-border transactions.

- Regulatory Challenges – Governments and regulators worldwide may tighten oversight on crypto transactions, especially if digital assets are used to bypass sanctions.

The Bigger Picture: Crypto’s Growing Influence

If Russia is indeed using crypto for oil trade, it could signal a major shift in international finance, with more countries exploring digital assets for trade settlements. While Bitcoin and Ethereum are decentralized, stablecoins like USDT remain under scrutiny due to their ties with centralized entities.

Will crypto redefine global trade, or will governments impose stricter controls? This remains an open question as nations, financial institutions, and regulators navigate the evolving digital economy.

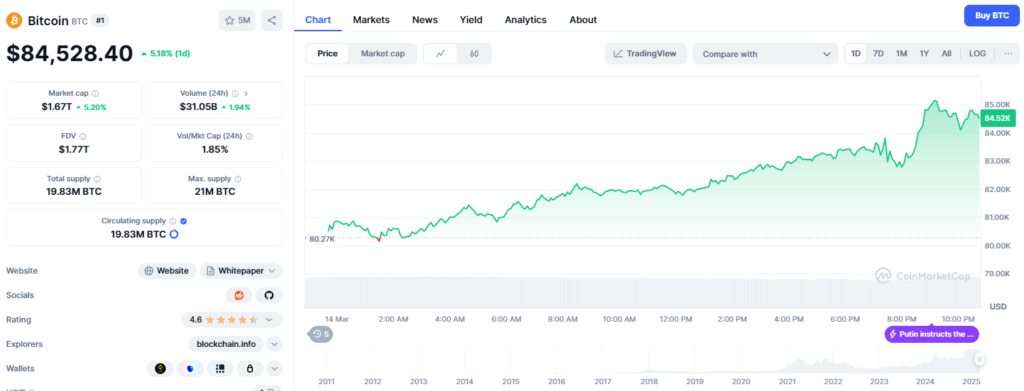

Russian Central Bank says President Putin instructed Bitcoin policy shift. The nation-state FOMO is ramping up.

Final Thoughts

While the allegations of Russia using crypto in oil trade remain unverified, the report highlights the growing role of digital assets in global finance. Whether as a tool for sanctions evasion, a bridge for international trade, or a decentralized financial alternative, cryptocurrencies continue to shape the future of money.

📢 What do you think? Will crypto reshape global trade, or is this just speculation? Let us know in the comments! 🚀

CoinDCX: For traders and investors in India, CoinDCX is the best platform which has quick deposits and withdrawls, lowest fee and CoinDCX is the platform I trust to learn, invest & trade in Crypto. Buy your first crypto and win up to ₹5,00,000 in crypto rewards!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Read more updates and articles on our Crypto category page

#Crypto #Bitcoin #Ethereum #USDT #Russia #OilTrade #Blockchain #Stablecoins #DeFi #Finance