Solana Price Crash Alert: Will SOL Drop to $100 in 2025?

What’s going on with Solana $SOL

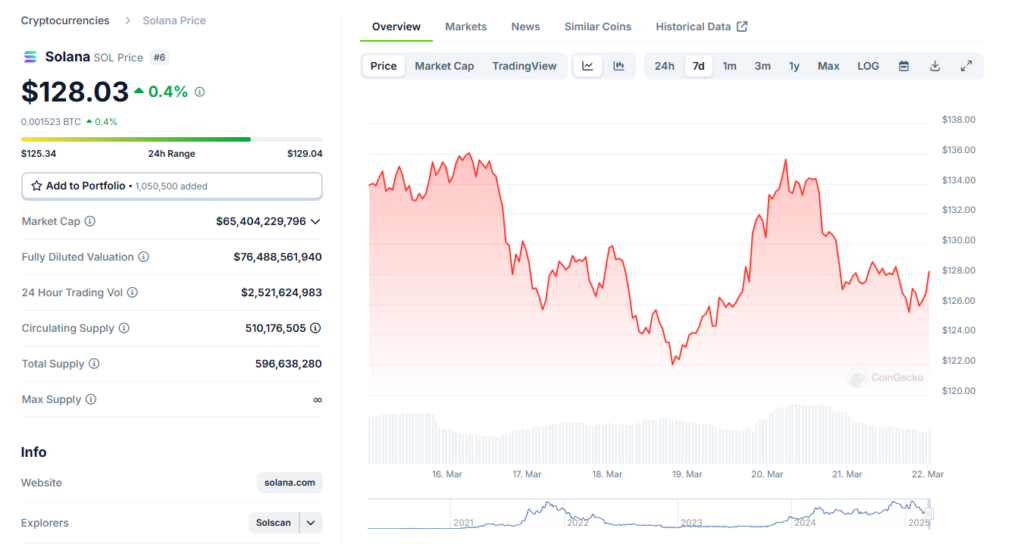

If you’ve been keeping an eye on the crypto market lately, you might’ve noticed Solana (SOL) taking a serious hit. Once a shining star in the blockchain world, its price has tumbled over 57% from its yearly peak of $295, landing at $126.5 as of March 21, 2025. That’s a jaw-dropping drop, slashing its market cap from over $127 billion to $64.45 billion—a loss of roughly $63 billion in just a few months. So, what’s going on with Solana, and could it really sink as low as $100? Let’s break it down in a way that’s easy to digest.

The Meme Coin Meltdown

Solana’s troubles started brewing within its own ecosystem, and the collapse of its meme coin craze is a big piece of the puzzle. Back in January, Solana-based meme coins were riding high with a combined market cap of over $25 billion. Fast forward to now, and that number’s crashed to just $7.2 billion. The only one still holding onto a market cap above $1 billion? The “Official Trump” token (TRUMP), though it’s down 1.42% recently. The rest of the pack—like the quirky, speculative coins that once fueled Solana’s hype—have faded into the background, leaving the network in a lurch.

DEX Volume Dries Up

This meme coin bust isn’t just a side story—it’s hit Solana’s decentralized exchanges (DEXs) hard. Platforms like Raydium, Orca, and Meteora, which thrived on the trading frenzy, have seen their volume plummet by over 34% in the last week alone, down to $8.3 billion, according to DeFi Llama. Compare that to Binance Smart Chain (BSC), which handled $14.2 billion, or Ethereum, which clocked $9.65 billion in the same period. Over the past 30 days, Solana’s DEXs managed $61 billion, lagging behind Ethereum’s $78 billion.

It’s a stark reversal for Solana, which had been the king of DEX activity since last October. Now, it’s like the party’s over, and everyone’s gone home.

Chain Fees Take a Nosedive

The slowdown doesn’t stop there. Solana’s network revenue has tanked, too. This month, it pulled in just $21.2 million—way down from $90 million last month and a far cry from January’s whopping $258 million peak. Those low chain fees might sound great for users, but they’re a red flag that activity on the network is drying up. Less trading, fewer transactions, and a whole lot less buzz mean Solana’s not raking in the cash it once did.

What the Charts Are Saying

If you’re into technical analysis (or just curious about where SOL’s price might be headed), the daily chart isn’t painting a pretty picture. Since February, Solana’s been on a steady slide from $295 to $126.5. On March 3, it flashed a “death cross”—a scary-sounding signal where the 50-day moving average crossed below the 200-day moving average, hinting at more trouble ahead.

Right now, SOL’s forming what traders call a “bearish flag pattern.” Picture a steep drop (the flagpole) followed by a tight, rectangular consolidation (the flag). This setup often means a big breakdown is coming. The price is hovering at a key support level it hasn’t breached since April last year. If it cracks, the next stop could be $100—a 25% drop from where it sits today.

Why This Matters to You

So, why should you care? If you’re holding SOL or thinking about jumping in, this is a wake-up call. The meme coin hype that once propped Solana up has fizzled, and the network’s losing steam compared to rivals like Ethereum and BSC. Sure, lower fees could lure some users back, but with trading volume and revenue shrinking, it’s hard to ignore the bearish vibes.

Could It Hit $100?

The $100 mark isn’t just a random guess—it’s where the charts and the ecosystem’s struggles point. If Solana can’t hold that critical support level, the bearish flag could send it tumbling. That said, crypto’s unpredictable. A sudden surge in activity or a market-wide rally could flip the script. But for now, the signs aren’t promising.

Final Thoughts—And a Glimmer of Hope

Solana’s had a rough ride in 2025, and it’s feeling more like a rollercoaster drop than a moonshot. From a crumbling meme coin scene to shrinking DEX volume and chain fees, the network’s facing some serious headwinds. If the bearish trends keep up, $100 might not just be a possibility—it could be the next reality.

But here’s the flip side: don’t count Solana out yet. Its tech—blazing-fast transactions and low costs—still makes it a heavyweight in the blockchain game. Use cases like DeFi, NFTs, and scalable dApps haven’t gone anywhere. If you’re in it for the long haul, holding SOL could pay off. With a bit of patience and a market recovery, $200 isn’t out of reach down the road. This is the general Solana Price Analysis, Crypto’s a wild ride, so will Solana bounce back or dip deeper? Time will tell—what’s your take?

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Read more updates and articles on our Crypto category page

#SolanaPrice #CryptoCrash #SOLPrice2025 #DEXVolume #CryptoAnalysis #SolanaTech #BearMarket