Stock Market Corrections: What They Mean & How to Stay Prepared

What is a Stock Market Correction?

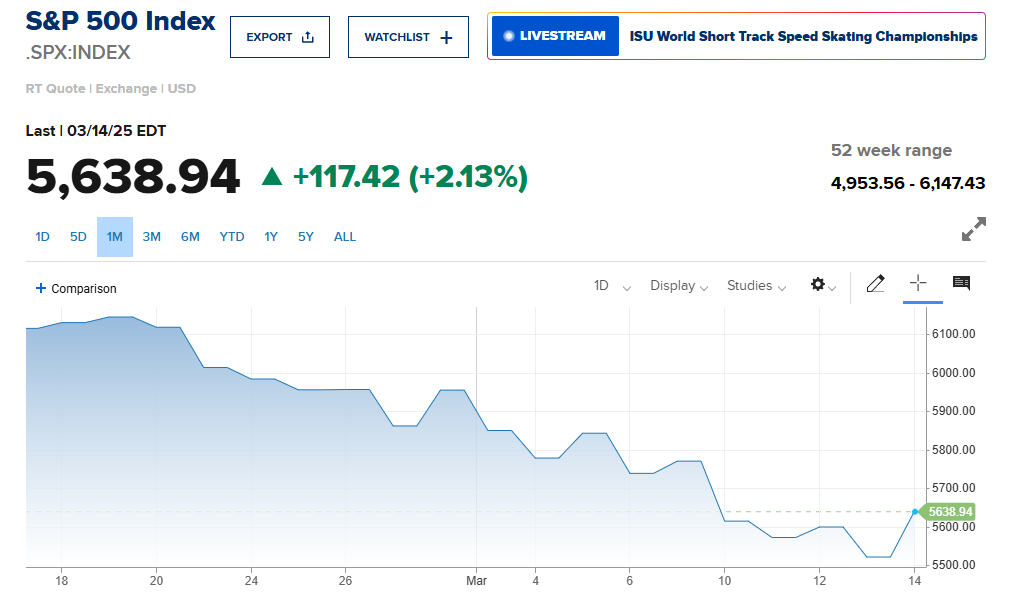

- A stock market correction occurs when stock prices drop by 10% or more from a recent high.

- These declines are normal and happen every few years.

- Market corrections help prevent bubbles by reducing overinflated prices.

- While corrections can be scary, they do not always lead to a bear market (a 20% or greater decline).

Why is the US Stock Market Dropping?

Several factors are behind the latest market correction:

- Economic Concerns: Investors worry about inflation, interest rates, and global trade.

- Tariff Uncertainty: Ongoing trade disputes and unpredictable tariff policies create instability.

- Interest Rate Decisions: The Federal Reserve’s actions on interest rates impact market confidence.

- Overvalued Stocks: Some stocks, especially in the AI sector, have surged too fast, leading to a pullback.

How Often Do Market Corrections Happen?

- On average, stock market corrections occur every two years.

- Even during strong market periods, like the 2009-2020 bull run, there were five corrections.

- The last correction happened in 2023, caused by rising Treasury yields and interest rate concerns.

- Some corrections turn into bear markets—like in 2022 when stocks fell over 25% due to rising interest rates.

What Happens After a Market Correction?

- Historically, markets recover within 113 days on average.

- Typical corrections result in an average 14% drop before rebounding.

- If a correction turns into a bear market, recovery takes longer—about 19 months on average.

- Major bear markets, like the Great Depression or 2008 financial crisis, resulted in severe losses but eventually rebounded.

How Bad Can a Bear Market Get?

- The worst bear market (1929-1932) saw stocks drop 86%.

- Some bear markets last years—like Japan’s market slump from 1989 to 2024.

- However, in the U.S., long-term investors usually recover losses by staying invested.

What’s Next for the Stock Market?

- No one can predict with certainty, but investors are closely watching:

- Government policies that could impact trade and inflation.

- The Federal Reserve’s interest rate decisions.

- Economic indicators like job reports and consumer confidence.

- Some analysts believe the market will stabilize, while others worry about continued volatility.

During a stock market correction, some sectors tend to perform better, while others may be more vulnerable. Here’s a breakdown of sectors to focus on and sectors to avoid during volatile times:

Sectors to Focus On (Defensive & Resilient)

These sectors typically hold up well during market downturns because they provide essential goods and services:

- Healthcare 🏥 – People still need medical care, pharmaceuticals, and health insurance, making this a strong sector.

- Companies: Pfizer (PFE), Johnson & Johnson (JNJ), UnitedHealth Group (UNH).

- Consumer Staples 🛒 – Includes food, beverages, household goods, and personal care products—necessities people buy regardless of market conditions.

- Companies: Procter & Gamble (PG), Coca-Cola (KO), Walmart (WMT).

- Utilities ⚡ – Electricity, water, and natural gas remain essential, so utility stocks tend to be stable.

- Companies: Duke Energy (DUK), NextEra Energy (NEE), Dominion Energy (D).

- Gold & Precious Metals 🏆 – Traditionally, gold and silver act as safe-haven investments during market uncertainty.

- Companies: Barrick Gold (GOLD), Newmont Corporation (NEM).

- Cybersecurity & Technology Infrastructure 🔒 – While speculative tech stocks may struggle, cybersecurity and IT services are increasingly essential.

- Companies: Palo Alto Networks (PANW), CrowdStrike (CRWD).

Sectors to Approach with Caution (More Volatile)

These sectors tend to be riskier in a correction:

- Technology 📉 – High-growth stocks often face sell-offs due to overvaluation concerns.

- Example: AI-related stocks like Nvidia (NVDA) and Tesla (TSLA) have seen sharp corrections.

- Consumer Discretionary 🎮 – Retail, travel, and luxury goods see reduced spending during economic uncertainty.

- Example: Amazon (AMZN), Nike (NKE), Disney (DIS).

- Real Estate 🏡 – Rising interest rates and economic slowdowns can weaken the housing market.

- Example: REITs like Simon Property Group (SPG) or Zillow (Z).

- Financials 🏦 – Banks and lenders may struggle if economic uncertainty affects lending and credit markets.

- Example: JPMorgan Chase (JPM), Goldman Sachs (GS).

Final Thoughts

Stock market corrections can be nerve-wracking but are a normal part of investing. Long-term investors who stay patient tend to recover losses and benefit from future gains. Keeping an eye on economic trends and maintaining a diversified portfolio can help navigate market fluctuations successfully.

For now, the market dances to Trump’s tune. Whether you’re a trader riding the 20-50% spike or a hodler dreaming of six-figure BTC, one thing’s clear: the crypto winter just thawed into a blazing spring. How high can it climb? Strap in—the charts say we’re only getting started.

Read more updates and articles on our Crypto category page

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

#StockMarket #Investing #MarketTrends #FinanceTips #EconomicNews #WealthManagement