Tesla Stock Plunges 15% – Biggest Drop Since 2020 Amid Sales Concerns

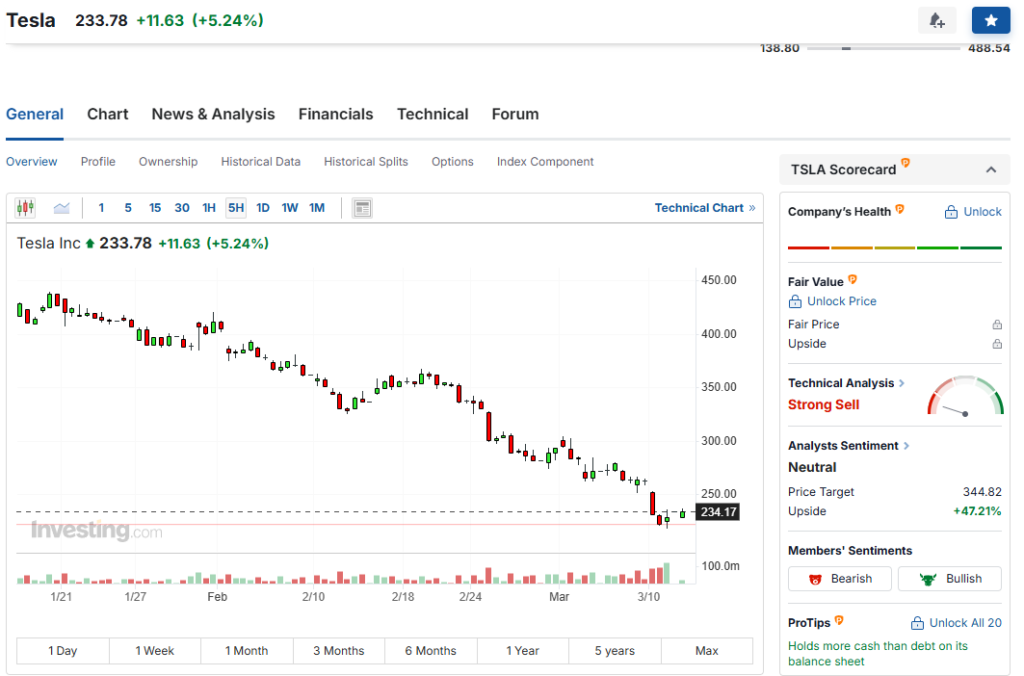

Tesla Inc. witnessed its worst single-day stock decline since 2020, dropping 15% on Monday amid concerns over weakening demand and lowered sales projections for 2025. Wall Street analysts have revised their delivery estimates downward, reflecting a challenging year ahead for the EV giant.

Key Factors Behind the Decline

- Lowered Sales Estimates: UBS Group AG’s Joseph Spak cut Tesla’s first-quarter delivery estimates by 16%, now expecting only 367,000 vehicles.

- Full-Year Decline Forecast: Tesla is now projected to sell 5% fewer vehicles in 2025 compared to last year, diverging from the average analyst expectation of a 10% increase.

- China Market Struggles: Tesla’s Shanghai factory reported a 49% drop in shipments for February, marking the lowest monthly output since July 2022.

- European Market Impact: Registrations in Germany fell by 70% in early 2025, partially attributed to CEO Elon Musk’s involvement in the country’s political climate.

Challenges in Tesla’s Largest EV Markets

- China Competition: Domestic brands like BYD are outpacing Tesla in sales and production efficiency.

- Model Y Transition Issues: The shift to a refreshed Model Y has led to production disruptions and muted consumer interest.

- Investor Sentiment: Since the beginning of 2025, Tesla’s stock has plummeted by 45%, erasing post-election gains.

What’s Next for Tesla?

- Growth Strategy Adjustments: Tesla executives maintain that 2025 will see a return to growth, though analysts remain skeptical.

- Potential Price Cuts: In an attempt to regain demand, Tesla may consider adjusting pricing strategies in competitive markets.

- Market Outlook: The EV sector remains dynamic, and Tesla will need to innovate rapidly to maintain its global dominance.

Conclusion

Tesla’s sharp stock decline signals a turbulent phase for the company, marked by fierce competition, regulatory challenges, and evolving consumer demand. While the road ahead is uncertain, Tesla’s adaptability and strategic pivots will determine its trajectory in the global EV landscape.

Experts suggest that once the markets stabilize a bit, then it is a good opportunity to invest again for long haul.

Got questions? Drop them below—I’m all ears!

Check out more article on Finance on our Finance Category section.

#Tesla #StockMarket #EV #ElonMusk #TeslaStock #Investing #ElectricVehicles #TechNews #StockCrash