Top 3 US Stocks for Short-Term Investing & Quick Returns in Aug 2025

Introduction

The US stock market in 2025 has seen rapid sector rotations, tech-driven rallies, and heightened volatility—making it a ripe environment for short-term investors. While long-term strategies focus on compounding growth, short-term investing capitalizes on momentum, earnings surprises, and market sentiment. Among the top picks this quarter, META (Meta Platforms Inc.), SoFi Technologies, and Robinhood Markets Inc. stand out as high-potential candidates for quick returns in US stocks short term.

This article breaks down their market performance, catalysts, and risks to help you strategize your next move.

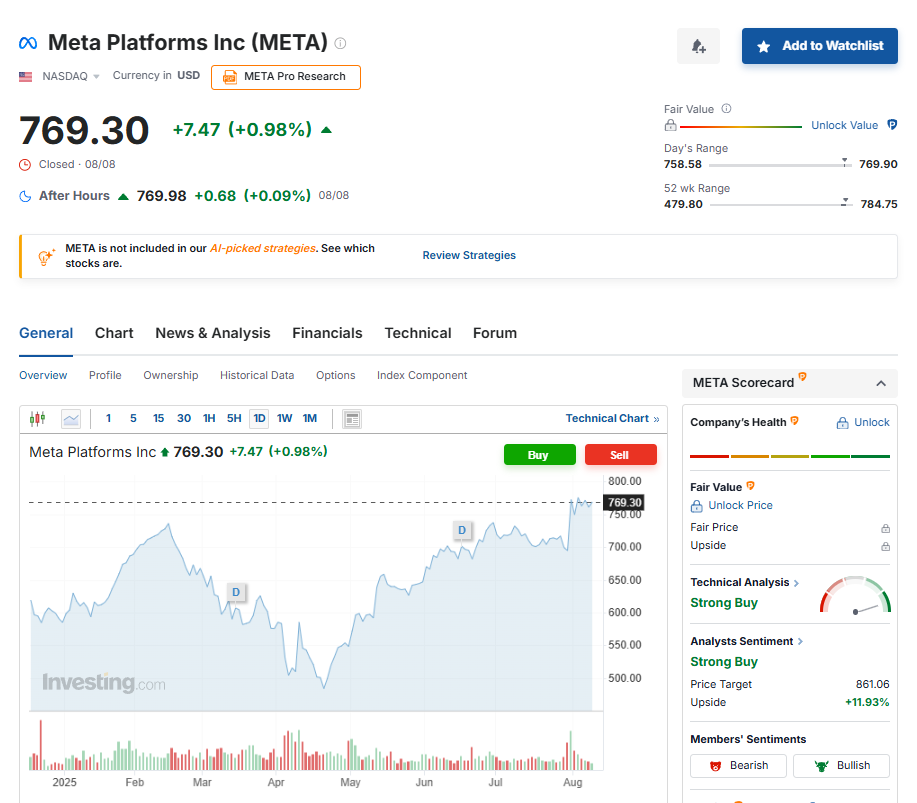

1. META (Meta Platforms Inc.)

Ticker: META

Sector: Communication Services / Technology

Current Trend: Bullish momentum post-earnings

Why It’s Attractive for Short-Term Investors

META has been riding a strong wave of revenue growth, fueled by digital advertising recovery and advancements in AI-driven ad targeting. With its aggressive investments in AI infrastructure and monetization of Reels, the company is regaining dominance in the social media ad space.

Key Short-Term Catalysts

- Q2 Earnings Beat: Recent earnings exceeded Wall Street expectations.

- AI Monetization: New AI-driven ad placements driving higher engagement.

- Metaverse Slowdown: Temporary spending cuts improving short-term profitability.

Risk Factors

- Regulatory scrutiny in the US and EU.

- Competition from TikTok and emerging platforms.

Short-Term Outlook: Strong buy sentiment for traders targeting 10–15% returns over the next quarter.

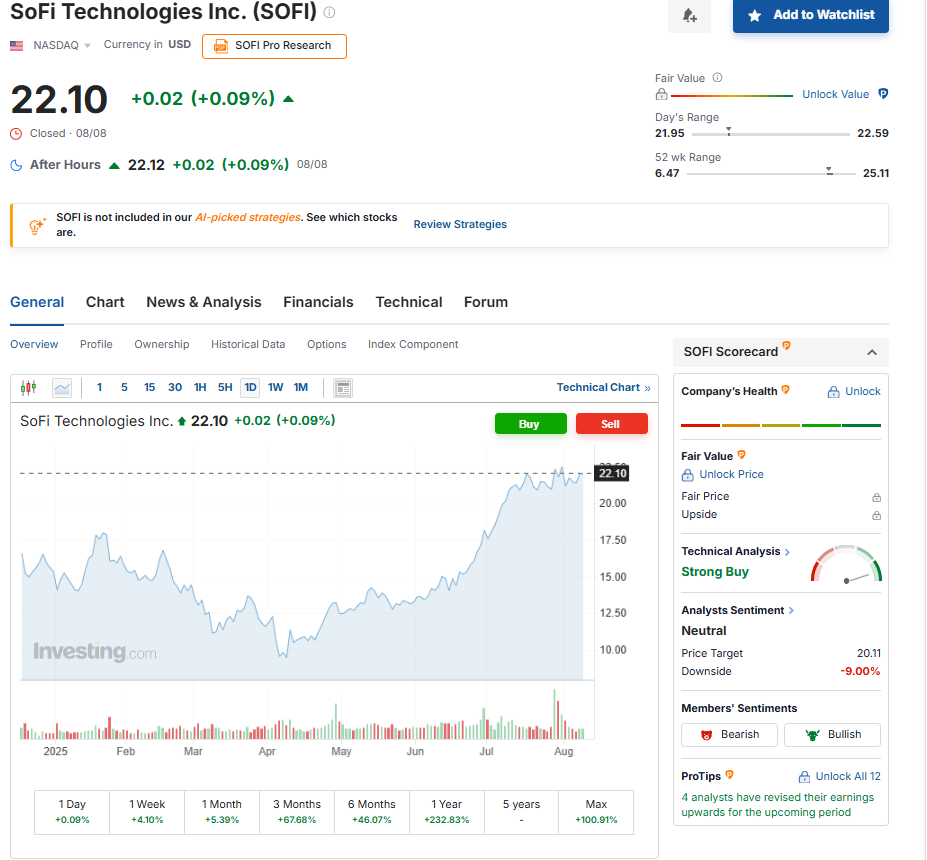

2. SoFi Technologies (SOFI)

Ticker: SOFI

Sector: Financial Technology (FinTech)

Current Trend: Momentum building after debt refinancing and student loan segment rebound

Why It’s Attractive for Short-Term Investors

SoFi has transitioned from a niche student-loan refinancing platform to a full-stack financial services provider. Its latest earnings showed increased user growth and higher lending revenue, sparking bullish sentiment.

Key Short-Term Catalysts

- Student Loan Restart: Federal loan repayments boost refinancing demand.

- New Product Launches: Expansion into high-yield savings and investment products.

- Improved Margins: Better cost management expected in Q3.

Risk Factors

- Rising interest rates impacting loan demand.

- High competition in the digital banking sector.

Short-Term Outlook: Medium-to-high growth potential with a 12–18% price target in the next two months.

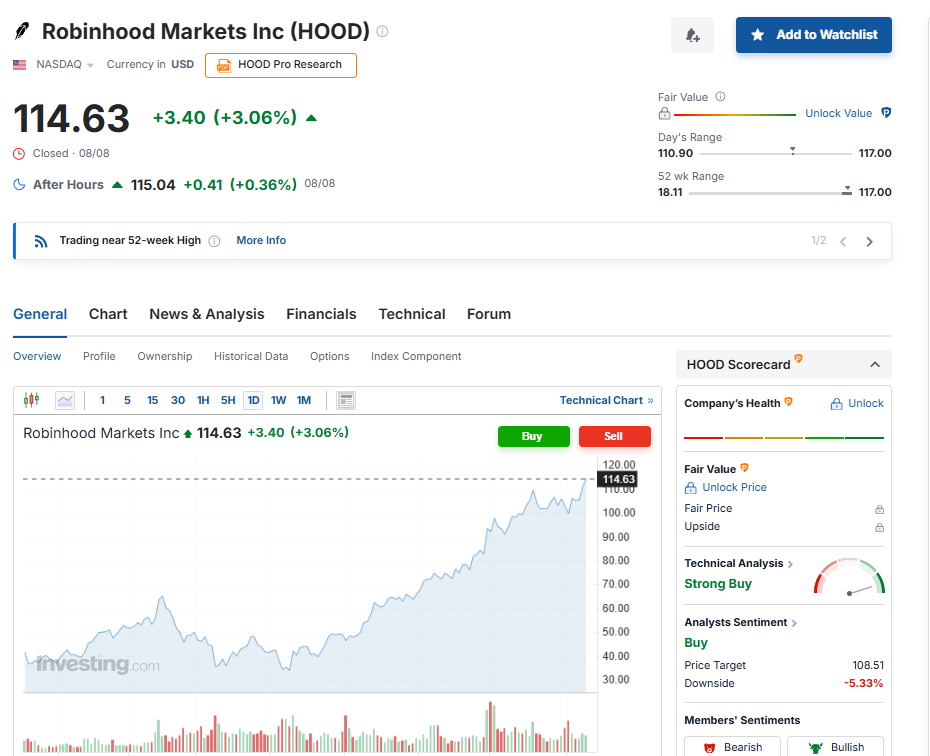

3. Robinhood Markets Inc. (HOOD)

Ticker: HOOD

Sector: Financial Services / Brokerage

Current Trend: High volatility with a bullish bias post-crypto market recovery

Why It’s Attractive for Short-Term Investors

Robinhood’s recent pivot toward crypto trading expansion has reinvigorated investor interest. With more retail investors returning to the market, HOOD is benefiting from increased trading volumes and crypto-driven fees.

Key Short-Term Catalysts

- Crypto Rally: Bitcoin and Ethereum price surges boosting transaction revenue.

- Option Trading Growth: Retail options trading volumes hitting new highs.

- International Expansion: New market entries in Europe and Asia.

Risk Factors

- Heavy reliance on retail sentiment.

- Potential revenue volatility during market pullbacks.

Short-Term Outlook: High-reward, high-risk play with a possible 15–20% upside if the crypto rally sustains.

Conclusion

For traders looking to capitalize on short-term market moves, META, SoFi Technologies, and Robinhood represent a mix of established tech dominance, fintech growth, and trading platform resurgence. While META offers stability with consistent earnings, SoFi brings fintech innovation, and Robinhood offers high-volatility opportunities tied to crypto momentum -US stocks short term.

Trading Tip: Always pair short-term positions with stop-loss strategies to safeguard against market reversals.

Also, read our other article MAANG Stocks Explained: How to Invest

Check out more article on Finance on our Finance Category section.

USStocks #StockMarket2025 #META #SoFi #Robinhood #ShortTermInvesting #TechStocks #TradingTips #StockAnalysis #FinancialGrowth