Top 5 US Stocks to Buy in August 2025 for Short & Long-Term Growth – Expert Analysis

Top US Stocks to Buy in August 2025 – Short & Long-Term Opportunities

have you been searching for the Best US stocks to invest in the market and not able to get a strong answer. Well, our post will guide you better. The US stock market in August 2025 is showing strong momentum, with several companies positioned to deliver robust gains for the rest of the year — and potentially well into the future. Whether you’re a short-term trader or a long-term investor, selecting the right stocks now could set you up for substantial returns.

Here’s our expert analysis of five top-performing stocks to watch: Duolingo, Equifax, Palo Alto Networks, PayPal, and Super Micro Computer.

1. Duolingo (NASDAQ: DUOL) – Expanding Global Language Learning Dominance

Current Trend: Bullish momentum with consistent quarterly revenue growth.

Why Invest:

Duolingo has been aggressively expanding its subscription model and AI-powered learning tools, resulting in higher engagement rates and record user numbers. Its recent partnerships with educational institutions further strengthen its brand moat.

Technical Analysis:

- Support: $190

- Resistance: $240

- Projected Year-End Target: $250–$265 if bullish trend continues.

Long-Term Outlook: Strong — AI integration in education will keep demand high over the next 5 years.

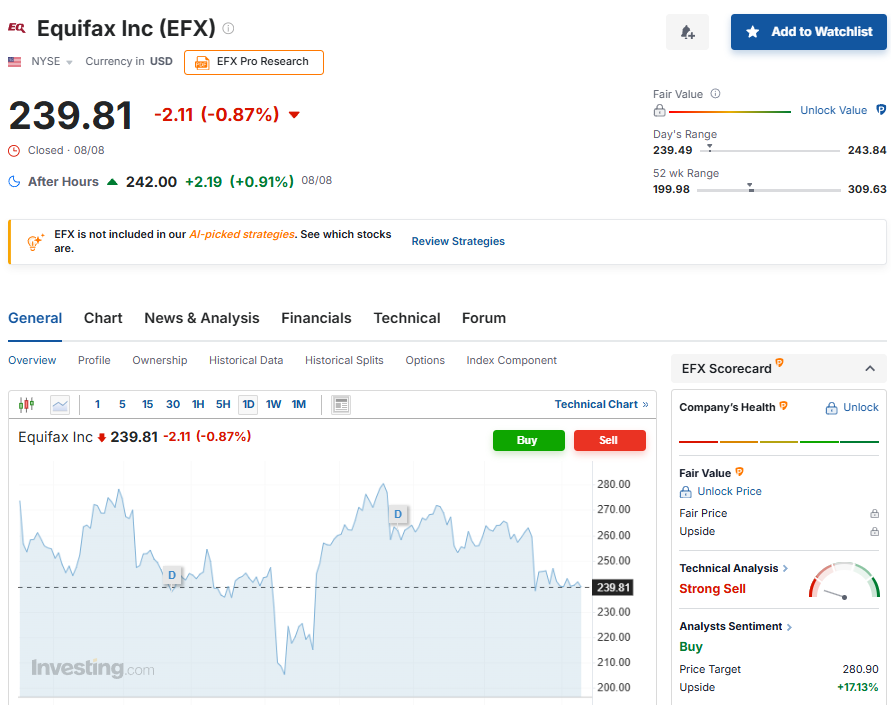

2. Equifax (NYSE: EFX) – Data Security & Financial Analytics Growth

Current Trend: Stable upward movement with moderate volatility.

Why Invest:

Equifax is benefiting from heightened demand for credit analytics, fraud prevention, and cybersecurity. The company’s investment in AI-powered risk assessment tools positions it well for the future.

Technical Analysis:

- Support: $220

- Resistance: $265

- Projected Year-End Target: $270–$280.

Long-Term Outlook: Solid — growing demand for credit insights will fuel revenue.

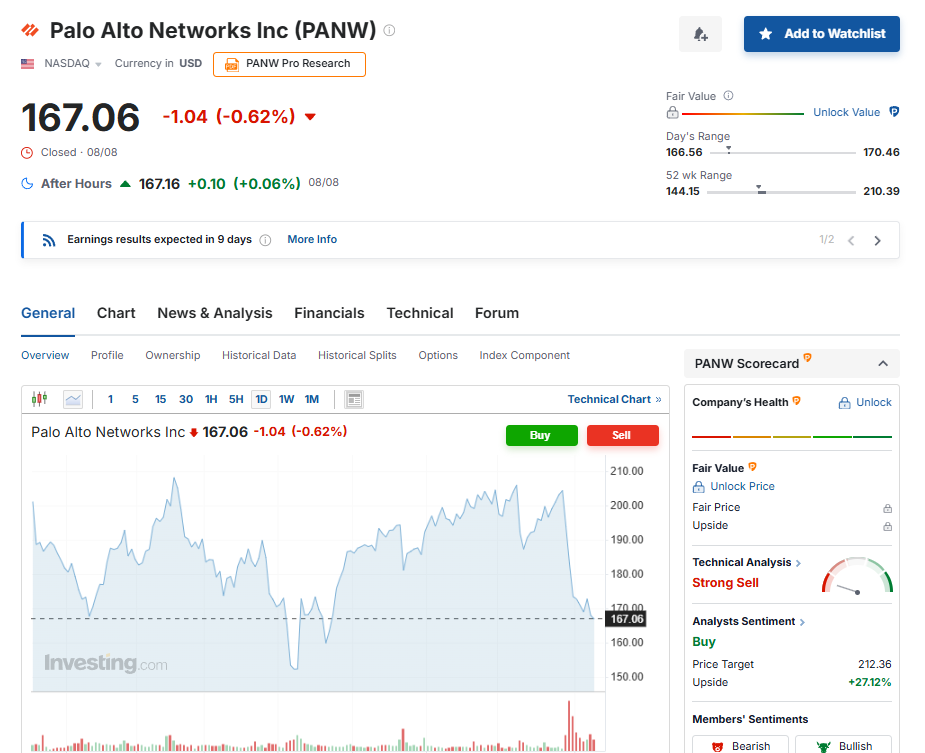

3. Palo Alto Networks (NASDAQ: PANW) – Cybersecurity Powerhouse

Current Trend: Breakout pattern forming after months of consolidation.

Why Invest:

As cyber threats rise, Palo Alto’s dominance in network and cloud security gives it a competitive edge. Its AI-enhanced threat detection systems are attracting enterprise clients globally.

Technical Analysis:

- Support: $310

- Resistance: $375

- Projected Year-End Target: $390–$410.

Long-Term Outlook: Very strong — cybersecurity spending will accelerate worldwide.

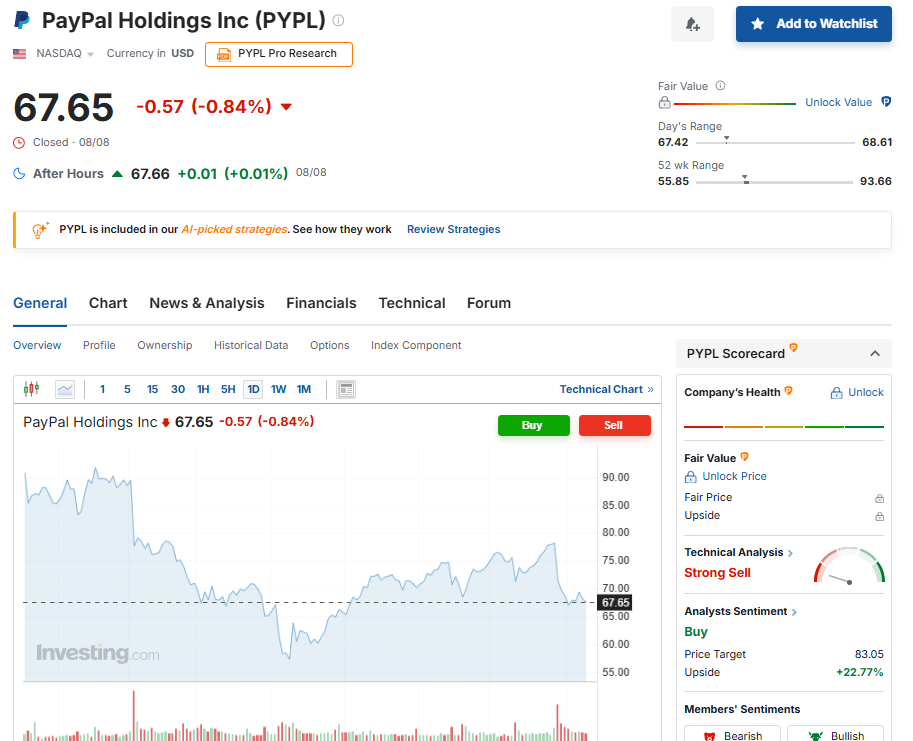

4. PayPal (NASDAQ: PYPL) – Digital Payments Recovery

Current Trend: Gradual recovery after a prolonged downtrend.

Why Invest:

PayPal is streamlining operations, introducing AI-powered payment fraud detection, and expanding into crypto transactions. Market sentiment is shifting positively.

Technical Analysis:

- Support: $58

- Resistance: $78

- Projected Year-End Target: $82–$88 if momentum builds.

Long-Term Outlook: Moderate to strong — digital payments will keep growing, but competition remains fierce.

5. Super Micro Computer (NASDAQ: SMCI) – AI Server Growth Leader

Current Trend: Strong bullish rally due to AI infrastructure boom.

Why Invest:

Super Micro is riding the AI data center demand wave, supplying high-performance servers for AI training and cloud services. Partnerships with NVIDIA and AMD fuel growth.

Technical Analysis:

- Support: $760

- Resistance: $920

- Projected Year-End Target: $950–$1,020.

Long-Term Outlook: Extremely strong — AI adoption will keep demand for SMCI’s hardware high.

Investment Timeline & Strategy

- Short-Term (3–6 months): Duolingo & Super Micro Computer for momentum trades.

- Medium-Term (6–12 months): Equifax & Palo Alto Networks for steady returns.

- Long-Term (1–3 years): All five stocks show strong growth potential, with Super Micro and Palo Alto as high-conviction plays.

Final Thoughts

So, for the Best US stocks to invest in August 2025 presents a golden opportunity to invest in US stocks driven by innovation, strong financials, and expanding markets. By balancing AI-driven growth companies like Super Micro and Duolingo with stable performers like Equifax and Palo Alto Networks, investors can position themselves for both short-term gains and long-term wealth creation.

Also, read our other article EPF Interest Rate for FY25 Stays at 8.25%: How Much You’ll Earn & When It Gets Credited

Check out more article on Finance on our Finance Category section.

#USStocks2025 #StockMarketAnalysis #Duolingo #Equifax #PaloAltoNetworks #PayPal #SuperMicroComputer #LongTermInvesting #TechStocks #AIStocks