Wall Street’s Wake-Up Call: Inside the November 2025 Stock Market Crash

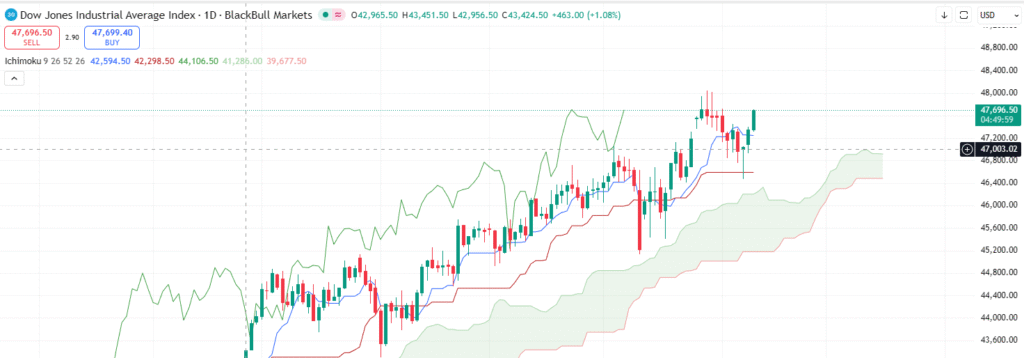

For months, Wall Street had been riding a high. Artificial intelligence was the new gold rush — valuations soaring, tech giants minting record profits, and investors talking about a “new era” of endless growth. Then November 2025 happened.

In a matter of days, the U.S. stock market tumbled — the Nasdaq and S&P 500 both recording their steepest weekly drops since 2022. What started as whispers about “AI bubble” valuations turned into a full-blown market rout that sent shockwaves across global exchanges.

Was it just a correction — or the beginning of something bigger? Let’s break it down. – U.S. stock market crash November 2025

What Triggered the Crash

The spark came in early November, when investors began questioning whether the AI trade had gone too far. After months of euphoric buying, analysts started warning that tech valuations looked eerily similar to the dot-com era.

Then came a cascade of bad news:

- Overheated AI valuations. Goldman Sachs analysts compared the 2025 AI mania to the early 2000s tech bubble, warning that “profit expectations have run far ahead of fundamentals.”

- Sticky inflation data. Fresh U.S. economic reports showed inflation holding near 3.4%, dampening hopes for early Fed rate cuts.

- Growth concerns. GDP forecasts were revised down to 1.6%, suggesting the economy may be losing steam.

- Global contagion. As Wall Street sold off, Asia and Europe followed — Japan’s Nikkei and Korea’s Kospi each dropped around 2%, while European markets hit multi-month lows.

The selling intensified as big names like Nvidia, Broadcom, and Microsoft fell sharply, erasing hundreds of billions in market value within a week.

Why It Happened: The Anatomy of a Correction

This wasn’t a random shock. It was a market finally confronting three uncomfortable truths:

1. Valuations Were Detached From Reality

AI optimism fueled record-high multiples for mega-cap tech. Nvidia, for instance, was trading at more than 40× forward earnings — pricing in a decade of perfect growth. When expectations reach that extreme, even a small wobble triggers panic.

2. The Economy Isn’t Invincible

Despite solid job numbers, growth indicators are slowing. Corporate margins are tightening, consumer spending is cooling, and inflation is proving stubborn. Investors realized the soft-landing narrative might not hold forever.

3. Sentiment Flipped Overnight

For nearly two years, investors believed dips were buying opportunities. But when everyone’s on the same side of the trade, there’s no one left to buy. Once momentum broke, algorithms and risk-control systems amplified the sell-off.

The Bigger Picture: Not 2008, But a Wake-Up Call

Let’s be clear — this isn’t 2008. The financial system isn’t collapsing, and corporate balance sheets remain solid. But it’s a reality check for markets that had grown dangerously comfortable.

The AI boom may still be real — but investors were pricing in perfection. The November crash reminded everyone that even transformative technology can’t outrun fundamentals forever.

The question now is whether this correction marks the end of the bull market, or just a healthy reset.

What Investors Should Watch Next

- Federal Reserve policy. If inflation stays sticky, rate cuts may be delayed — keeping pressure on valuations.

- Tech earnings. The next round of results from Nvidia, Microsoft, and Alphabet will test whether growth justifies the hype.

- Broader economic data. Watch manufacturing, job openings, and retail spending. A clear slowdown could extend the downturn.

- Market breadth. A true recovery needs more than just AI stocks leading. Energy, finance, and industrials must show strength.

Lessons From November 2025

- Diversification matters again. The days of “just buy tech” are over. Balanced portfolios will outperform concentrated ones.

- Valuations can’t defy gravity. Even revolutionary themes like AI must eventually justify their price tags.

- Volatility is back. The ultra-calm, low-VIX era is gone. Expect wider swings and sharper pullbacks.

The Bottom Line

The November 2025 market crash was less an accident and more an overdue correction — a reminder that every bull run carries the seeds of its own pause.

Whether it turns into a deeper bear market depends on what comes next: can the AI story deliver real profits fast enough, and can the economy stay resilient without a Fed bailout?

For now, the message is simple: stay cautious, stay diversified, and don’t confuse innovation with immunity.

Also, read our other articlehttps://bytestack360.com/maang-stocks-investment-guide/

Check out more article on Finance on our Finance Category section. U.S. stock market crash November 2025