What is Polymarket & How Does it Work?

Have you ever wanted to bet on whether a political candidate will win, if a company will launch a product by a certain date, or what the weather will be like next month? Polymarket makes this possible through a unique platform called a “prediction market.” Let’s break down what Polymarket is, how it works, and why people are using it – Polymarket explained.

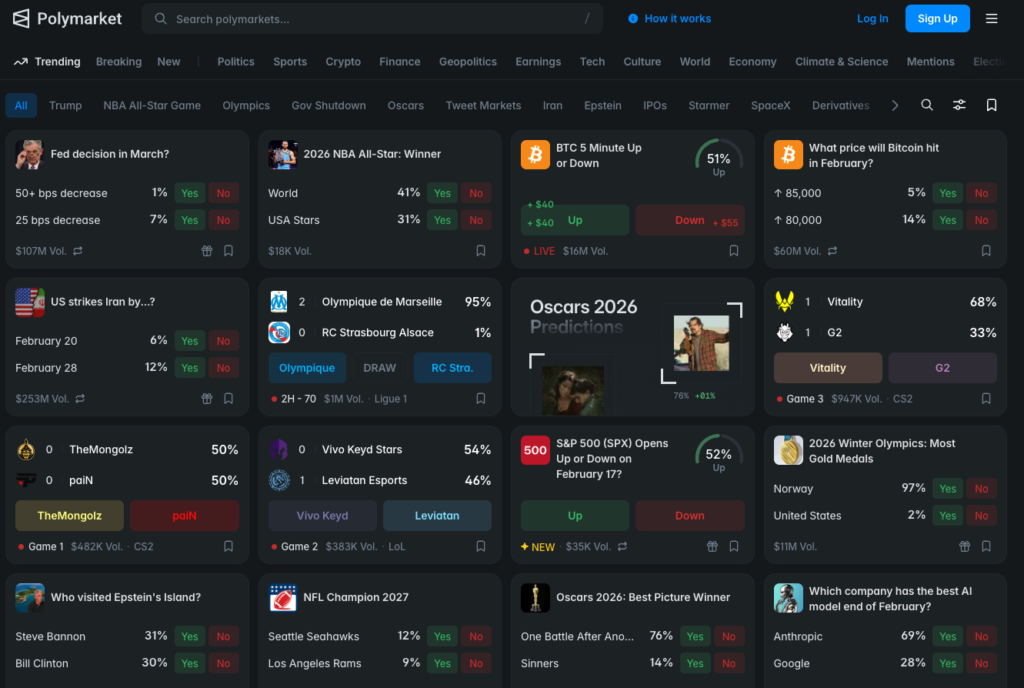

What is Polymarket?

Polymarket is a decentralized prediction market platform where users can bet on the outcomes of real-world events using cryptocurrency. Think of it as a cross between a betting platform and a stock market, but instead of betting on sports or trading company shares, you’re trading on whether specific events will happen.

Simple example: You believe the next iPhone will be released before December 2026. On Polymarket, you can buy “Yes” shares for this prediction. If you’re right, you profit. If you’re wrong, you lose your investment.

Key Features:

- Decentralized – Runs on blockchain technology (Polygon network)

- Real-money predictions – Use USDC cryptocurrency to trade

- Wide variety of markets – Politics, sports, crypto, economics, entertainment, and more

- Community-driven – Anyone can create markets for others to trade on

- Transparent – All trades are recorded on the blockchain

How Does Polymarket Work?

Polymarket operates on a simple principle: crowd wisdom. The idea is that when many people put their money where their mouth is, the collective predictions tend to be surprisingly accurate.

The Basic Mechanics

1. Markets are Created

Someone creates a market asking a yes/no question, such as:

- “Will Bitcoin reach $100,000 by the end of 2026?”

- “Will it snow in New York on Christmas Day?”

- “Will the Federal Reserve raise interest rates in March?”

2. Shares are Traded

Each market has two types of shares:

- “Yes” shares – Pay $1 if the event happens

- “No” shares – Pay $1 if the event doesn’t happen

The price of these shares fluctuates based on what traders think will actually happen.

3. Prices Reflect Probability

If “Yes” shares cost $0.65, the market is saying there’s a 65% chance the event will happen. If they cost $0.20, the market thinks there’s only a 20% chance.

4. You Profit from Being Right

- Buy “Yes” at $0.65, event happens → You get $1 (profit: $0.35)

- Buy “No” at $0.35, event doesn’t happen → You get $1 (profit: $0.65)

Real Example

Market: “Will Ethereum reach $5,000 by June 2026?”

- Current price: Yes shares = $0.45, No shares = $0.55

- You think Ethereum will definitely hit $5,000

- You buy 100 “Yes” shares for $45 total

- If you’re right: You get $100 (profit of $55)

- If you’re wrong: You lose your $45

Step-by-Step: How to Use Polymarket

Getting Started

Step 1: Create an Account

- Visit Polymarket’s website

- Sign up with email or social account

- No extensive KYC required for smaller amounts

Step 2: Fund Your Account

- Polymarket uses USDC (a stablecoin pegged to the US dollar)

- You can deposit USDC directly from a crypto wallet

- Or buy USDC through the platform using a credit card or bank transfer

Step 3: Find Markets

- Browse categories: Politics, Crypto, Sports, Pop Culture, Science, etc.

- Use search to find specific topics

- Check the volume and liquidity of markets

Step 4: Make Your Prediction

- Choose “Yes” or “No” based on your belief

- Enter how much you want to invest

- Review the potential profit/loss

- Confirm the trade

Step 5: Monitor Your Positions

- Watch how prices change as new information emerges

- You can sell your shares before the event resolves

- Lock in profits or cut losses early if needed

Step 6: Resolution

- When the event happens (or the deadline passes), the market resolves

- Winners automatically receive $1 per share

- Funds are credited to your account

Understanding Market Dynamics

Why Prices Change

Polymarket prices move based on:

Supply and Demand

- More people buying “Yes” → Yes price goes up

- More people selling “Yes” → Yes price goes down

New Information

- Breaking news can cause rapid price swings

- Polls, announcements, or events affect probabilities

- Smart traders profit by reacting quickly to new data

Market Sentiment

- Fear and greed drive short-term movements

- Long-term trends follow rational analysis

Liquidity Matters

High liquidity markets:

- Easy to buy and sell quickly

- Prices are stable and fair

- Lower spreads between buy/sell prices

Low liquidity markets:

- Harder to find buyers/sellers

- Prices can be less accurate

- Higher spreads eat into profits

What Makes Polymarket Different?

Compared to Traditional Betting

Traditional Sportsbooks:

- Centralized companies set odds

- House takes a cut (often 10-20%)

- Limited to sports and entertainment

- Account can be closed anytime

Polymarket:

- Peer-to-peer trading

- Much lower fees (typically 2% or less)

- Any real-world event can have a market

- Decentralized – no one can freeze your account

Compared to Other Prediction Markets

Polymarket’s advantages:

- User-friendly interface – Easier than competitors

- High liquidity – Popular markets have millions in volume

- Blockchain-based – Transparent and censorship-resistant

- No geographical restrictions – Available globally (with some exceptions)

- Fast settlements – Usually resolves quickly after events

Types of Markets on Polymarket

Political Markets

- Election outcomes

- Policy decisions

- Approval ratings

- Geopolitical events

Cryptocurrency Markets

- Price predictions

- Protocol launches

- Regulatory decisions

- Exchange listings

Sports Markets

- Championship winners

- Award recipients

- Records being broken

- Team performance

Business & Economics

- Company earnings

- Product releases

- Economic indicators

- Stock market movements

Entertainment & Culture

- Award show winners

- Movie box office performance

- Celebrity predictions

- Viral trends

Science & Technology

- Scientific breakthroughs

- Space missions

- AI developments

- Climate events

Risks and Considerations

Financial Risks

You Can Lose Money

- Predictions can be wrong

- Markets can be irrational in the short term

- Never invest more than you can afford to lose

Volatility

- Prices can swing wildly on breaking news

- Emotional trading leads to losses

- Timing matters as much as being right

Platform Risks

Smart Contract Risk

- Code bugs could cause losses

- Platform is relatively new

- Always use money you can afford to lose

Regulatory Uncertainty

- Laws around prediction markets vary by country

- Regulations could change

- Some jurisdictions may restrict access

Resolution Disputes

- Occasionally, outcomes aren’t clear-cut

- Community votes on ambiguous resolutions

- Rarely, resolutions are contested

Common Mistakes to Avoid

- Betting with emotion – Stay objective

- Ignoring liquidity – Stick to active markets

- Not taking profits – Don’t be greedy

- Following the crowd – Think independently

- Over-leveraging – Start small, learn gradually

Tips for Success on Polymarket

Do Your Research

- Study the event thoroughly

- Look for information advantages

- Understand what could change outcomes

- Check multiple reliable sources

Start Small

- Begin with small amounts

- Learn how the platform works

- Understand market dynamics

- Build experience before going bigger

Diversify

- Don’t put everything in one market

- Spread risk across different events

- Balance high-conviction with exploratory bets

Think Probabilistically

- A 70% chance means you’ll be wrong 30% of the time

- Focus on finding mispriced markets

- Long-term success comes from many good bets, not one big win

Stay Informed

- Set up news alerts for your markets

- Follow relevant experts and analysts

- Join Polymarket community discussions

- React quickly to breaking information

Is Polymarket Legal?

Legal Status Varies by Location:

Generally Allowed:

- Most countries permit prediction market participation

- Treated similarly to crypto trading

Restricted or Unclear:

- United States (complex regulations)

- Some European countries have specific rules

- Always check your local laws

Best Practice:

- Research your jurisdiction’s stance

- Consult a legal professional if uncertain

- Use VPNs responsibly (but know they don’t guarantee legal protection)

The Future of Polymarket

Growing Adoption

Polymarket is experiencing rapid growth because:

- It’s more accurate than polls for predictions

- Media outlets cite Polymarket odds

- Institutional interest is increasing

- User experience keeps improving

Potential Developments

- More market types and categories

- Enhanced analytics and tools

- Mobile app improvements

- Integration with other platforms

- Possible token launch

Impact on Society

Prediction markets like Polymarket could:

- Improve decision-making for businesses and governments

- Provide real-time sentiment on important issues

- Create incentives for truth-seeking

- Democratize forecasting and analysis

Bottom Line

Polymarket is a fascinating platform that lets you profit from correct predictions about real-world events. It combines elements of trading, gambling, and forecasting into a decentralized, blockchain-based system.

Polymarket is good for:

- People who follow news and current events closely

- Those comfortable with cryptocurrency

- Traders looking for new opportunities

- Anyone interested in prediction markets

Polymarket might not be for:

- Complete crypto beginners (start with basic crypto first)

- Those looking for guaranteed returns

- People who can’t afford to lose their investment

- Anyone in jurisdictions where it’s restricted

Key Takeaways:

- Polymarket lets you bet on real-world events using crypto

- Prices represent crowd-sourced probability estimates

- You can profit by being more accurate than the market

- It’s decentralized, transparent, and global

- Start small, do research, and never invest more than you can lose

Whether you’re interested in politics, sports, crypto, or just want to test your prediction skills against the crowd, Polymarket offers a unique way to put your knowledge to the test—and potentially profit from it. Polymarket explained

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Read more updates and articles on our Crypto category page and also read Layer-2 Blockchains Explained: Why They Matter for Crypto’s Future

#crypto #bitcoin #ethereum #Solana #altcoins