Why Bitcoin Crashed From Its All-Time High — The Real Reasons Behind the Sudden Drop & What’s Next

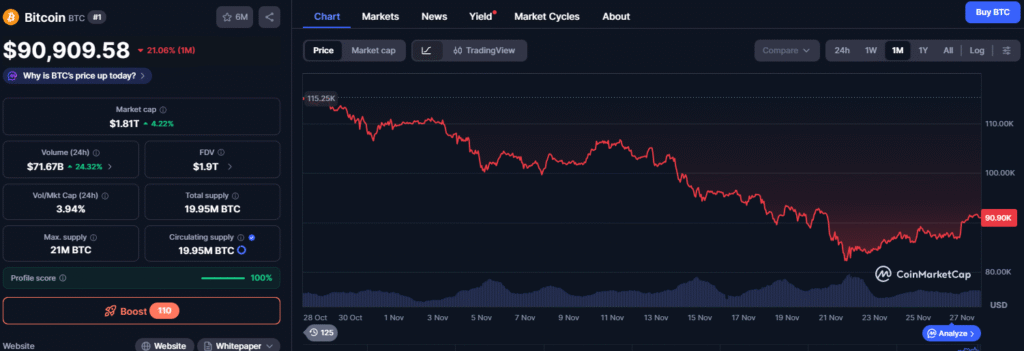

Bitcoin was soaring. Momentum was strong, predictions were wild, and social feeds were celebrating new all-time highs — until suddenly, the market flipped.

Prices plunged sharply, liquidations exploded, and fear spread across the crypto world -bitcoin correction 2025.

So what actually caused Bitcoin to crash so fast?

Why did the market reverse right after hitting record highs?

Let’s break down the real reasons, the hidden triggers, and what this means for the future of Bitcoin.

1. Massive Leveraged Longs Were Wiped Out

When Bitcoin hits new highs, traders tend to pile into aggressive leveraged positions expecting “higher highs.”

But leverage cuts both ways.

As soon as Bitcoin showed weakness:

- Billions in leveraged positions were liquidated

- Forced selling accelerated the drop

- Cascade liquidations pushed the price down even faster

This creates a domino effect where one dip triggers a deeper dip.

In short: The market was overleveraged. All it needed was a spark.

2. Institutional Profit-Taking After Peak Levels

Large players — institutions, hedge funds, ETFs, and whales — typically sell heavily after new all-time highs to secure profits.

When they start unloading:

- Selling pressure spikes

- Retail panic follows

- Momentum reverses

Institutional cycles often lag behind price hype, creating sharp but short-lived corrections.

This wasn’t “the end.” It was a structured cooldown by big money.

3. Regulatory Headlines Sparked Fear

Every major Bitcoin crash in history has a common trigger: regulation fear.

Even small headlines about:

- Potential crypto tax changes

- Stricter AML/KYC rules

- ETF restrictions

- Exchange investigations

- Government warnings

can create instant market panic.

Whether the news is large or small, fear > fundamentals in the short term.

4. ETF Outflows and Rebalancing Shocked the Market

Bitcoin ETFs created massive inflows during the bull run.

But when:

- ETFs rebalance

- Investors take profit

- Institutions rotate into bonds or equities

it creates millions — sometimes billions — of dollars in selling pressure.

ETFs amplify both upside and downside momentum.

5. Whale Wallets Sold at the Top

On-chain trackers showed:

- Old wallets moving coins

- Exchanges receiving large inflows

- Whale clusters selling into strength

Whales love to sell when excitement peaks, then re-accumulate when fear returns.

Their selling often marks local tops.

6. Retail FOMO Turned Into Retail Panic

When the hype is loudest, retail investors enter aggressively — often at the top.

Then:

- A 3–5% dip

- Turns into fear

- Which turns into panic selling

Emotional trading amplifies volatility.

Retail entered late, exited early — as always.

So… What’s Next for Bitcoin? (Future Outlook)

Despite the crash, the long-term fundamentals remain powerful.

Here’s what the future looks like:

1. Bullish Long-Term Trend Still Intact

Bitcoin corrections of 20–30% are normal — even during bull markets.

Past cycles show that:

- New highs → correction → new highs again

Corrections clean out weak leverage and strengthen the next run.

2. Institutional Adoption Will Keep Growing

Bitcoin ETFs opened the door for:

- Pension funds

- Banks

- Insurance firms

- Corporate treasuries

This is sticky capital, not speculative money.

Long term: extremely bullish.

💎 3. Halving, Scarcity & Supply Shock Still Strong

The halving cycles remain the strongest driver of Bitcoin’s macro trend.

Less supply entering the market = structurally higher long-term price.

Nothing about the correction changes this.

🌍 4. Bitcoin Is Becoming Global Infrastructure

Countries, corporations, and financial systems are treating Bitcoin as:

- A digital asset

- A hedge

- A settlement layer

- A programmable reserve

Its role in global finance is expanding — not shrinking.

📈 5. The Next Wave Could Be Even Bigger

Once leverage resets and fear cools off, Bitcoin historically rebounds stronger.

Corrections set the stage for:

- Healthier rallies

- Cleaner uptrend

- More sustainable price discovery

The next move could surprise everyone — again.

🧠 Final Thoughts

Bitcoin didn’t crash because something was “wrong.”

It crashed because the market overheated — and needed a reset.

This correction:

- Cleans leverage

- Forces smart money rotation

- Sets up stronger long-term growth

The fundamentals haven’t changed.

The adoption curve hasn’t slowed.

The future of Bitcoin remains incredibly strong.

This is volatility — not the end.

And in crypto, volatility is opportunity – bitcoin correction 2025.

Read more updates and articles on our Crypto category page and also for Bitcoin price Forecast. Also, read our article on – How the Elon Musk–Donald Trump Feud and Epstein Files Are Quietly Rocking the Crypto Market

Bitcoin #CryptoCrash #BTC #CryptoMarket #Blockchain #CryptoNews #BitcoinPrice #BullRun #CryptoAnalysis #Investing